Logical Invest

Investment Outlook

May 2018

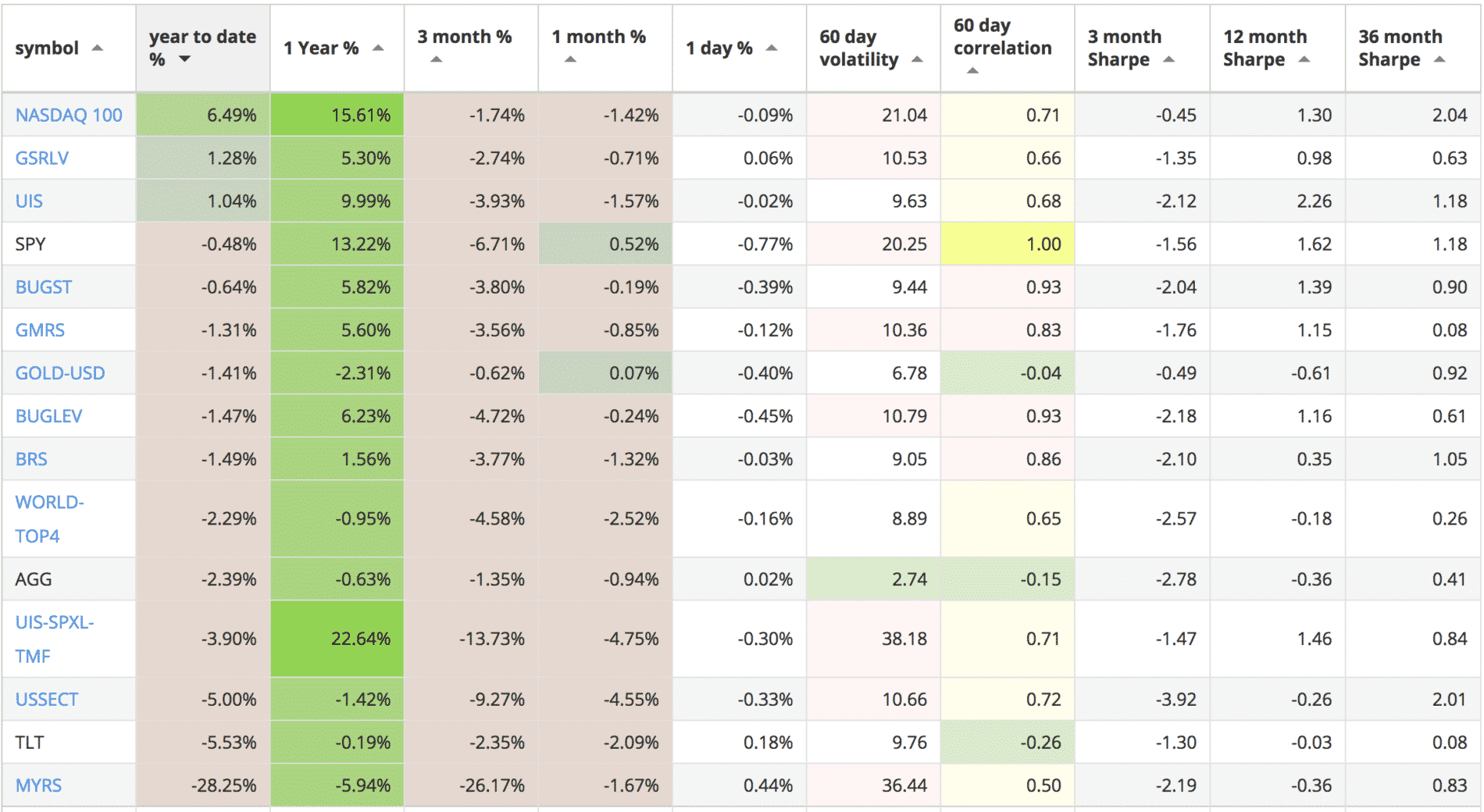

Our top 2018 investment strategies, year-to-date :

- The NASDAQ 100 strategy with +6.49% return.

- The Global Sector Rotation strategy with +1.28% return

- The Universal Investment strategy with +1.04% return.

SPY, the S&P500 ETF, returned -0.48%.

