Logical Invest

2017 Year In Review

Overview:

2017 was another excellent year for our strategies with double digit returns and very low volatility. Although world economic data are positive, central bank tightening and possible rate increases may warrant more conservative approaches. We provide a basket of strategies to accommodate. Here are some of the best for this year:

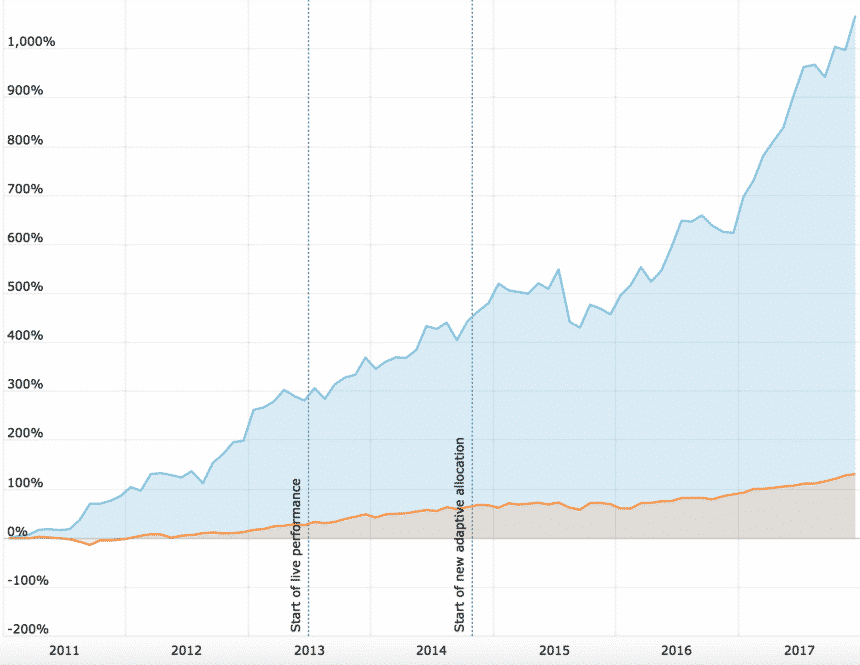

The Maximum Yield Investment strategy (+64%)

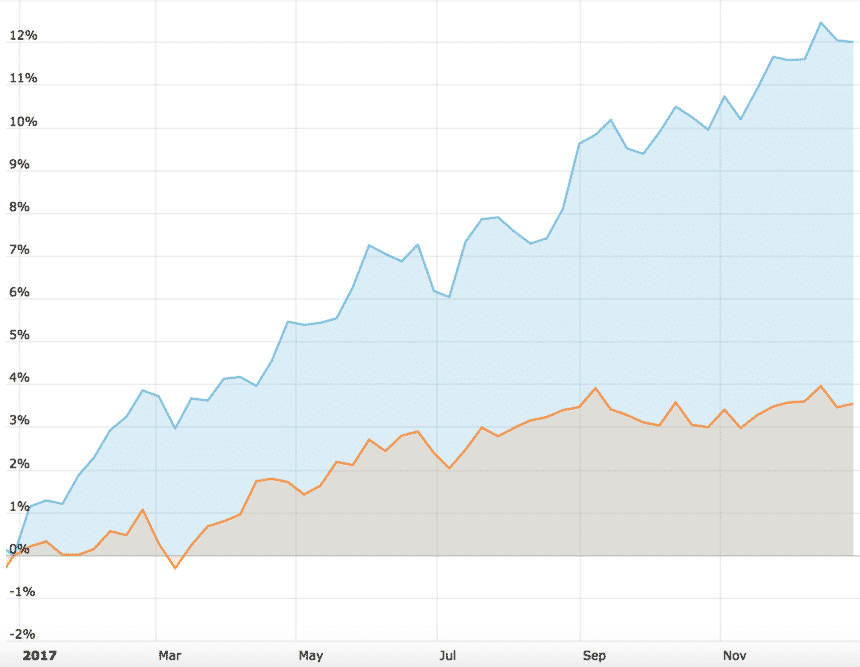

The maximum yield was our very first quantitative strategy. It was first traded using VIX futures in order to collect mid-term volatility premium. It was then adapted to use ETFs. In the chart below you can see the theoretical backtested results before 2013 (left of the first line) and the live results to the right of the first line. The strategy was again improved in 2014 adding a variable Treasury component. It has performed in line with expectations. 2017 was an exceptional year with +64% return.

