Forum Replies Created

- AuthorPosts

Frank Grossmann

ParticipantThis is the latest QuantTrader Version 312S with the updated QuantTrader.ini file of our strategies.

312S Changes:

– Bug fixes of the current prices download managementDownload link: https://dl.dropboxusercontent.com/u/43364046/Logical-Invest%20QuantTrader%20versions/QuantTrader312S.zip

Frank Grossmann

ParticipantThis is a strange post. We know the author quite well. It is true that GMRS was the worst performing strategy for some time, but this did not begin when it went live and it also has noting to do with curve fitting. It began when the US market reached a all time high about May 2015. From this moment the US market went sideways with some quite big corrections. The mediocre performance is easy to explain. Since May 2015 it looked as if the US market has reached it’s all time height and investors rotated in other foreign markets. However these rotations have been several times only of short duration and the US market always recovered. This resulted in the realization of losses for several market rotations. It is just a fact that trend following strategies don’t like periods where there is no trend and markets go sideways up and down.

The second reason for the lower performance is that we had some very big currency spikes and drops. If the US$ goes up against foreign currencies then foreign ETFs will lose about the amount the US$ goes up. We had several 6-8% US$ jumps up and down. These jumps have been stronger than any market trend and made investments in foreign markets very difficult. The bad thing was, that this huge additional volatility was totally unpredictable because it was the mere result of small wording differences in the minutes of our central bank leaders.

All together every strategy can have difficulties for some periods. This is just normal. GMRS is 15% up since we started live trading about 3 1/2 years ago. Europe made about 10% during the same time frame. So, for US investors this is probably a mediocre result. For European investors however the result is quite good.Frank Grossmann

ParticipantI know that Yahoo does not really provide good adjusted data of less important non US ETFs. We are at the moment testing if we could use free Quandl data instead, but this will take a moment to finish.

You can open the ETF csv files in Excel and edit your data this way, but from this moment you need to make sure that you never choose to download new data,because then your edited data would be overwritten.

You can load currencies using the Yahoo symbols (AUD=X for Australian dollar).Frank Grossmann

ParticipantHere is a zip file containing some ETF lists in csv format. There is Nasdaq100, Dow30, US sectors, 240 SP500 stocks with highest market cap. …..

You can use these ETF lists to load all ETFs automatically into QuantTraderFrank Grossmann

ParticipantThis is the latest QuantTrader Version 311S with the updated QuantTradre.ini file of our strategies.

311S Changes:

– Now QT will ask you if you want to download current 15 min delayed prices. This will only happen when the US market is open (beginning from 3.45pm). Downloading current 15 min delayed prices is slower than downloading the last days closing price.

– Several input checks now prevent the user to input forbidden special characters into different text fields. This was corrupting the QuantTrader.ini file in the past.

– It is now also not longer possible to input 5% limits when the QT was in the 10% step mode.Download link: https://dl.dropboxusercontent.com/u/43364046/Logical-Invest%20QuantTrader%20versions/QuantTrader311S.zip

Frank Grossmann

ParticipantWith the newest Version 310S of QuantTrader, I have added a “Strategy of Strategies” which allocates between 9 Logical Invest strategies. Maximum investment per strategy is set to 30% and the strategy shows the top 6 strategies.

Unfortunately the strategy will not give you an allocation down to every ETF because the LI strategies itself are already metastrategies and this “Strategy of Strategies” is a metastrategy of metastrategies. You will still need to multiply the % Strategy investment by the strategies ETF allocation to get the final allocation.This is the latest QuantTrader Version 310S with the updated ini file of our strategies.

310S Changes:

– several smaller Bug fixes

– Now the strategy always loads the 15 minute delayed prices if you start it during normal market hours. This allows you to start it for example the last day of the month at 3pm and then you can do your allocation changes during the last hour.

– The strategy drag down field now automatically gets large enough so that you can read the complete strategy names.Download link: https://dl.dropboxusercontent.com/u/43364046/Logical-Invest%20QuantTrader%20versions/QuantTrader310S.zip

Frank Grossmann

ParticipantThis is the latest QuantTrader Version 309S with the updated ini file of our strategies.

309S Changes:

– Bug fix when exporting and importing strategiesDownload link: https://dl.dropboxusercontent.com/u/43364046/Logical-Invest%20QuantTrader%20versions/QuantTrader309S.zip

Frank Grossmann

ParticipantThis is the latest QuantTrader Version 308S with the updated ini file of our strategies.