Market comment:

Spring is coming and so is the beginning of the challenging part of the investing year. There is a reason people say “Sell in May and go away”. Historically, on average, it has been easier to make money investing from November to April than from May to October. Seasonality does not predict price action but it does reveal a historical tendency of the market to underperform during the spring and summer months. Of course this applies to U.S. equities while the opposite holds for treasury returns.

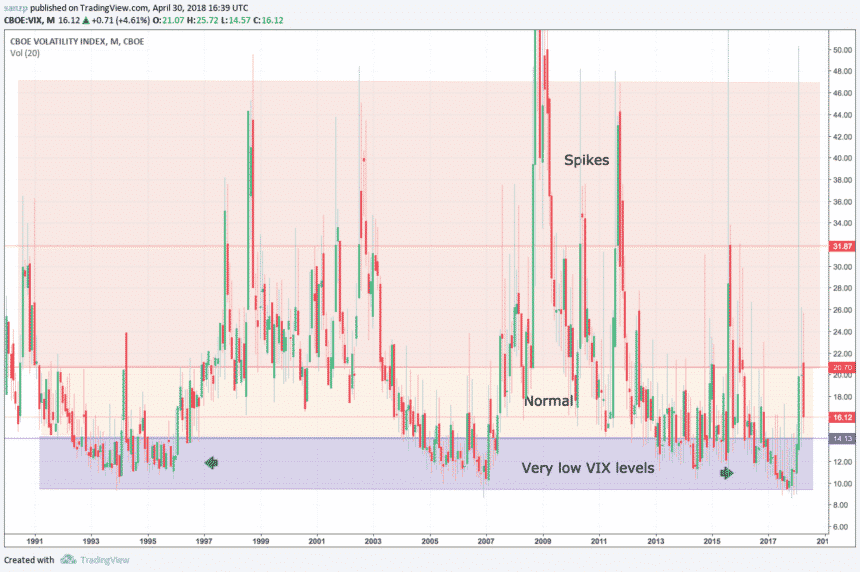

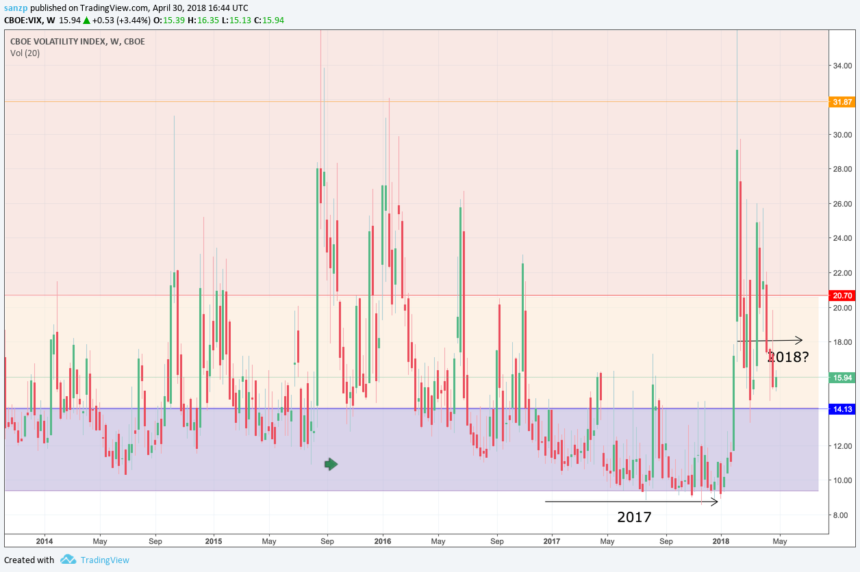

A revival of volatility is also pointing to a choppy market. After the unprecedented February spike in VIX, volatility has bounced back and forth a few times. It seems to want to settle in the 14-20 mid-range range rather than the 9-14 extreme low-levels of 2017. There is a wide-spread expectation that this levels will be the new norm going forward.

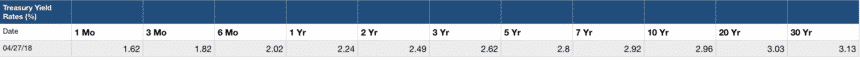

Yields are up. Expectations are that the Fed will hike interest rates 3 more times this year. Unemployment is down at the 4.1% level for the 6th consecutive month. Wages are rising but at a slower pace than expected, meaning there is room to grow. Official (i.e., underestimated) inflation is at 2.4%. The 10-year Treasury touched the 2.96% mark, while the curve has flatten considerably. A 2-year note will give you a worry-free 2.49% yield while a 30-year 3.13%.