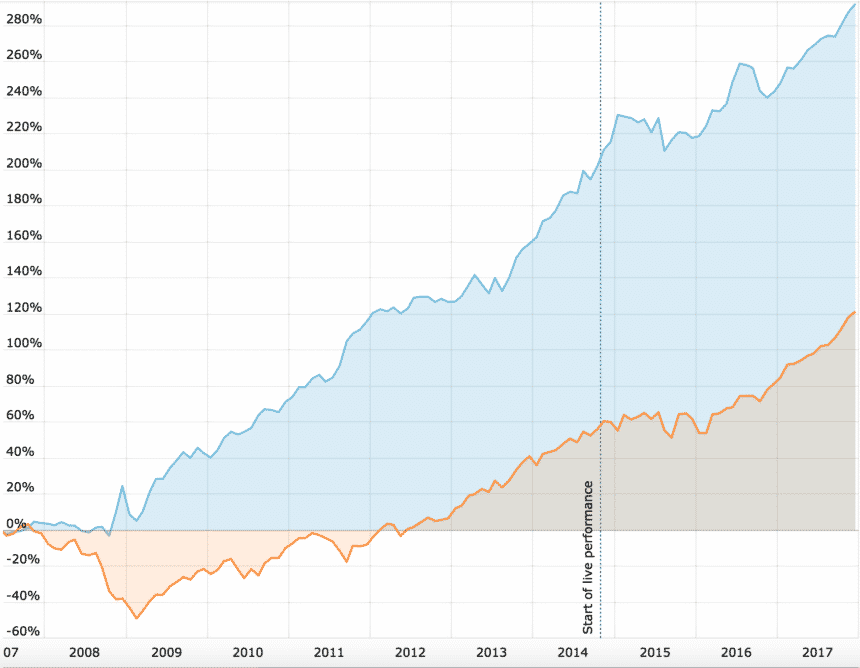

The Universal Investment Strategy (+14.34%, Leveraged version: +49.13%)

The strategy is an intelligent and dymamic version of the 60/40 equity/bond strategy. It was built with the 2008 crisis in mind where a shift into bonds would have limited any catastrophic portfolio losses. As you can see from the graph, the live performance (after 2014) is in line with the backtested results. In 2015, where most investors lost money, it remained flat. It has yet to be tested in an extreme bear market. In 2017 we improved the strategy so as to dynamic allocate to TIPs (inflation protected Treasuries) in case interest rates start rising (causing Treasuries to underperform). 2017 performance was 14.34%. The leveraged version of this strategy using 3x ETFs returned 49.13%.

Bond Substitution Strategies

Many investors prefer the security and safety of bonds. Unfortunately in the current environment bonds pay out very little and run the risk of a rising interest rate environment.

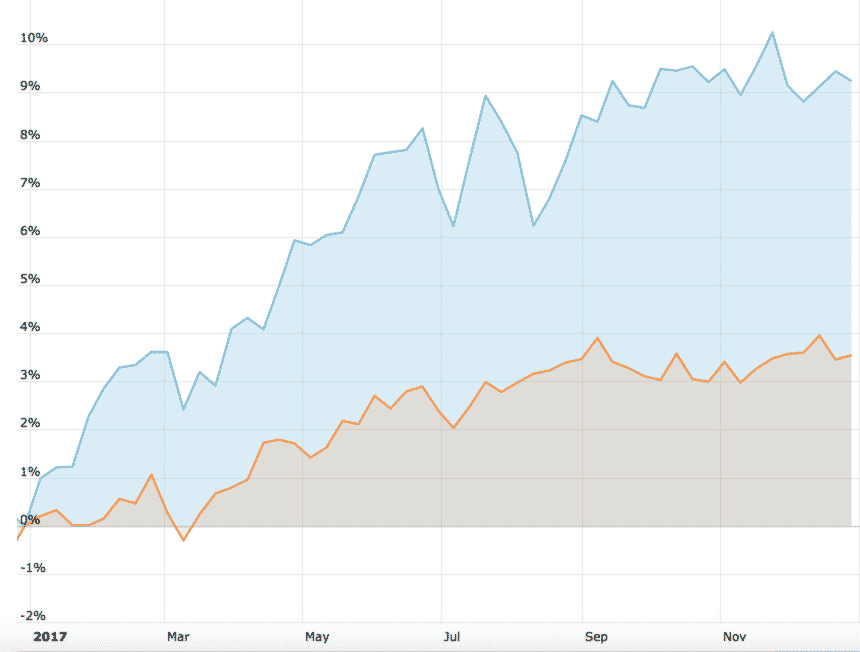

Bond Rotation Strategy (+9.22%)