For most strategies there are 3 versions. Example:

GMRS (is the equity only strategy)

GMRS hedged (is the hedged strategy composed of the GMRS equity strategy and the hedging strategy (BRS Top1))

GMRS table output (is only used to produce the ranking tables with all ETF symbols)308S Changes:

– Bug fix when exporting meta-strategies

– New “go to cash” function.

Go to the “Strategy Parameters” and open the “Advanced” tab. You will see an input field for the “Cash Sharp Limit”. You can give cash a sharpe value and then cash is ranked together with the ETFs. Good values are Sharpe values of about 0.85. All top ranked ETFs are compared to this cash Sharpe and if the ETFs have a lower Sharpe than cash, the strategy will replace them with cash. QuantTrader calculates sharpe slightly different to allow a ranking of ETFs with negative performance. The percentages are normalized to 1. 0% performance=1. 2% performance=1.02, -5% performance=0.5. Same is done for volatility. If we have for example a performance of 12% and a volatility of 17%, then the normal Sharpe would be 12/17=0.7. The sharpe how we calculate it is 1.12/1.17= 0.95.

So, if you use for example 0.85 as cash limit, then ETFs can also have slightly negative performance and they are still not replaced by cash. You will have to do some backtests to find out which is a good cash sharpe value. Giving cash a sharpe value is the much better method than just going to cash when the lookback performance of an ETF was negative.Download link: https://dl.dropboxusercontent.com/u/43364046/Logical-Invest%20QuantTrader%20versions/QuantTrader308S.zip

Frank Grossmann

ParticipantIf you have a new QuantTrader version, then you just have to copy your old QuantTrader.ini file in a folder together with this new version and then start QuantTrader. All your previous strategies are now opened in the new version of QuantTrader. If you want to go back to an older version of your strategies, then just look for one of the QuantTrader.ini backup files. These have date and time added in front. You just have to delete this date-time and use it like a normal QuantTrader.ini file

Frank Grossmann

ParticipantOption strategies are very hard to backtest. Data is difficult to get and even if you backtest, spreads can be much different doing real trades.

The only thing I do in sideways markets is to sell slightly OTM SPY calls and sell slightly OTM TLT put. At the moment with SPY near all time high and TLT really low, SPY will rather correct to the downside and TLT probably to the upside. This way you can generate income during sideways markets.

Gold or currencies are too impredictable for me. You can never know which side they go.Frank Grossmann

ParticipantThis is the latest QuantTrader Version 307S with the updated ini file of our strategies.

For most strategies there are 3 versions. Example:

GMRS (is the equity only strategy)

GMRS hedged (is the hedged strategy composed of the GMRS equity strategy and the hedging strategy (BRS Top1))

GMRS table output (is only used to produce the ranking tables with all ETF symbols)307S Changes:

– Quarterly rebalancing is now possible (Q symbol). Normally you also have to change (make longer) the lookback periods to obtain good results with quarterly rebalancing. You have to do this in all sub-strategies. For example you have to change the GMRS strategy itself to quarterly with a good lookback period and then also switch the GMRS hedged strategy to quarterly. Also this strategy will probably need a longer lookback period. Be aware that with quarterly rebalancing the hedge is only increased with a very long delay. Therefore you should run the strategy with high volatility attenuation values. This means that you always allocate about to risk parity.

– Bug fix with ETF multipiers. For every ETF you can set a multiplier which multiplies or divides the daily performance. This is for example necessary if you work with inverse ETF. Many of them only exist in a -2x or -3x leveraged version. If you multiply them by 0.5 or 0.333, then they behave like a 1x leveraged ETF in the strategy. But be aware that you have to buy 2 or 3 times less of these ETFs. The allocation is the one for the unleveraged ETF.Frank Grossmann

ParticipantIn the past I always did only a single strategy with stocks and Treasuries mixed. Quite a big improvement was when I realized that in fact stocks and Treasuries need different lookback periods for good results. To do this I now always did a stock only strategy. For Nasdaq, such a strategy has quite long lookback periods. Only like this we could find stocks like Google, Tesla, Netflix …. which outperformed the markets for years. To hedge I now combined the stock-only Nasdaq strategy with a treasury hedge. This way I can impose a shorter lookback period for the Treasury hedge. I need a short period for the hedge, because I want the hedge react very fast if first signs of a market correction appear. In fact this was much more efficient than my old idea to switch to a low volatility version of the Nasdaq so that I did not continue with this vola switch.

