Summary

- We propose a set of investment strategies that combine traditional assets classes such as Equity, Bonds and Commodities with crypto-based assets such as Bitcoin and Ethereum. These strategies can be traded in a regular brokerage account.

- The obvious problem with creating crypto-only portfolios is the high correlation amongst crypto assets. To compensate we include three traditional uncorrelated asset classes, namely U.S. Equity, long term Treasuries and Silver.

- To further compensate for the extreme volatility of Bitcoin and Ethereum we use Leveraged ETFs, namely SPXL (SP500), TMF (30Y Treasuries) and AGQ (Silver). The first two ETFs track 3 times the daily returns of the corresponding asset class while AGQ tracks 2 times the daily return of Silver.

- The first of these strategies, the C&L Top 2, show average annual returns of 78%-189% per year. Historical drawdown is above 65%. It is categorized as a high risk/high reward strategy. It should be used with caution and with funds one can afford to lose.

- Backtest and Live tracking: https://logical-invest.com/app/strategy/clt2

Motivation

Crypto investing and traditional investing seem to be worlds apart. They are populated by different age groups with different investment philosophies as well as risk/reward profiles.

Traditional investors building retirement accounts will not seriously look to crypto assets due to risk, volatility and lack of familiarity with the underlying tech.

Younger investors will often benchmark their wealth in Bitcoin or Ethereum. As a result, traditional investing, with 3-7% returns, seems like a waste of time, a bet with historically negative returns (vs BTC or ETH).

Jumping above and beyond what seems like a generational gap in investment management, we propose a strategy that uses assets from both worlds without bias. We use tried and true classic management tools such as momentum, correlation and volatility. These tools have been used successfully in the past because they are not based on the financial data per say but rather on the underlying human behaviour that moves price.

For both traditional and crypto investors

Traditional investors can use it (with caution) to boost returns of current portfolios by using a rules-based methodology that directly compares crypto returns to familiar asset classes.

For crypto investors, the difficulty lies with the decision of when to exit because another asset class is doing better. Most just stick to their crypto investment. This strategy ranks the risk weighted crypto performance against equity, treasuries and precious metals and gives the investor a way to avoid long crypto bear market periods.

The first of the hybrid strategies: The Logical Invest ‘Crypto & Leveraged Top 2’

The Logical Invest C&L Top2, is an aggressive strategy that directly invests in the top performers across crypto and non-crypto assets.

The strategy picks from the 5 available instruments: Bitcoin, Ethereum, SPXL, TMF and AGQ. Once every two weeks, it ranks the assets using our Modified Sharpe Ratio1, identifies the top 2 performers and invests 50% of the portfolio to each one.

Here are some examples of possible market regimes:

- Ethereum is performing well but Bitcoin is under-performing. The strategy can invest 50% in Ethereum and 50% in SPXL.

- We are in a prolonged crypto bear market. The strategy can shift to 50% in SPXL and 50% in TMF.

- Cryptos are outperforming every other asset. The strategy could invest fully on crypto assets by allocating 50% to Bitcoin and 50% to Ethereum.

2 week rebalancing frequency

The strategy rebalances in the beginning and in the middle of the month. This provides a balance between a very active daily or weekly rebalancing, that can cause whipsaws, and a monthly rebalancing that may be too slow considering how fast the crypto markets move.

The 2 week frequency is simple to execute, avoids whipsaws but can still react to shifting market trends.

