Logical Invest

Investment Outlook

July 2018

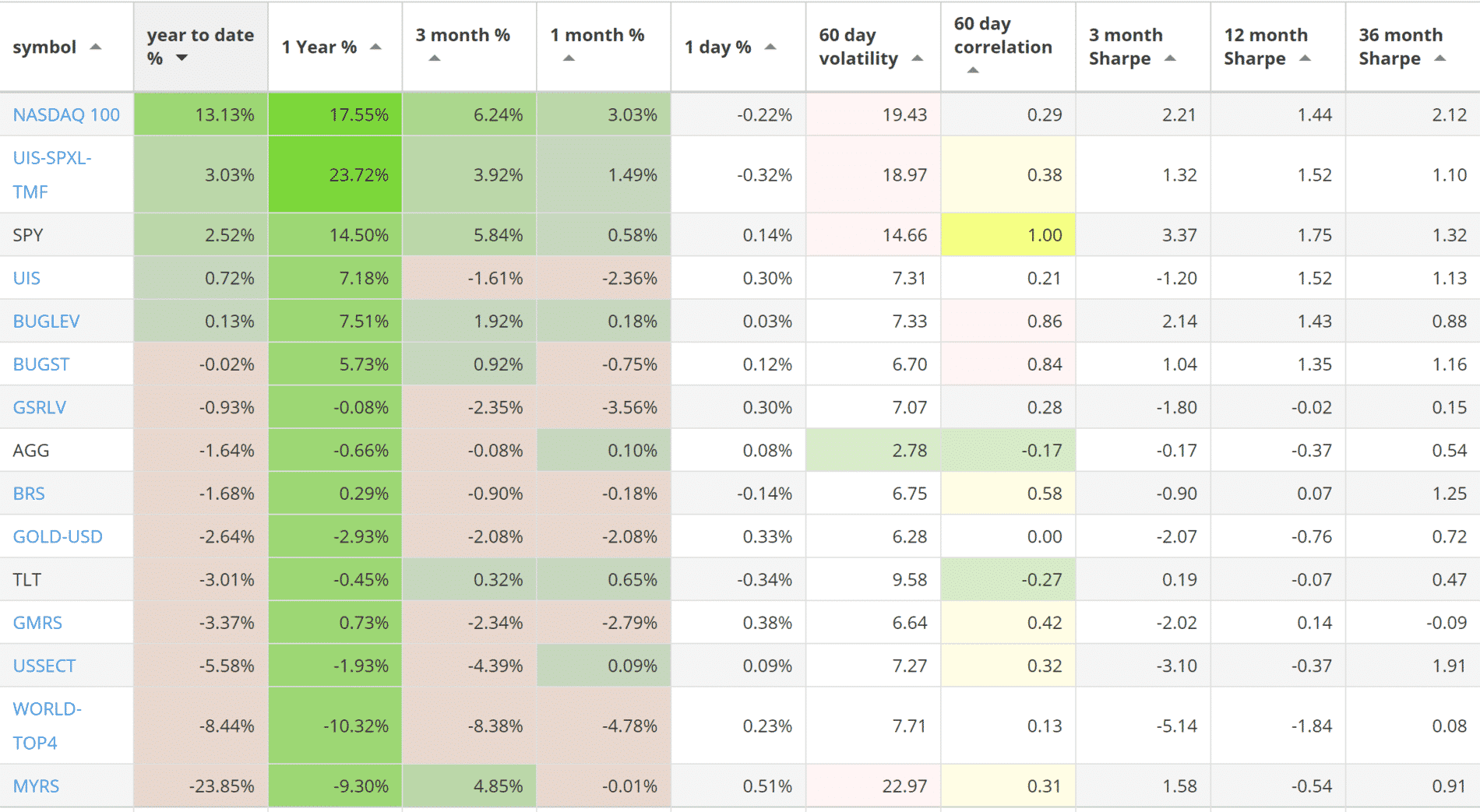

Our top 2018 investment strategies, year-to-date :

- The NASDAQ 100 strategy with +13.13% return.

- The 3x Universal Investment strategy with +3.03% return.

- The Universal Investment strategy with +0.72% return

SPY, the S&P500 ETF, returned +2.52%.