It is important to know, that the strategy we use is always the hedged version. The unhedged one is only used as a sub-strategy.Frank Grossmann

ParticipantBacktests prove that weekly rebalancing reduces the performance of all strategies because you react to every small up or down of the markets. This results in many small buy high sell low trades. Less rebalancing is better because this allows you to invest in longer term trends.

3x leveraged ETFs perform well in up or down markets. If the markets go sideways, then they can suffer reballancing losses.Frank Grossmann

ParticipantIn fact adding option strategies to strategies like UIS (SPY-TLT) or BUG (with SPY-TLT-GLD) is a very good strategy during sideways markets. You can do only covered calls, or you can also sell wide OTM strangles (about Delta 10) on GLD and TLT. The only thing not to do is to sell naked puts on SPY because SPY has a big downside risk. If you sell a strangle on SPY, then always add a protective put to limit the downside. Best is to do it so, that you do not have any downside risk but only upside risk which is acceptable because the risk of a SPY upside crash is extremely small.

The nice effect of such a option strategy on SPY TLT and GLD is that the underlyings have low to negative correlation. Even if you would once lose with one of the options strategies, you would still have a high chance to win on the two others.Frank Grossmann

ParticipantThese are values found in the Optimizer window. Before running the optimizer you have to choose a chart range for the optimization in the main trader windows. You will set for example the “History range” of the graph to 2 years. This way the optimizer will run quite fast, because it will only optimize the parameters for the last 2 years. If you hover above the chart, then the optimizer will show you the results for a certain combination of lookback period (6-200 days) or volatility attenuator (0-10).

The “Range return” will show the portfolio return for the selected 2 years. Same for Range Sharp. Much more important is the Annual Return (=CAGR Compounded Annual Growth Rate) and the Annual Sharpe. Only with these annualized values it is possible to compare results.

By the way it may make sense to sometimes choose a chart range for the optimization which is smaller than the total available range of the ETFs. This way you can find strategy parameters which work better for a special market situation like for example the up and down sideways market we have since 2 years.Frank Grossmann

ParticipantThe 3x leveraged SP500 ETF is moving very similar to ZIV, so many times also the ratios are the same. If however the VIX Futures go again in steep contango so that ZIV will gain again from rolling the Futures, then the ratio can be quite different.

Frank Grossmann

ParticipantThe problem with investing in oil using ETFs is the strong contango of oil futures. Today it is at about 8$ per year. This means that even if the spot oil price goes up 25% during a year, the ETF is still flat or even slightly negative. In fact you could always make a lot of money by shorting oil ETFs, but not by going long oil. Oil is very volatile. Prices can make huge unpredictable jumps on political or terror events. I tried to backtest strategies with oil ETFs, but I was never able to achieve good results.

Frank Grossmann

ParticipantIn the strategy we will propose to use double leveraged forex positions. This works better because the volatility of these ETFs (EUO, CROC, YCS) matches about the GLD volatility.

Frank Grossmann

ParticipantI never did risk reversals, but I like to sell otm put options both on SPY and TLT with about the same premium. As SPY/TLT are inverse, the chance is big that both or at least one of them expire wortless.

Frank Grossmann

ParticipantOur QuantTrader software allows to backtest with out of sampling lookback and volatility factor. We did this also for the Nasdaq 100 strategy. It means that the software always calculates the best lookback period and volatility factor based only on historical data. It will then use this settings to do the rankings for the next month investment. Every month the settings are recalculated using historical data. So the calculations never includes pricing data which would have been unknown when the end of the month allocations are calculated.

This year is a difficult year for momentum strategies. Markets go sideways without a clear momentum. This is a situation which we always had just before rates bagan to hike. Another problem is the bad performance of treasuries which is also due to the rate hike fear. Treasuries are a very important component to reduce risk and so a bad performance is bad for the whole strategy performance.

The third problem is the very strong US dollar which directly impacts the performance of unhedged foreign ETFs. Year to date the US$ surged 12% against the Euro. This means a loss of 12% for the Eurostox 50 ETF FEZ compared to the Euro denominated Eurostox 50 Index.

