It has been now 18 months since our post on “The power of diversification: Portfolios of Logical Invest Strategies”. Back then our main argument for diversification using a robust portfolio of several of our strategies was that “diversification is ‘a rare free lunch’, it is well accepted part of modern financial portfolios, and to stay financially healthy it is important not to skip lunch”.

Several new strategies have been published since then, among them the “NASDAQ 100” strategy, the “Gold-Currency” strategy and our “Hell on Fire”, the 3x leveraged Universal Investment strategy. At the same time, we went through the bumpy start into 2016 and most recently the waves created by the BREXIT referendum.

Does our stated hypothesis of formerly presented portfolios still hold true? How have the individual components performed, and most importantly, have they added value through low correlation? Have new optimum portfolios emerged since then? These are some of the questions we want to shed light on in this new post.

Correlation, still the grand lady of Portfolio Diversification

The year 2015 was without doubt one of the most difficult for momentum based investment strategies like ours: Sideward moving markets without clear trends in all asset classes, heavily event driven movements triggered by central banks, especially in bonds.

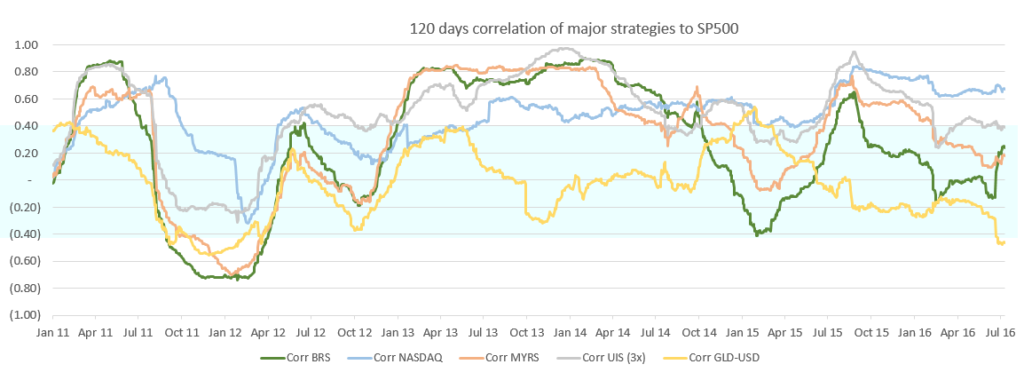

The nervousness in markets is clearly visible in below chart depicting the 120 days correlation of some of our strategies to the S&P 500: Our “Sleep Well Bond Rotation (BRS)” had a strong performance late 2014 and early 2015 coupled with strongly negative correlation to equities, thus being a main force for performance and diversification.

However, things changed around mid-2015, when suddenly bonds became strongly correlated to equities, and our Gold-Currency strategy published in December 2015 took over as main diversifier in portfolios with strongly negative correlation to equities.

When equities went very suddenly south early 2016 based on fears of a slow-down and debt issues in China, the S&P 500 lost 7% within the first 6 weeks in the new year. Once again diversification showed to be fundamental to smoothen portfolio volatility and reduce draw-down. Our Bond Rotation gained 3%, while the Gold-Currency strategy increased by 7% in the same 6 weeks period, thus a balanced portfolio was only marginally affected by this turmoil.

In the aftermath of the June 23 BREXIT referendum, the “serial diversification”, e.g. the effect that monthly switches between the “fasted horses” reduce the average correlation profile of our strategies of our strategies, played out quite nicely. While equities took a deep dive only to recover over a 2 weeks period, strategies with bonds as crash protection like the Maximum Yield Rotation Strategy (MYRS) and Universal Investment Strategy (UIS / 3x UIS) jumped by 4.4%, 3.6% (and even 10.5% for the 3x UIS) during June 2016.

Optimum Portfolios on the Markowitz Efficient Frontier

We updated our Excel Portfolio Builder and calculated the hypothetical best combinations of our strategies for achieving prominent investor objectives:

- Maximizing the Sharpe Ratio or the Risk-Benefit balance of the investment

- Minimizing volatility or keeping it below a certain level which the stomach can handle

- Reducing Draw-Down, the biggest evil when it is about sticking long-term to a portfolio

Some disclaimers before we start exploring the individual portfolios: This optimization is Markowitz style applied Modern Portfolio Theory looking for portfolio on the Efficient Frontier, that is using past long term median returns and covariance matrix to optimize a portfolio towards the set objective (here maximizing return for given levels of volatility) using secondary constraints (maximum Volatility or DrawDown Level).

