Updates/News

- Our new Crypto and Leveraged Top 2 Strategy, an innovative way to construct Bitcoin and Ethereum portfolios.

- New version of QuantTrader available for download with the newest strategies and updated Nasdaq components.

The new Crypto and Leverage Top 2 strategy

Our new and innovative C&L Top 2 strategy combines traditional assets classes such as Equity, Bonds and Commodities with crypto-based assets such as Bitcoin and Ethereum.

To compensate for the extreme volatility of Bitcoin and Ethereum we use Leveraged ETFs, namely SPXL (SP500), TMF (30Y Treasuries) and AGQ (Silver).

Average annual returns range between 110%-259% per year depending on where one starts the backtest (read more on our blog post). Historical drawdown is above 60% . The strategy stands apart from our usual strategies where priority is long term capital preservation.

This is a high risk/ high reward strategy, purely focused on growth and almost twice as risky as our ‘Hell on Fire” 3x Universal Investment strategy.

Interestingly we are launching the strategy right after one of the worst correction in crypto with Bitcoin droping some 50% and Ethereum 60% o their value in a matter of weeks. After a small rise from the local bottom we are currently 43% lower from Bitcoin’s all-time-high and 40% lower from Ethereum’s.

Fro more information read our blog post:

https://logical-invest.com/the-logical-invest-crypto-and-leveraged-strategies/

If you are interested in how the strategy handled the drop and what it picks next, visit the strategy page:

https://logical-invest.com/app/strategy/clt2

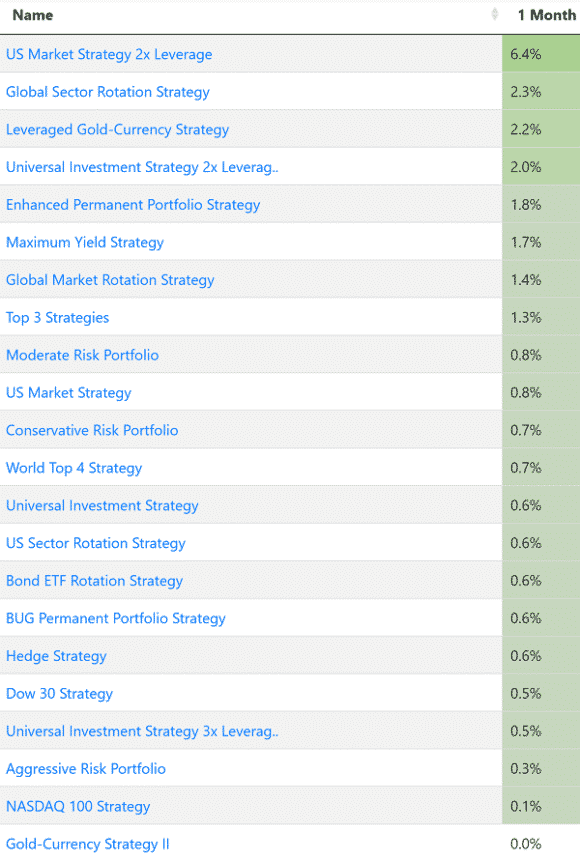

Strategy Performance

June was a ‘green’ month for our strategies with almost all of them having positive returns.

As for the main asset ETFs, SPY managed +0.7%, TLT remained flat for the month while GLD was a winner at +7.7%.

Please join the forum and discuss the recent changes in the markets, our portfolios and LI strategies.

The Logical-Invest team.