Our Bond Rotation Strategy (BRS) has dynamic exposure to various types of bonds (junk, foreign, convertible, tips). This way it is able to diversify and enhance risk-adjusted returns. The chart below shows BRS vs the aggregate U.S. corporate Bond ETF (AGG).

Zooming into 2017 we see how BRS outperforms U.S. corporate debt (ETF:AGG) as the threat of rising rates create underperformance in corporate bonds.

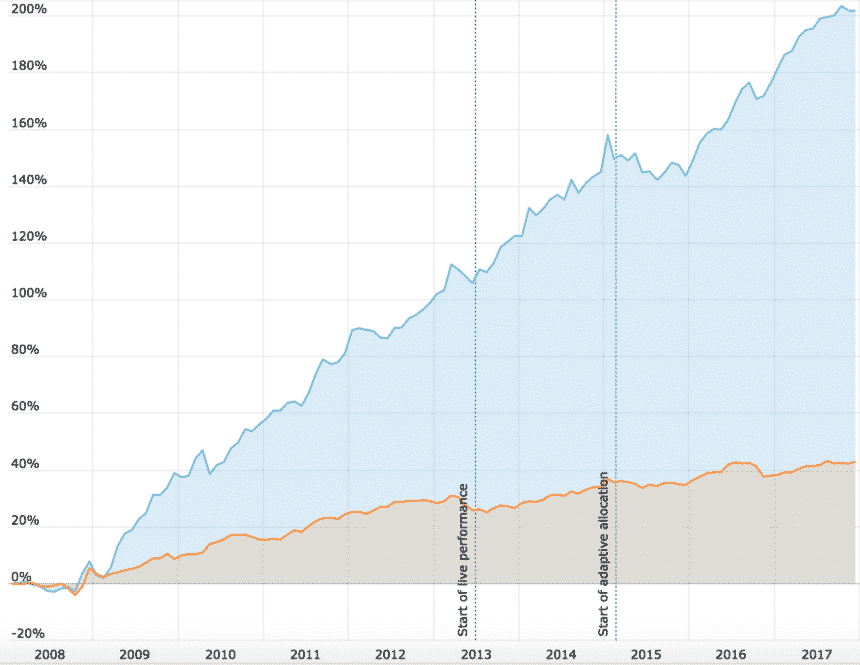

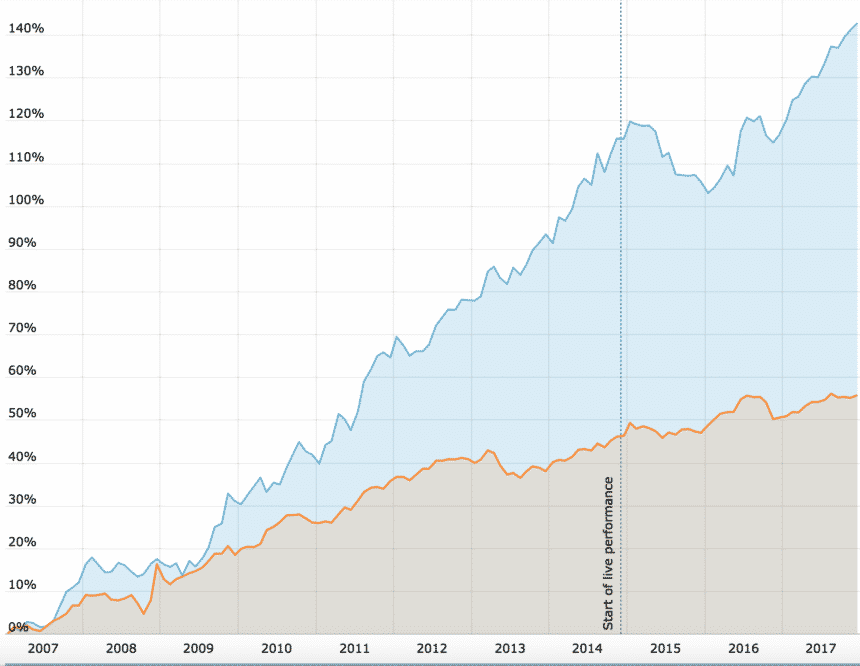

The Bug (Enhanced Permanent Portfolio) (+12.33%)