Performance

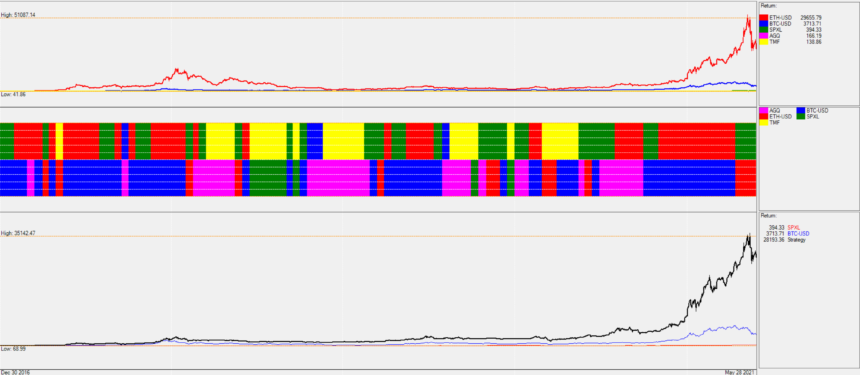

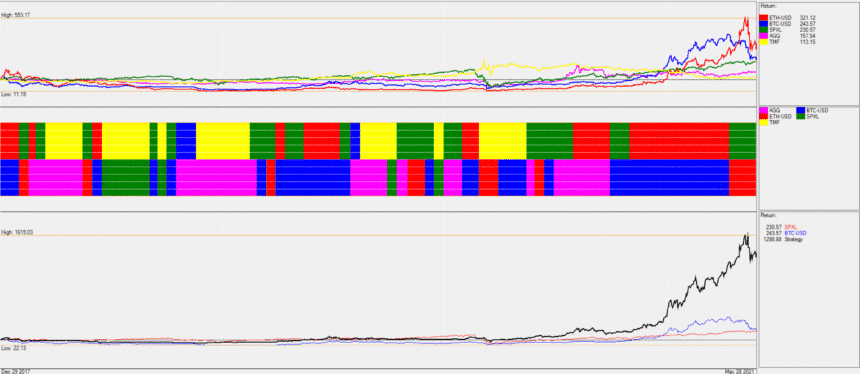

Our first backtest covers the dates from January 1st 2017 to May 27th 2021.

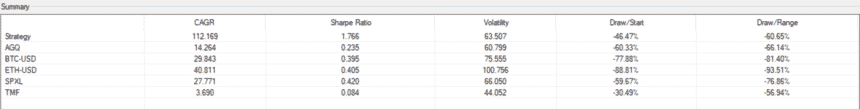

The strategy returned 28,093%. Compound annual return (CAGR) is at 259%, while max drawdown is at 61%.

For the same period SPXL returned 294%, BTC returned almost 3,613% while ETH returned 29.555%.

In the following table you can see the strategy performance figures vs it’s constituents.

The returns from the crypto assets are so large that the strategy outperforms by 94 times the SP500, which had a great run itself.

A CAGR of 259% means one would, on average, more than triple capital every year.

Too good to be true?

Identifying unrealistic assumptions

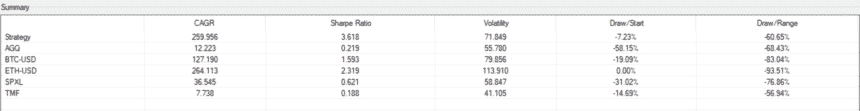

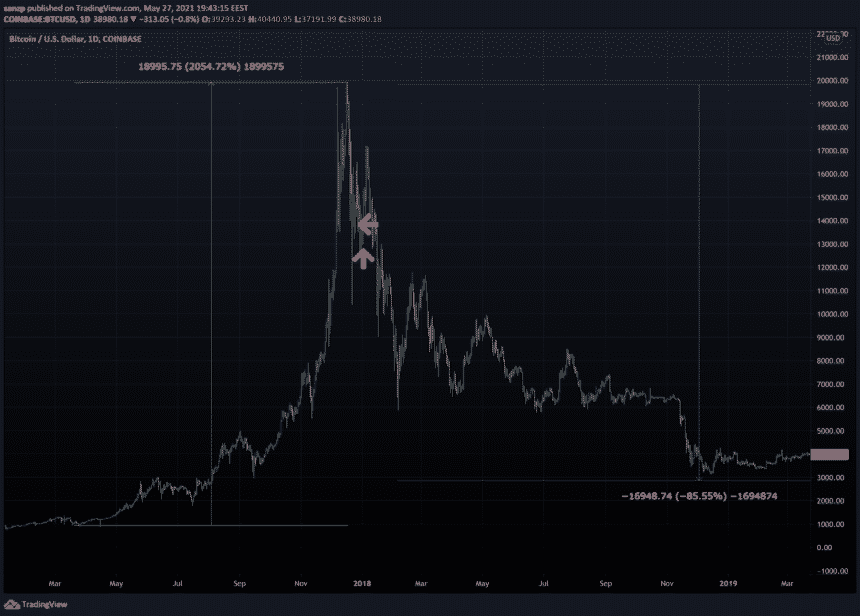

These numbers are nothing short of extraordinary. Nevertheless, it makes little sense to backtest any strategies that contain Bitcoin and Ethereum before 2018 since their 2017 bull market was so outrageous that it tends to obliterate all other asset returns.

Above we see a chart of Bitcoin centered around the 2017 bull market. You can see that just in 2017, returns surpassed 2,000%.