Interested readers will see where above emphasis points lead to: Trying to predict future performance based on average past returns from 2009 to 2016 through a mathematical optimization with by nature very volatile covariance matrices might serve as an indication or rough guide for building a diversified portfolio – but not more: It is not to be understood as exact science and does not substitute your own analysis and most importantly “getting comfortable” with putting money into the underlying ETFs.

Another limitation of this exercise is that we did not put a limit on the number of strategies to be employed in the portfolio, that is while in some portfolios only two or three of our strategies receive weights, in other portfolio there are weights assigned to up to all eleven strategies – which clearly will not be a workable option even to our “All Strategies” subscribers.

However, by letting the optimization pick any and all of our strategies you get an indication of where to look for setting priorities in your portfolio, e.g. get a feeling of which strategies to weight higher, and which ones to either eliminate or substitute by other with similar behavior. In a follow-up article – and hopefully backed up by many requests from our readers in the comment section – we will then present some selected portfolio employing a maximum of three strategies for easier handling.

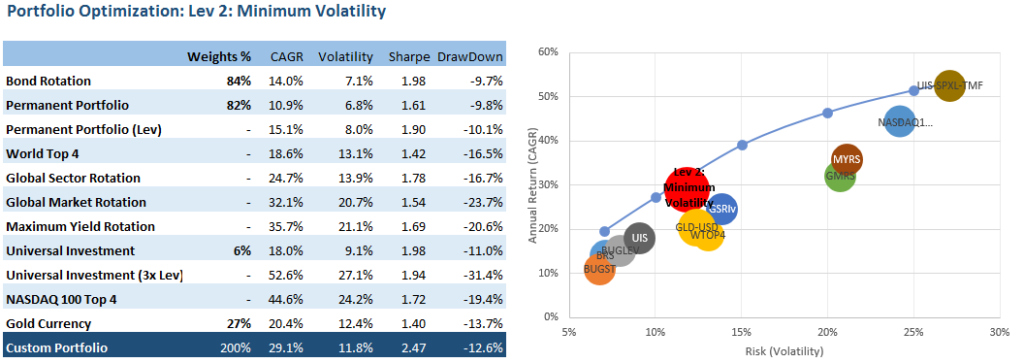

Here a short overview of some prominent portfolio options including the weights of individual underlying strategies. In the following we will dive deeper into some selected strategies, for keeping things easy all options can be found in a separate link displayed at the end.

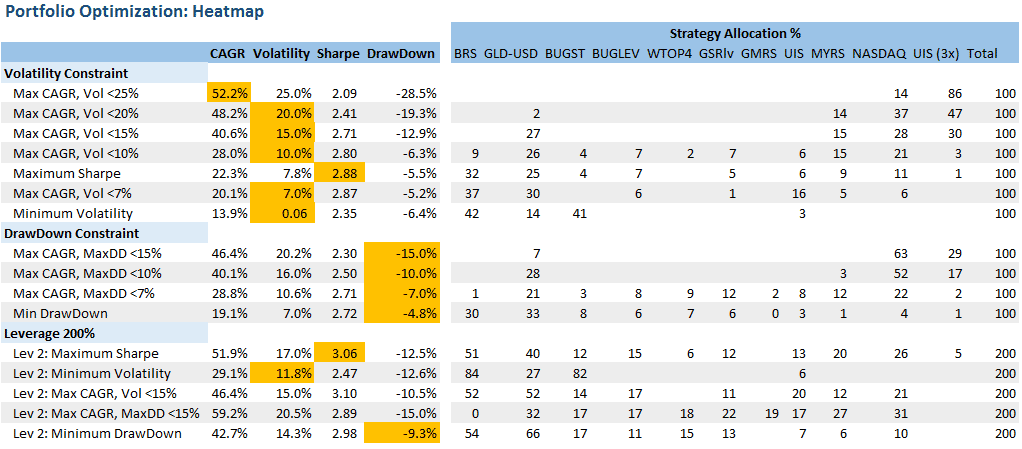

Volatility minimized or constrained portfolio options:

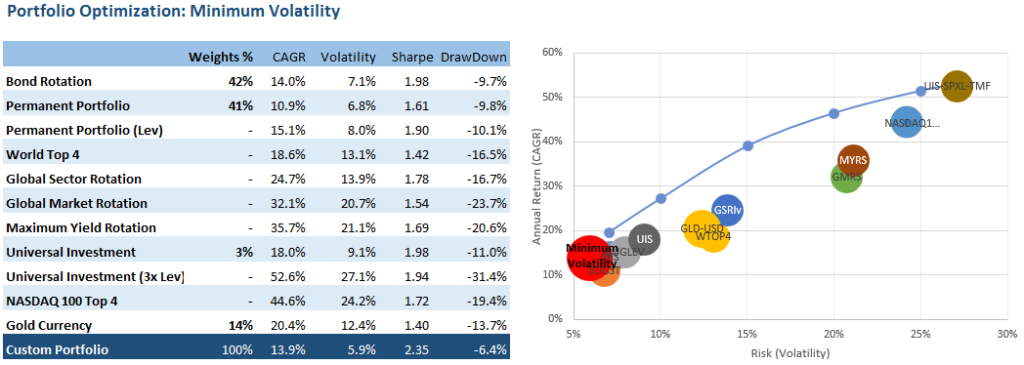

Minimum Volatility Portfolio:

For most of our readers this combination will not be a surprise. Combining Bond Rotation and Permanent Portfolio with another low-correlation strategy as the Gold-Currency Strategy results in a minimum volatility of only 5.9% but a compound return of close to 14%. This is equity like return with bond like risk at its best.

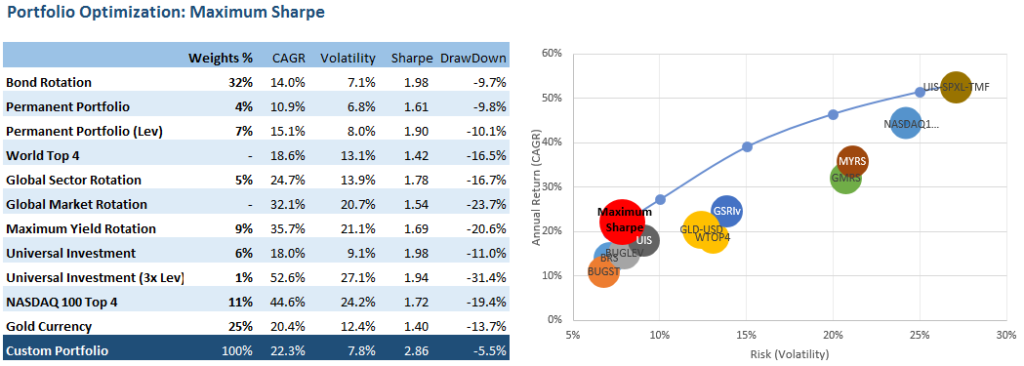

Maximum Sharpe Portfolio:

This is for sure only a theoretical option for most of our audience, investing in nine individual strategies with up to 30 underlying ETF most probably is too much complexity to replicate this dream Sharpe ratio of 2.86.

However, look at the highest weight strategies to understand the logic behind: Bonds, Gold-Currency, Nasdaq 100, and Permanent Portfolio sum up to 80% of the allocations – this might be a viable option for dedicated DIY investors seeking the “biggest Sharpe bang for the buck”.

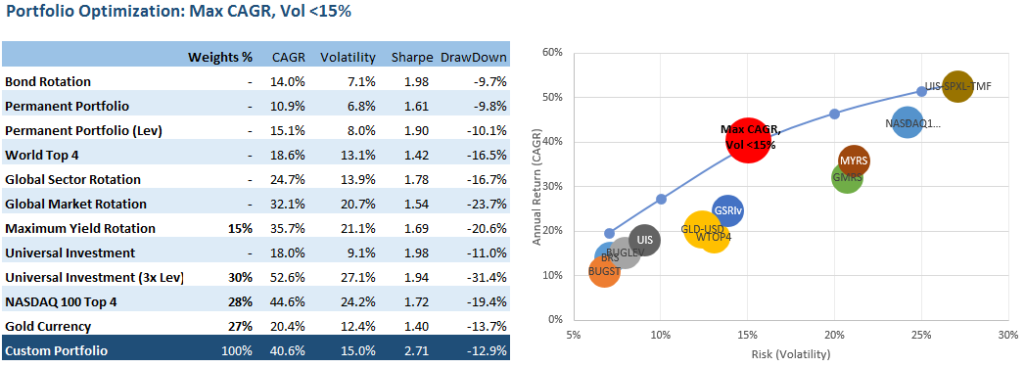

Volatility constraint of 15% (Historical average for classical 60/40 Bond Equity portfolio):

This is one of the most popular portfolio scenario requested by readers and also my favorite. 15% volatility is about the level one would expect from a 60/40 Bond Equity portfolio.