Historically the markets normalized some months after the first rate hike. These periods of uncertinity have always been quite short compared to markets with up (bull) or down (bear) momentum.Frank Grossmann

ParticipantDuring bear markets, the strategy will most probably allocate a major part in long term treasuries if they continue to work as a safe haven asset. Most probably it will also switch to the low volatility Nasdaq 100 strategy. However if US equity enters a bear market, then it can well be that other strategies are a better choice. With the Nasdaq 100 strategy you depend only from the US market while other strategies like Global Market Rotation can then switch to foreign markets which have much lower valuations and may outperform the US market for some time.

So, it is always good to switch to strategies which did well in the near past. At the moment the Nasdaq 100 strategy is going very well. Strategies with which invest in foreign ETFs have problems because of the strong US$Frank Grossmann

ParticipantThe Nasdaq100 strategy had a maximum drawdown of 25% during the 2008 correction. As long as treasuries work as a save harbour asset, the strategy will allocate most of the money in long duration treasuries during a correction. It will also most probably switch to the low volatility Nasdaq 100 sub strategy.

Frank Grossmann

ParticipantThere are several reasons not to use opening prices. The most important is that for the ETFs we only get adjusted closing prices from the data provider. So all our calculations are based on closing prices and our subscribers can backtest and verify the results. The second reason is that using adjusted closing prices is a sort of industry standard. Websites like EtfReplay.com which let you backtest simple rotation strategies use the same approach. The third reason is that using the end of day closing price, I can calculate the new allocation just after the last trading day of the month, and this way you know the allocation before the market opens the next day. Also I do not recommend to trade at open, because this would probably result in quite a big slippage if all subscribers would do so. It is better to have the trades distributed over the first 2 days. So, anyway every investor will get slightly different prices.

Frank Grossmann

ParticipantAt the beginning of a strategy investment it is clear that it makes a difference when you invest. However these are long term strategies, and after a few month it makes not much a difference anymore. Sure one month you probably have a less good trade than our end of month rebalancing, but there are about the same amount of month where you get a better trade. After a number of trades the difference is about zero. The difference of trades for such a short period is more random noise. If it would not be random, then we would instantly made a nice strategy out of it.

The only real difference which will reduce your performance slightly compared to our published performance is that we do not calculate spreads and commissions. These are different from broker to broker, but the spread for SPY/TLT and even SPXL/TMF is very small, and commissions are also small seen that most of the time you rebalance only 10% of your portfolio. All together spread and commissions are less than 1% for the whole year with a good discount broker.Frank Grossmann

ParticipantI am sorry, but I can not give you such an advice. I am not allowed to do this in a forum like this.

Frank Grossmann

ParticipantI did both, and I can not tell you what is better. I tried this options strategy for some time, but I think I am not really an options specialist and I do not have the tools to really backtest these option strategies.

Frank Grossmann

ParticipantFor me the main reason to buy UB futures instead of TLT is that you do not have to pay the 30% witholding tax on dividends.

Frank Grossmann

ParticipantI don’t understand what you mean with lack of leverage for 3x funds. 3x means 3x leveraged.

Frank Grossmann

ParticipantYes, we considered to use currency hedged ETFs for example in the GMRS. We also did backtest to see if we would have better results, but this was not the case. In fact the currency hedge is like an additional forex trade and forex trades are probably the most difficult trades ever. The result is pure hasard and so hedging did not make the strategies any better. In fact these up and down cycles of foreign currencies against the dollar are an important part of the market momentum’s and it would be wrong to correct this influence. The valuation of a foreign market in US$ always seems to be more correct than the valuation in Euros.

Frank Grossmann

ParticipantYou can’t do much else. The only thing would be to impose a volatility limit and go partially to cash if market volatility increases. However with bonds the problem is that these things are normally triggered by FOMC and FED statements and these are difficult to guess right.

Frank Grossmann

Participantnow I would invest in the March UB and US futures. I would roll about 1-2 weeks before expiry at March 20 into the June futures

Frank Grossmann

ParticipantThe UB future is about the same as TLT

Frank Grossmann

ParticipantI did a 5 year backtest with the BRS strategy replacing PCY with TBF (which is the short TLT EFF)

TBF was chosen shortly 3 times. Longest in 2013 from July to September. However this did not help a lot. See results below.