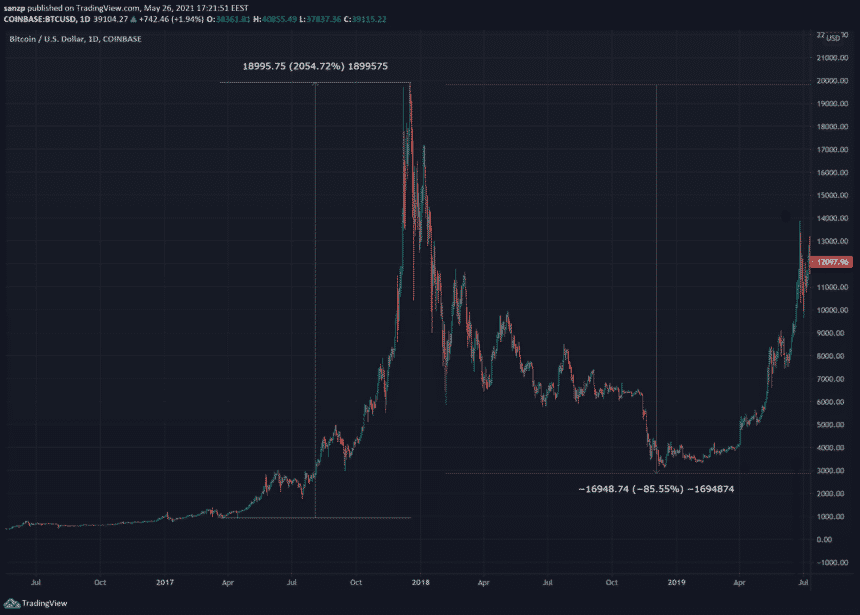

Ethereum’s returns for that year were even larger at roughly 17,000% as per the chart below.

It is also unrealistic to assume anyone would invest in crypto assets so early in 2017 unless they had specific tech-based backround, knowledge of blockchain or cryptography, access to crypto-exchanges and a tendency for reckless risk. Keep in mind that in early 2017 Bitcoin was an unregulated, unsupervised asset without any of the know-your-customer and anti-money laundry rules that exist today.

Bitcoin could not be easily purchased let alone changed back to fiat ($USD). There was no guarantee at the time that a bank would accept money originating from Bitcoin trading or Bitcoin mining. It is safe to assume that most retail investors were not aware or had no access to the markets early in the first half of the 2017 bull market.

A realistic entry point for testing: January 2018.

In order to be realistic and err on the side of caution we will assume a regular investor was more likely to enter during the hype of the market, well after Bitcoin passed the $10,000 mark. We believe that is when most early retail investors got baptized in the world of crypto.

Looking at a chart we see that at the end of 2017 prices went parabolic. After passing the 10K mark they kept going up until they reached almost the 20,000 mark. In hindsight we can see that this was the top, right before the start of a 2-year bear market. This is close to where we will start our second backtest.

To simplify we start our test from January 2018 (see arrows on the chart below) when Bitcoin traded at $13480 and Ethereum $759, close to the local top.

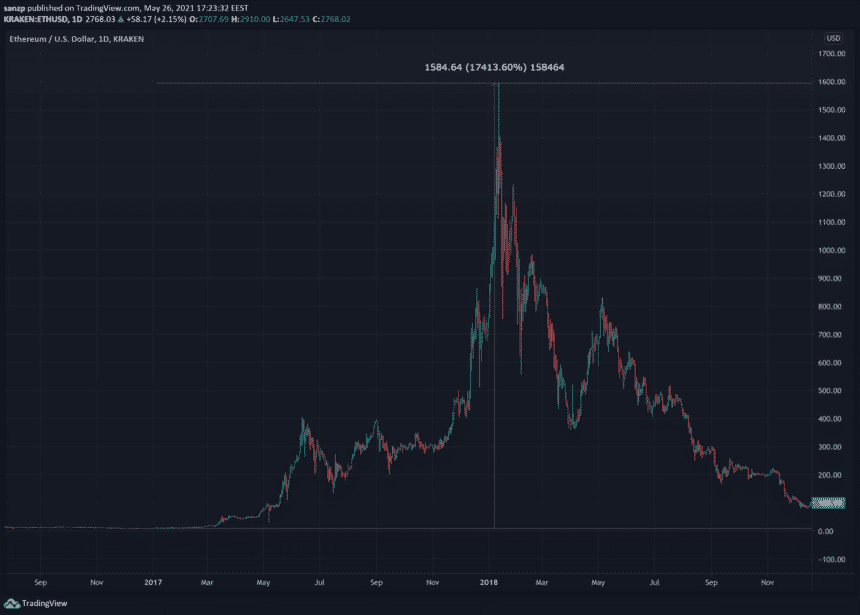

The unfavorable scenario: January 1 2018 – May 27 2021

Even starting to invest near the top of the 2017 crypto mania, the strategy outperforms each of the assets by a large margin.