Interestingly, just next door in Europe, the 2-Y German Government Bond will yield 0.58%, while investing in Bulgarian Gov. bonds will pay you less (1.25%) than the U.S. full-faith-and-credit backed 2Y Note. Surprisingly the EUR/USD rate has not collapsed yet.

Our strategies came in negative for the month as equity markets, treasuries and even gold showed weakness. The exception was the Gold-Hedged strategy which stayed flat at +0.07%. The strategy held a small Euro-short component (via EUO, the short Euro ETF) that returned +4.18% and buffered the GLD drop. One of the worst performers this month was the U.S. Sector strategy. The strategy held a 13% stake in ERY, the 3x Energy Bear ETF. This was a hedge to balance out the 87% of the portfolio long positions . Due to geopolitical risks including the recent Syrian military intervention, oil prices shot up causing large losses on ERY which in turned weighted the strategy down to a -4.55% return for the month.

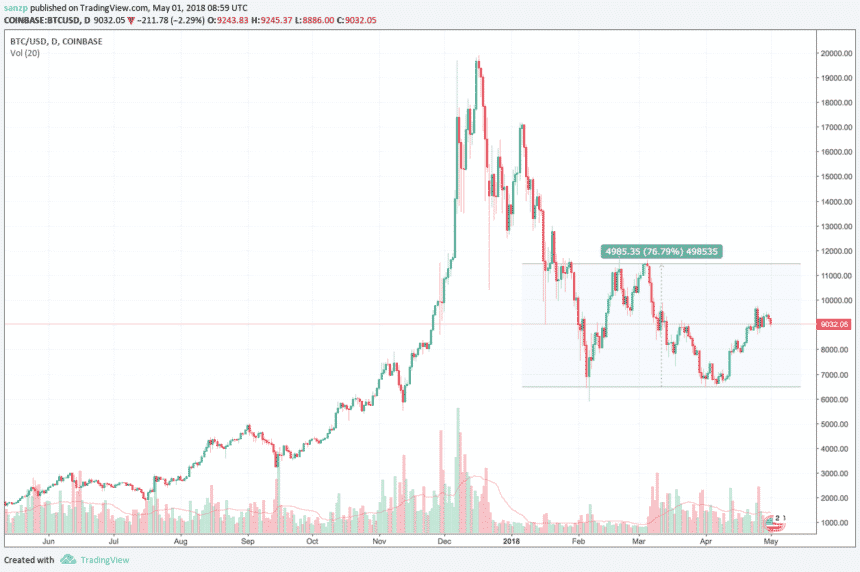

Crypto-currencies are having a comeback after having lost more than 60% of their value. Bitcoin has recovered from the 6,000 levels and now sits at 9,000. But the action is in the Altcoins which are posting dramatic increases of 70-200% in the past 30 days. A sideways consolidation movement as well as loss of interest from smaller retail investors are usually positive signs of future growth.

We wish you a healthy and prosperous 2018.

Logical Invest, May 1, 2018

Strategy performance overview:

Visit our site for daily updated performance tables.

Symbols:

BRS – Bond Rotation Strategy

BUGST – A conservative Permanent Portfolio Strategy

BUGLEV – A leveraged Permanent Portfolio Strategy

GMRS – Global Market Rotation Strategy

GMRSE – Global Market Rotation Strategy Enhanced

GSRLV – Global Sector Rotation low volatility

NASDAQ100 – Nasdaq 100 strategy

WORLD-TOP4 – The Top 4 World Country Strategy

UIS – Universal Investment Strategy

UIS-SPXL-TMF – 3x leveraged Universal Investment Strategy

AGG – iShares Core Total US Bond (4-5yr)

SPY – SPDR S&P 500 Index

TLT – iShares Barclays Long-Term Trsry (15-18yr)

Interesting article on VIX from Reuters

https://www.reuters.com/article/us-usa-stocks-volatility-analysis/february-volatility-hurricane-upended-vix-linked-trading-idUSKBN1I122J