Our other long term strategy is our own quantitatively-enhanced version of the Permanent Portfolio. It provides dynamic and adaptive exposure to the three major asset classes: Equity, Bonds and Gold. It is an “all-weather” core strategy build to survive in many different economic environments. It went live in late 2014 (see vertical line in chart).

It lost money in 2015 as all three core assets (Equities/Bonds/Gold) underperformed but eventually found its footing in 2016 and 2017. This type of strategy is designed to work in the long term by adapting to the current economic environment. Having a gold component, it an acceptable core strategy even in times of inflation. For 2017 it was an excellent choice for risk conscious investors having a maximum drawdown of just -1.85%.

Below is a detail of the chart for 2017 of the BUG vs AGG.

You can see all our strategy charts on our website or download a free trial of our QuantTrader software that includes them and allows you to test them.

Improvements in 2017

- We offered our proprietary QuantTrader software to subscribers.

- Moved to a multi-strategy investment paradigm creating models that allocate capital across multiple strategies.

- Offered managed accounts through the Estate Planners Group, a Registered Investment Advisor.

- Added a consolidation tool right into QuantTrader. It can now calculate all shares needed to be bought/sold even when investing in multiple strategies.

- Updated QuantTrader to (optionally) download the latest version of our strategies to be in sync with Logical Invest’s latest updates.

- Moved away from the Yahoo data feed. QT now pulls data from Tiingo, IEX and Google finance.

Plans for 2018:

Free QuantTrader ‘light’ software for all existing and new subscribers. Except the fact that subscribers will be able to issue signals intraday this will allow us to easily add new strategies, build custom ones and create a community to easily exchange them.

Continue with our primary job: Trade, monitor the markets, continue analysis and research in current and future strategies and experiment with different and new assets classes including crypto-currencies.

We wish you a healthy, happy, creative and prosperous 2018.