Due to picking such an unfavorable entry point the BTC and ETH performances are much lower at 143% for Bitcoin and 221% for Ethereum.

The strategy manages 1198%.

During the same period, SPXL returned 130%.

Looking at the sharpe ratios, the Top 2 strategy far outperforms all other assets (Sharpe 1.7 vs 0.42 for the next best one). Interestingly the sharpe ratios of BTC, ETH and SPXL are awfully close (around sharpe 0.4) despite BTC and ETH having huge gains during 2020-2021. This testifies to the strength of the U.S. equity market on a risk adjusted basis as well as to the volatility of the crypto markets that can both boost and wreck an account.

It is for this reason that the Crypto & Leverage Top2 strategy can theoretically outperform even cryptocurrency portfolios. Again, looking at the maximum drawdown numbers we can see that Bitcoin and Ethereum holders have suffered extreme drawdowns of 81% and 93% respectively. These crypto bear markets can last for a year or more and can easily wipe all previous gains. If and when those infamous crypto ‘winters’ return the Top 2 strategy can contain losses by switching to the equity and bond ETFs.

Closing thoughts

The Crypto and Leverage Top 2 strategy is the first of a set of strategies that combines traditional asset classes with Bitcoin and Ethereum and can be traded currently at most U.S. brokerages through the Grayscale Trusts, the Canadian based Purpose ETFs or CME Futures.

It is a highly risky, highly aggressive strategy and should be considered separate from our other Logical Invest strategies. The risk of loss of capital is quite substantial so bear that in mind and do not use with funds you cannot afford to lose.

The strategy page is here: https://logical-invest.com/app/strategy/clt2

1 The algorithm uses the modified Sharpe formula Sharpe = rd/(sd^f) with f=volatility factor or Volatility Attenuator. The f factor allows us to change the importance of volatility.

- If f=0, then sd^0=1 and the ranking algorithm will choose the composition with the highest performance without considering volatility.

- If f=1, then we have the normal Sharpe formula.

- If f>1, then we rather want to find combinations with a low volatility. At extremes this becomes close to a Minimum Variance algorithm.

This is exciting and impressive. Playing a bit with the strategy in QT but replacing BTC and ETH with GBTC and ETHE. While still impressive, the return doesn’t come anywhere close to the strategy. Not a flaw of the strategy but of the reality of ETHE and GBTC. If you had a crypto account you could use real crypto but you would end up with unallocated cash when not 100% in crypto.

ETHE historical pricing is not reliable so it may skew results. As of late both trusts track BTC and ETH closer. Our preliminary research here https://logical-invest.com/trading-cryptocurrencies-bitcoin-and-ethereum-on-a-traditional-brokerage/

Other options are trading micro futures https://www.cmegroup.com/trading/micro-bitcoin-futures.html.

You could also trade 2 accounts but it is not very practical. We may present the strategy to some crypto protocols to see if there is a market for synthetic (or nirrored) SPXL, TMF, etc.

Would you trade based on the CLT2 signals then purchase ETHE or GBTC, or would it be better to set up a modified CLT2 strategy using these funds? Theoretically, these two strategies may not give the same signals due to differences in the underlying securities.

I would use the CLT2 signals because that is the data the strategy is based on. You can then trade using GBTC or if you have access, the CME mini-futures.

Very interesting work on developing this strategy.

It’s a big leap to go from reading about this tempting, high volatility, strategy to investing in it without know past performance and risk metrics using the options in our brokerages. Namely GBTC & ETHE.

Please show your usual performance charts and results metrics when this strategy is implemented using GBTC & ETHE for the available history of these vehicles.

Thanks

Oops, copy/paste issues from my clipboard. I wrote the above, & copied to clipboard, before I found this article which I read with interest. What I meant to paste is:

To subscribe to this strategy I need to buy the All Portfolios tier? Is that the most affordable way to get it?

Thanks!

Yes, the strategy is part of the All Portfolio package. It is meant to compliment our other strategies.