Must reads:

- Frank Grossmann’s article “How to Hedge in Times of Market Trouble” (Seeking Alpha, LI Blog)

- 2019 strategy updates (LI Blog)

Protecting your money

After almost 10 years of a continuous bull market and 2 years of exceptional growth (2016-2017), 2018 was the first year that the SP500 turned negative. Apart from the dollar index, most asset classes also fell.

To make things worse, the S&P500 dropped -20% from the September highs during what is traditionally the best 3 months of the year. Although unfortunate, it does create a rare opportunity to evaluate how our portfolios react to an unexpected real-life correction.

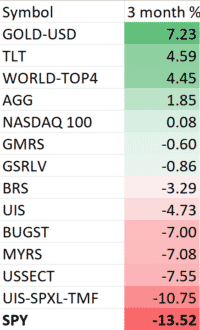

Here is a look at the Logical Invest strategies historical performance during these last 3-months compared to holding SPY.

Every single strategy, including our very aggressive ones (3x UIS and MYRS), lost less than the SPY. Our non-leveraged strategies maxed out at a loss of -7.5%, while BRS and UIS averaged -4%. The NASDAQ 100 came out flat, while the World Top 4 (+4.45%) as well as GOLD-USD (+7.23%) came out positive.

Even though hedging did help limit losses, we are re-designing the way we protect our strategies in case 2018 proves to be an intro to a bear market.

Please read Frank Grossmann’s article “How to Hedge in Times of Market Trouble” (Seeking Alpha, LI Blog), a detailed account of how to design a sophisticated hedging mechanism without sacrificing performance.

Some 2018 highlights:

- The flattening of the curve but more importantly the rise of short-term interest rates on the dollar vs International currencies. This created flows from risky foreign assets into short term U.S. Treasury bills.

- The resulting rise of the U.S. dollar index translated in many other assets (Gold, Foreign Debt, Foreign Equities) to fall.

- The rise of volatility with an unprecedented move in February that caused massive losses and the halting of trading of the popular XIV and SVXY ETFs. Volatility has almost doubled from last year, returning to more ‘normal levels’ as we mentioned back in May .

- The U.S. market dived during the end of the year and it is still well under its 200-day moving average.

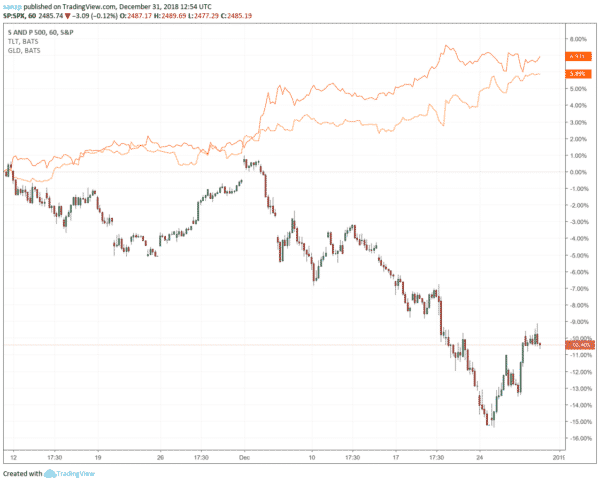

- Treasuries and Gold, once again, turned to be safe heavens to the SP500 decline. These last three month our strategies outperformed mainly due to that fact.

In some ways the market reminds us of 2015 when all asset classes, except the US market, were negative. The difference is that in 2018 we are now well into a flat yield curve which as we have mentioned in the past may signal a coming recession.

Stay the course. Really?

It sounds like advice given by rich wise men that many of us ‘weak hands’ fail to follow. But is this true? Sure, to stay the course means being involved and invested in the markets for the long run. But when you hold a portfolio that is not diversified enough, unable to protect you from large drawdowns, relies on discretionary decisions to go to cash and carries risk you cannot afford, maybe that is not such great advice. You may be tempted to go to cash too soon or once invested, you may hold well into the bottom creating losses that are difficult to recoup from.

Staying the course should not be a search for inner strength, a continuous monologue of should I or should I not or an opportunity to practice meditation while under heavy losses. The effort should be placed before, when designing the portfolio. If you are equipped with a well-diversified portfolio that can withstand different regimes and that you believe in, staying the course is great advice.

What next for 2019

As we see at the latest AAII survey, bear sentiment is high. Almost 50% of traders expect a bear market in the next few months. The last reading that exceeded that number was back in 2013. This could be bullish at least in the shorter term. Or maybe the SP500 will not crash, as many expect, but slowly rise to revisit the September highs, which would mean a healthy 10% return. Or maybe the market does correct?

We have prepared a few changes and strategy updates. These will enable our strategies and portfolios to adapt to what we see as a changing set of conditions. Here is a brief synopsis of recent changes:

- A new DOW 30 strategy that pick the top 4 Dow stocks. This is a growth strategy that is somewhat more defensive than the NASDAQ 100 as it only invests in very large companies. It is also hedged using our new HEDGE strategy.

- A new U.S. Market strategy that can pick SPY, QQQ, DIA or SPLV for the equity part while using the HEDGE sub-strategy as a hedge. The possibility of investing in the low volatility SP 500 (SPLV) ETF makes this also a defensive strategy.

- A new HEDGE for all our equity strategies that can shift between multiple safe-heaven assets including TIPS, Gold and even the Dollar Index.

Read more about our 2019 strategy updates on our recent post.

We wish you a happy new year and a prosperous 2019, and look forward to a vivid discussion,

Visit our site for daily updated dashboard.

*Historical performances are based on actual signals given at the time. They differ from backtested data on parts of our site.

I am a new subscriber, my interest is with the aggressive risk portfolio in the core portfolio array, when will I get the current portfolio holdings? Or are they the current holdings listed ? I saw a holdings page where there was a notification stating that the holdings are for the prior month, so I just wondered if I am using the site correctly. thanks,

You should not be getting the notification as I see you have access. Try again, it may have been a temporary problem. https://logical-invest.com/app/strategy.php?symbol=Aggressive

If it still down’t work, email us at [email protected]