Logical Invest, January 1, 2018

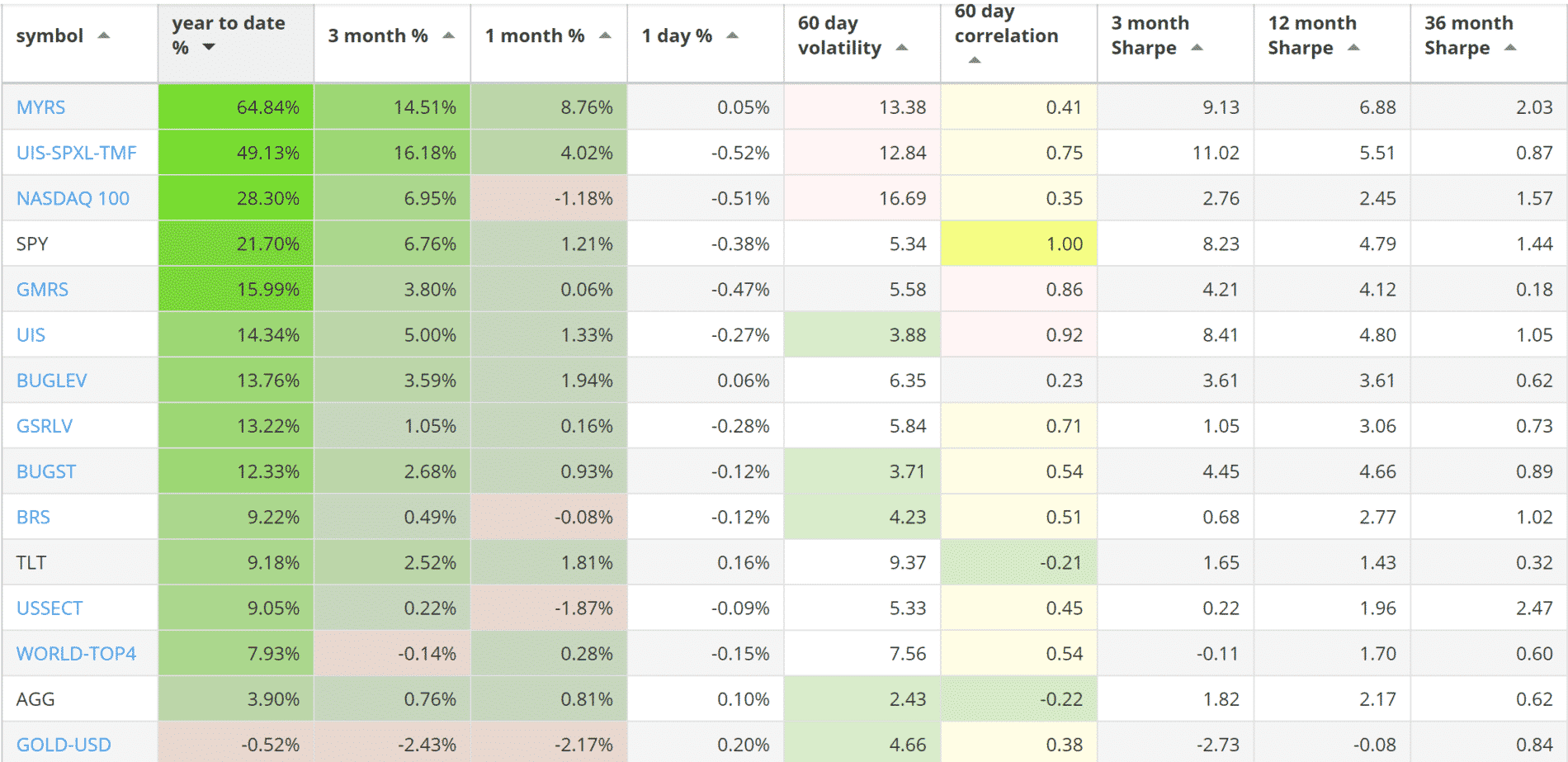

Strategy performance overview:

Visit our site for daily updated performance tables.

Symbols:

BRS – Bond Rotation Strategy

BUGST – A conservative Permanent Portfolio Strategy

BUGLEV – A leveraged Permanent Portfolio Strategy

GMRS – Global Market Rotation Strategy

GMRSE – Global Market Rotation Strategy Enhanced

GSRLV – Global Sector Rotation low volatility

NASDAQ100 – Nasdaq 100 strategy

WORLD-TOP4 – The Top 4 World Country Strategy

UIS – Universal Investment Strategy

UIS-SPXL-TMF – 3x leveraged Universal Investment Strategy

AGG – iShares Core Total US Bond (4-5yr)

SPY – SPDR S&P 500 Index

TLT – iShares Barclays Long-Term Trsry (15-18yr)

Happy New Year!

Have you given any thought to optimizing performance for taxable accounts or at least providing data to help us estimate the impact of taxes on the various strategies? Here are a few ideas:

1. Display the value of short and term long term gains and losses on an annual basis

2. Display performance after taxes using average tax rates

2. Display performance after taxes with user entered tax rates for short and long term gains

4. Adapting existing strategies for longer holding periods

5. New strategies with long holding periods

I know that everyone’s tax situation is different, but when taxes can impact returns by as much as 40% they must be factored in when comparing against alternative buy-and-hold strategies.

Dear Patrick,

Thank you for the feedback. Taxes are extremely important and can impact returns. There are different tax regimes and we are often asked to adapt strategies for different countries. Because our main work is trading and R&D, our long term solution to this is by giving access to QuantTrader and letting our own users modify and optimise the strategies themselves. In other words we would rather set up a “strategy library” and encourage contribution than research different tax regimes and country specific products. So if a user is familiar with U.K. law and can adapt a strategy with tax optimised funds and parameters, they could post it so all U.K. subscribers can jump in, improve and benefit. Same with the U.S. E.U., Australia, etc. That said, U.S capital tax optimisation is important (given our customer base) and we will consider it.

If you look at very long-term VIX chart, you see that volatility is at cyclical lows like in 2000 and 2007. As the current bull market matures, volatility might start rising again, even before an eventual peak in the stock market. Is there any backtesting that includes selling volatility in such a scenario?

https://logical-invest.com/forums/topic/using-synthetic-data-or-external-data-sources-in-quanttrader/