Normal BRS: CAGR 15.48 Sharpe 2.35

BRS with TBF: CAGR 12.80 Sharpe 1.80I think it is better to go to cash for the case that everything would go down simultaneously. This is better than going short Treasuries.

Frank Grossmann

ParticipantNo, it is absolutely correct to convert like you do in TMF.

Frank Grossmann

ParticipantHello Greg. I am always reading Cliffs SA articles and he also gives me sometimes good ideas, but I think that using TBF as a hedge is fundamentally wrong. TBF is the same as shorting TLT. The biggest no go of using this as a hedge is that it is no hedge anymore because TBF has a positive correlation with the stock market. If there would have been any bigger crisis during cliffs backtest period, then stocks and TBF would both have gone down. Also using TBF is betting against the trend. Longer term, treasuries will always go up. So, keeping an inverse treasury is just very risky. Then you could as well hedge with SH which is the inverse SPY.

In fact these are long/short strategies, and I did hundereds of backtests with such strategies, but because of the short part of the strategies these always lagged strategies which only invest long with the trend.

One idea was for example to construct a market neutral strategy by going long the top x ETFs and going short the bottom X ETFs. But this does not work, because even if you short always the worst ETFs, it is very difficult to have have a positive performance because even if these ETFs are bad, they still have a positive trend due to inflation and other things. Shorting good ETFs like TLT or SPY is even worse because you have a strong uptrend against you. Worst of all for a hedge is a volatility ETF. There you have several percents of downtrend per month against you.Frank Grossmann

ParticipantIch würde folgende in EUR gehandelten ETFs als Ersatz vorschlagen

MDY – SPDR S&P 400 US Mid Cap UCITS ETF, ISIN IE00B4YBJ215, WKN A1JSHV, SPY4

FEZ – db x-trackers EURO STOXX 50 UCITS ETF (DR) LU0274211217

EEM – iShares Core MSCI Emerging Markets IMI UCITS ETF, ISIN IE00BKM4GZ66

ILF – iShares MSCI EM Latin America UCITS ETF (Dist) ETF, ISIN DE000A0NA0K7, WKN A0NA0K, IUSC

EPP – iShares MSCI Pacific ex-Japan UCITS ETF (Dist) ETF, ISIN DE000A0YBR12, WKN A0YBR1, EUNJ

EDV – iShares $ Treasury Bond 20+yr UCITS ETF DE000A12HSS9Diese ETFs wären die genauen Euro ETFs für die GMRS. Ich denke aber dass sie mit den US$ ETFs bessere Ergebnisse erhalten. Der US ETF Markt ist effizienter, die Spreads sind kleiner. Auch hat zur Zeit der USD-EUR Wechselkurs einen grossen Einfluss.

Am besten ist es wenn sie ein Margenkonto bei einem Discount-Broker wie Interactive Brokers eröffnen. Dort können sie ihr Geld in Euro lassen. Es wird nie in USD gewechselt. Nur die laufenden Gewinne der ETFs fallen in USD an. Sobald aber eine Position geschlossen wird, werden die USD in EUR gewechselt.

Somit ist das Währungsrisiko gering. Ich habe auch ein IB Konto, allerdings in SFR, wofür ich seit dem 20% Kursanstieg des SFR recht froh bin.Frank Grossmann

ParticipantThe UIS table is now corrected. Since the live trading date, the performance was correct, but before we changed slightly the strategy parameters and did not update the backtest table. BUG should also be fixed.

Frank Grossmann

ParticipantI think it is absolutely necessary to review a strategy from time to time and do changes, if you can validate an improvement. The only thing which is fixed, are the monthly returns in the “return & investment tables” section. We would never update these to an improved backtest.

The only thing I would not change is the main characteristics of the bond strategy. This is, switching between a mix of negatively correlated bonds to maximize return and minimize volatility and drawdowns.

I even think the permanent portfolio is a good example to show why it is important to improve strategies. Sure you could just use the original PP buy and hold strategy with 25% GLD, 25% SPY, 25% TLT and 25% cash, but using a modern adaptive strategy with the same PP ETFs, you can get twice the return to risk ratio.

The new adaptive bond strategy has been very well backtested and compared with the old strategy and the result is very clear that we should switch to the new strategy. We will publish a complete paper on this soon.