The big change to the last post 18 months ago is that now our solver does not suggest any allocation into the Bond Rotation Strategy anymore, but the Gold-Currency strategies takes its role as main diversifier with 27% allocation. Also keep in mind that the bond component of MYRS and UIS act as serial diversifiers for smoothening the ride towards a 40% CAGR with a historical maximum drawdown of only 13%.

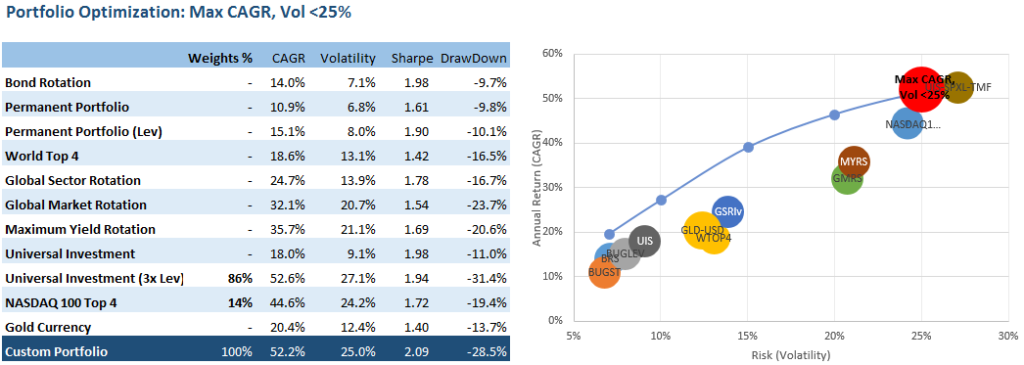

Volatility constraint of 25% (or: why constraints anyway?):

If you are rather the “No risk, no fun” type of investor or have a separate pocket for wild rides without getting sea-sick, then this might be your option. Yet, we do not encourage anybody to put any money into such portfolio that might be needed for living the next 5 years.

Being invested in three times leveraged ETF and the top four NASDAQ 100 stocks is not the investment style we advocate for, but an average 52% CAGR with a Sharpe Ratio above 2.0 is indeed offering a huge profit kick.

DrawDown minimized or constrained portfolio options:

We frequently get requests for portfolios which limit the maximum drawdown and implicitly this is also what we´re looking for: Maximizing return while not suffering the hard-to-stomach times when you only see red and start doubting about your portfolio (and the rest of the world ..).

However, keep in mind that drawdowns are a difficult animal to control: Dives from quick and sharp sell-offs are nothing a momentum based rotation strategy with a typical 50-80 days lookback can avoid through any “crash-protection mechanism”. Diversification across different strategies with alternating logic and investment style can only minimize the effects, but never completely off-set. Too much “Diworsification” through bonds or safe heavens slows performance down or can even increase drawdowns in these times where markets are central bank controlled.

Mechanism like stop-loss limits either hurt long-time performance, or even worsen things when you get stopped out during minute-crashes only to see things getting back to normal some instances later. And finally exotic methods like using OTM options normally come at prohibitive costs.

So, while long time volatility constraints work quite well, below constraints on drawdown can already be obsolete by tomorrow after the next central banker makes an unexpected announcement, or any other external shock, therefore take them with a grain of salt.