Market comment:

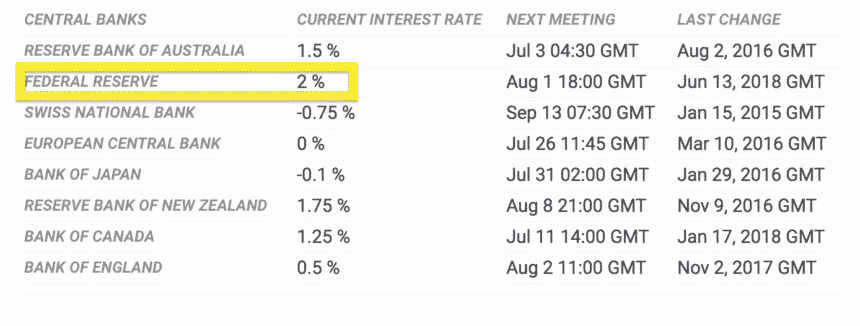

General investor sentiment is quite bearish. The most recent AAII Investor Sentiment survey shows only 28% of investors believe the markets will do well in the next 6 months, while 40% are bearish and 30% are neutral. No wonder, as the topic of upcoming tariffs and trade wars dominated media. Furthermore, the Federal Reserve raised its target for the federal funds rate to a range of 1.75%-2.00% and upgraded the anticipated number of future rate hikes to four for 2018, reflecting a hawkish bias. Both events caused the dollar to surge further as investors fled emerging markets for the safety of interesting bearing U.S. cash. It was not a good month for foreign markets.

Current central bank interest rates. Anyone tracking pre and post crisis rates will find this picture quite odd with Australia and New Zealand offering lower returns than the dollar. Table courtesy of fxstreet.com

China (FXI) fell by -6.7%, Brazil (EWZ) by -8.5% while the broad emerging markets ETF (EEM) was down -4.53%. Gold fell again this month by -3.6% while TLT, the 30 year Treasury ETF was slightly up at +0.64%. The big winner for this month was Mexico at +6.8% probably due to positive expectation for the newly elected president. ZIV, which we use at our MYRS strategy, was up +6.9 percent by June 15th only to loose as much in the second half, finishing the month at -0.56%. SPY was slightly up at +0.56%.

The month’s best strategy was the Nasdaq 100 which held two winners, namely NTFLX (+11%) and Amazon (+4%). The two Universal Strategies, did not track each other well as they used different hedges. The non-leveraged UIS, using a more sophisticated hedging algorithm, was invested in GLD (-3.61%) while the most ‘simplistic’ 3x UIS used TMF (+1.49%) as a hedge. 3x UIS came in at +1.49% while UIS lost -2.36% for the month. Most other strategies came in slightly negative while the global rotation strategies lost an average of -2%. The worst performer, as expected, was the World Top 4 strategy.

Volatility also increased and stayed at slightly elevated levels but not outside what would be the norm.

Cryptocurrencies continue to scare holders as Bitcoin broke a critical 6,000 barrier to reach 5750 only to bounce back up to 6300.

A last note to our European customers: Due to new legislation, U.S. based ETFs are unavailable to European retail customers. We find this highly problematic for any cost-conscious investor as these ETFs are diverse, carry low fees and spreads and are very liquid . We hope this situation will be resolved but we are testing alternatives (EU based ETFs, CFDs, etc) in case it persists. You can read more about it as well as contribute your experience or opinion here.

We wish you a healthy and prosperous 2018.

Logical Invest, July 1, 2018

Strategy performance overview:

Visit our site for daily updated performance tables.

Symbols:

BRS – Bond Rotation Strategy

BUGST – A conservative Permanent Portfolio Strategy

BUGLEV – A leveraged Permanent Portfolio Strategy

GMRS – Global Market Rotation Strategy

GMRSE – Global Market Rotation Strategy Enhanced

GSRLV – Global Sector Rotation low volatility

NASDAQ100 – Nasdaq 100 strategy

WORLD-TOP4 – The Top 4 World Country Strategy

UIS – Universal Investment Strategy

UIS-SPXL-TMF – 3x leveraged Universal Investment Strategy

AGG – iShares Core Total US Bond (4-5yr)

SPY – SPDR S&P 500 Index

TLT – iShares Barclays Long-Term Trsry (15-18yr)