So, all our strategies can change slightly over time, because the markets change, we get new ETFs or even only because also our team learns to use new ways to execute these strategies.Frank Grossmann

ParticipantYou would need to short 300’000$ VIX futures. One future is 1000x the price, so at 19.50 you would need to short about 15 VIX June futures. The UB future is quite expensive. One future is about 172’000$. 70% EDV would be 700’000$ EDV or 1.5x = 1’050’000$ TLT equivalent. This means you need to buy 6 UB futures.

The UB futures need to be rolled every 3 month. You can keep the VIX future also for 2 month. I would close it before it moves down to month 3.Frank Grossmann

ParticipantIf you invest large amounts of money, then it makes sense to trade (short) the VIX (5/6 month) and UB treasury futures instead ZIV/EDV. These futures have a very high liquidity and are traded 24h a day. I personally always trade the underlying futures if you can do this for an ETF.

ZIV has quite a small volume, but underlying are very liquid VIX futures month 4-7. So also high amounts of ZIV can be bought without problems. The same is valid for EDV.

You can not replace ZIV, which is a medium term volatility ETF, with the high volume front month ETFs like SVXY, XIV, TVIX. These have a much higher volatility. ZIV has the much better return to risk ratio.

I think it is no problem to invest several millions in a strategy because most of the time the allocations do only change by 10-20% each month.

If you invest larger sums, then you should not buy all at open, but better accumulate slowly with limit orders. You have enough time to do the changes.Frank Grossmann

ParticipantI have just posted a short blog with a 20 year UIS backtest here: https://logical-invest.com/universal-investment-strategy-20-year-backtest/

Frank Grossmann

ParticipantNo, I don’t think an option strategy derived of the MYRS strategy makes much sense. The problem is poor liquidity and very high spreads of these options. It will be difficult to make money with those options.

Frank Grossmann

ParticipantWe do not give specific option signals, as there are too much different possibilities. Beginning of December however I made an example of an option trade in a blog…….

For example you could sell 20 x OTM SPY put options with a strike of 195 and expiry of February 20. So, the strike is about 10% below the current SPY price. You will get 2.55$ premium.

At the same time you could sell 40 x OTM TLT put options with a strike of 115 and expiry of February 20. So, the strike is about 5% below the current TLT price and you will get 0.69$ premium.

For SPY I normally set a lower strike, because if the market crashes, then only SPY will go down. TLT normally goes down slowly. It is important to have some stop loss limits. You can set these for example at double the premium or you close the put position if the underlying ETF falls below the strike.This is just an example. Option trading is not an exact science and there are hundreds of possibilities to do such a trade. Best is to inform you for example at http://www.tastytrade.com.

Frank Grossmann

ParticipantNo, I think like this BRS and GMRS are much better hedged or diversified than before.

Before it was well possible that BRS and GMRS have been all invested in ETFs with a positive correlation to the stock market. Something like CWB, JNK + MDY.

Correlations between ETFs had no influence on the investment. Also when invested in a hihg volatile ETF like ILF, the overall allocation has not been modified.

Today GMRS would automatically adjust the treasury part to reduce the high ILF volatility, and the same happens for the BRS strategy.Now you just have to add the treasuries together and buy only once (EDV= 1.5xTLT) and you are perfectly protected.

Frank Grossmann

ParticipantYou are right, you can not trade at close, but I would also not trade directly at the next open, because then you have normally quite big variations. I would trade during the first 2 days of the month. It makes not much difference on the performance, because the allocation will most probably not change during these 2 days. Backtests have shown, that the price variations during this short period are rather random. If you trade for several months, then the differences to a trade at close of the last day of the month are more or less zero. But sure, if you look only at one month, there can be a big difference. The only important thing is to execute the rebalancing trades very near together.

Frank Grossmann

ParticipantYes, the new algorithm is calculating the composition which gave the best return to risk ratio (Sharpe ratio) for the lookback period. If no positive Sharpe ratio is found because both assets go down, then the algorithm will slowly reduce the total allocation from 100% invested up to 0% (= 100% cash). The strategy will also go partially to cash when volatility is too high.

Frank Grossmann

ParticipantThe bond rotation strategy includes very different types of bonds. This goes from Treasuries (TLH) up to corporate bonds (CWB) which behave like stock market ETFs. So, I think that also in an environment of rising rates, this strategy should be able to produce positive returns.