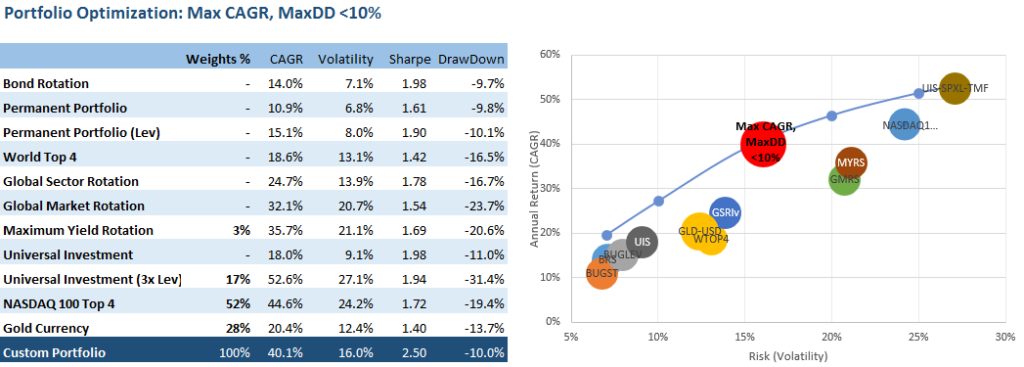

Maximum 10% DrawDown Constraint:

Even this portfolio has only shown a maximum 10% drawdown in the recent years, we still consider it quite aggressive and not our preferred option. Above 50% in Nasdaq and 20% in 3x leveraged or volatility ETF is quite risky, even if the remaining 28% invested in Gold-Currency balance things a bit.

Two times leveraged portfolio options:

For investors with margin accounts here two leveraged options which might be interesting. Using leverage is often mis-understood as betting one’s last shirt and associated with pure gambling.

Here the counter-argument: If you do have access to a margin account, a well-balanced portfolio, know it´s risk profile well and are comfortable sitting-out longer under-water periods, it makes economic sense to achieve a higher return on your own equity – using the currently extremely low interest charged by your broker.

In this case, make sure you remain on the very conservative edge on the volatility side to stay as far as possible from potential margin calls, that is, leverage low volatility locking in higher Sharpe, not looking for higher returns only – like the portfolio proposed below.

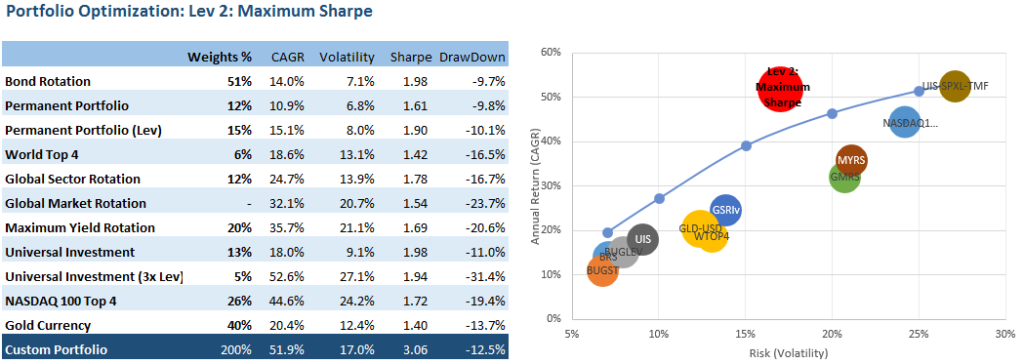

Two times leveraged Maximum Sharpe Portfolio:

Below portfolio is consistent with its simple leverage sibling: Bond Rotation and Gold-Currency are the main components, with the rest being split across 8 other strategies. Definitely a complex portfolio which will take quite some time to rebalance, but worth it considering a historical Sharpe ratio above 3.0 resulting from a 52% return at an S&P 500 like 17% volatility level.

Two times leveraged Minimum Volatility Portfolio:

To be even on the safer side, this two times leveraged portfolio consisting of Bond Rotation, Permanent Portfolio and Gold-Currency has a historical volatility of only 12% and a similar drawdown.

Summing it up

In conclusion, using either of our Online or Excel based ‘Custom Portfolio Builder’ allows you to set up powerful asset allocation scenarios using our strategies. We hope this post aids you in building your own portfolio using above examples as framework and inspiration.

The evolution from static buy-and-hold portfolios into a multi-level concept of setting up a diversified portfolio of smart individual tactical investment strategies breaks the classical “Efficient Frontier” shifting it more than just a notch towards higher performance at the same level of risk, or less risk at the same performance levels.

Yet, we´re still in the phase where we apply fixed-weight allocations to strategies in order to come up with a buy-and-hold portfolio of now individual strategies. What if we would apply the same switching mechanism we apply in our individual strategies at a portfolio level? Switching to the fastest horses in our stable of strategies once a month? Yes, we know, we´ve been preaching and teasing this ‘new’ approach now for more than a year – but stay tuned, we´re about to launch it! Finally!

