Update January 2017: The recent performance of investing in volatility can be seen here.

You are probably wondering how we could achieve yearly performances of more than 50% with some of our rotation strategies. The reason is that the Maximum Yield Rotation Strategy and the Global Market Rotation Enhanced Strategy are investing in inverse volatility.

Invest in inverse Volatility

So, here are now some facts to show you why I like inverse volatility so much.

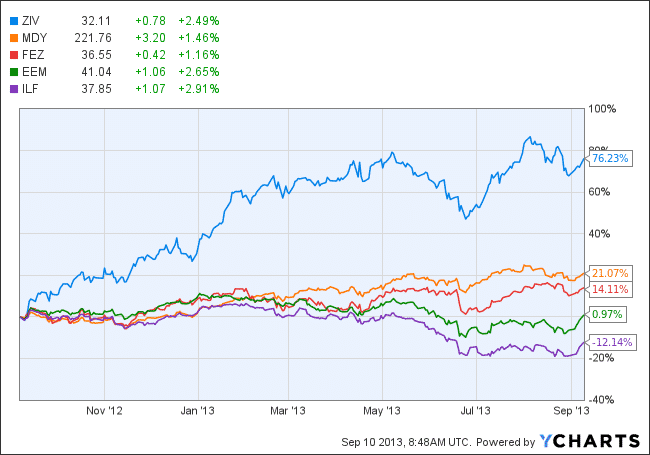

In this chart you see the performance of the ZIV mid-term inverse volatility ETF compared to some other global market ETF from our rotation strategy. The ZIV performance of 76% for the last 12 month was just incredible.

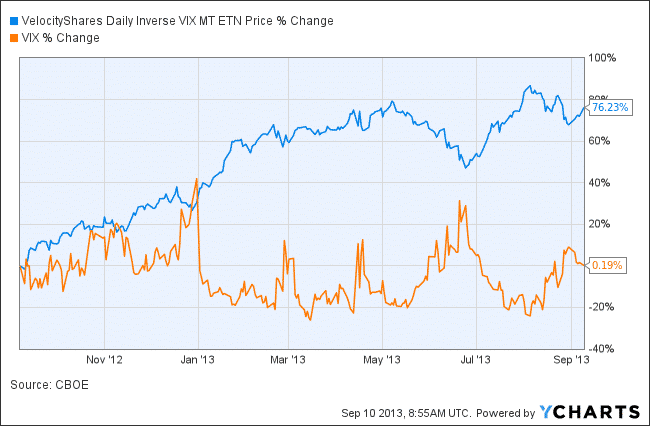

In the next chart you see a comparison of the VIX volatility index compared to the ZIV performance. ZIV has a inverse relation to the VIX index. This means that ZIV goes down when volatility or VIX goes up. For the 1 year period VIX is more or less the same (+0.19%). The VIX index is now at 15.6%.

So, why did ZIV go up so much, when the VIX index is unchanged?

This is because of the strong contango of the VIX mid-term futures of which the ZIV ETF is composed. If I calculate, then I get an average monthly performance of 4.8% (=12. root of 1.76), during the last 12 month, due to the strong contango of the VIX futures which track volatility.

At the moment the monthly “roll yield” of ZIV is a little bit lower, but it is still about 3% per month.

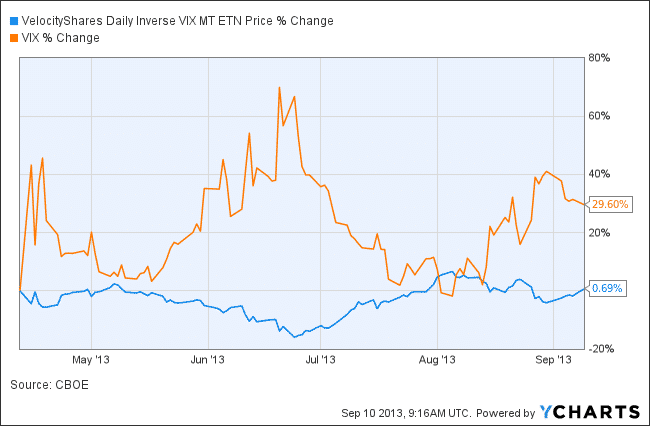

Now, if you look at the ZIV performance you see that ZIV only made 0.69% since April 12.

Why this??? If you look at the VIX Index, you see that during the same period, it went up by almost 30%. You see, that the positive effect of the high roll yield of the ZIF ETF was able to compensate this 30% increase.

The good thing is, that ZIV acts like a spring which is compressed. Because the VIX index always goes back to some low VIX values (mean reversion) between these “VIX fear spikes”, ZIV will release all this accumulated “roll yield” sooner or later. You just have to wait.