Frank Grossmann

ParticipantThere are many short periods where TLT-SPY has positive correlation. If both go up then anyway we are happy. If both go down like 2013 for a short time, then it is not so good. If you analyze the correlation, then you see that it has it’s negative lows always if there is a market correction. So, in fact this means that if the market crashes investors sell SPY and go into the safe haven ETF TLT. As long as it is like this the strategy works. During low volatility calm bull markets, there is no problem if the correlation fluctuates sometimes towards zero.

Frank Grossmann

ParticipantHello Anna

None of the strategies invests in the Japanese stock market. In the Global Market Rotation we have EPP which is the MSCI Pacific, but also this Index excludes Japan. In fact Japan is excluded in nearly all global indexes, because this market is too much manipulated by the influence of Japanese politics.

Best regards

FrankFrank Grossmann

ParticipantYou have the new charts in the latest strategy blog: https://logical-invest.com/new-maximum-yield-rotation-strategy-backtest-charts/

Here is the old chart for MYRS since 2010

The CAGR annual return is nearly the same. 56% for the old MYRS and 54% for the new strategy. The difference is small because in the past ZIV performed well over long periods and if this is the case, then both strategies invest 100% in ZIV. For such periods with a strong trend, rotation strategies with a 100% switch do perform very well and the new strategy will perform about the same because it is also 100% invested in ZIV.

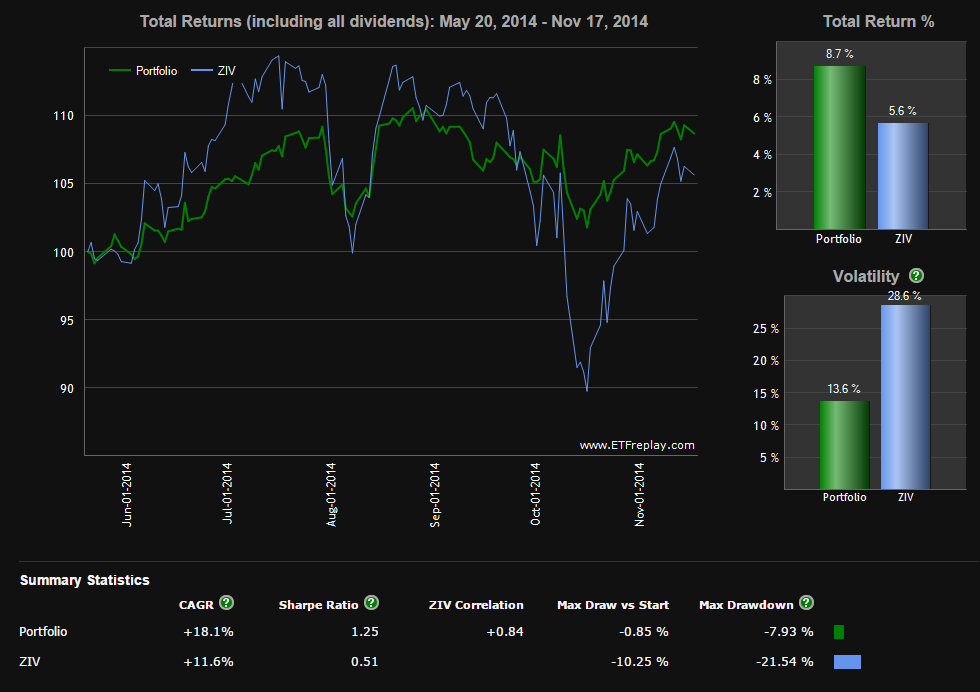

The difference between a 100% rotation and a rotation with variable allocation however is very evident when the trend slows down and goes over in a flat market like it is the case for 2014. In this case a variable allocation does much better. The volatility is reduced a lot and the new Sharpe ratio (1.15 for 2014) is double the old Sharpe ratio (0.61 for 2014). Since about March, the new strategy is holding about 50% Treasuries (EDV). The effect of this can be seen here:

You have better return with a fraction of the volatility. Holding 100% ZIV for 2 weeks in such a volatile whipsaw market is like playing Russian roulette. The chance that the strategy is switching wrong is very high. With the new strategy I feel much safer now. It is a pity, that I can not back-test it for much longer periods with ZIV, but the results correlate nearly 100% with my new Universal Investment strategy which invests with a variable allocation in SPY-TLT. This one can be back-tested until 2002 and also shows much better results during market periods without a strong trend.

Best regards

Frank- AuthorPosts