Let us know if we can support you in building other portfolios or provide more background information. Please also post in the comment section any specific portfolio combination you’d like to see so we can model the most requested for you.

In anticipation of a vivid discussion,

Alexander

This is an excellent article. One thing I’m not sure of is not using data from 2007-2008 in considering volatility and especially drawdown.

The Excel spreadsheet seems to only work on Windows. Mac Office generate an error when loading the file – due to Solver installation.

Excellent article and very nice work on this topic. Thank you.

Reuptake & Jason, thanks for your kind words, happy to elaborate on any specific topic of interest or further portfolio models.

And yes, the Excel Optimizer only runs on recent MS Office versions, sorry for the limitation and happy to model any other specification for you.,

Does Office 2016 for Mac support Portfolio Builder? I’m considering an upgrade. Overall I’m happy with previous version, running Portfolio Builder would be the most importand reason to do an upgrade… so I’d prefer to be sure it’s compatible.

Yes, the Excel tool runs on Office 2016 for MAC for the preconfigured portolios and configuring your own.

However, the more sophisticated Solver optimization is not running yet.

Here a version which disables the Solver check on start: https://drive.google.com/file/d/0B2nAWp8wo_B6LW5qRkFjVzlaMDA/view?usp=sharing

We´re working on fixing this.

Somehow I managed to run it, including Solver portfolios. The only problem (apart from some Excel crashes) I got is that I’m unable to load new data from LI servers. First it tell me that I have to “unprotect” it, then, after I do this, there are some VB errors.

Is it possible to have a longer look back period on the simulations? Back to year 2000 would be helpful as it would include several large drawdowns and rebounds in the S&P. Another concern is the downward slope of bond yields over the past 30 years and the current low and compressed yields. At some point when yields are rising over several years it would appear the bond rotation strategies may not be as effective in adding long term return. They would still most likely work as non correlated hedges to equities during equity drawdowns but could lose value over the longer term as yields rise month after month. It would seem a strategy rotation or upgrader system as you described could help avoid the limitations and risk associated with static long term portfolios of models. The past 7 years will probably not look like the next 7 years and it would seem being able to identify the best portfolio of models each month and upgrading could be quite beneficial. I look forward to that system being published, especially when the models are reduced to a manageable number to realistically switch monthly. I appreciate all of the in depth and thoughtful analysis you are doing and that you share your thoughts and work with us along the way. I can’t think of any additional parameters than what you have already covered and propose to cover in the next piece. I like that you share your favorites. Great work. Thank you!

John, thanks for the comments.

Longer backtests would indeed be good, but are always a limitation when running all our strategies in parallel. For example the volatility ETF used in Maximum Yield only got popular after 2009 / 2010 and on single stock strategies we would include a survivor ship bias. Most other strategies have individual backtests well before the 2008 crisis, I would refer you to them for further analysis.

Agree on your observations on bond returns, we also rather see them adding value as uncorrelated hedge, i.e. crash-protection, then as return boost going forward, at least until the ZIRP times are over (if they will..).

Will start working on the next post with limited number of strategies, and smart switching algos, agree that in the future we´ll need more adaptive approaches than in the past due to higher overall correlation between hedges and uncertainty how central banks will handle monetary and fiscal policies.

Great article.

I have been unable to download the excel file and cannot find how to get the solver. I have a Windows machine. Please advise on that, and what links to click in the LI website..

Have a look here of how to activate the solver in Excel 2010 and above, and please let me know if this helps: http://www.addictivetips.com/windows-tips/microsoft-office-excel-2010-solver-add-in/. The download link to the Excel file is here: https://logical-invest.com/wp-content/uploads/2016/07/Portfoliobuilderexcel-v.032.xlsm, or here a Google Drive version: https://drive.google.com/open?id=0B2nAWp8wo_B6QVRodXZPWllDZmc

The optimizations take a while to run, about 2 minutes on my Core I7 with Excel 2016 – lot of boundaries defined which add computing time.

If there is a forum I would run a webmeeting to walk your through the features, just let me know through the comments or by mail to [email protected].

The World Top 4 & GMRS appear not to be utilized much in the optimized portfolio simulations. Do you suspect that this is due to poor relative performance of international equities & the relatively short back test? How often is the portfolio builder updated with recent data? I am concerned about the short back-test period. Would be great to have more back-test data included to improve robustness (confidence). I understand some of the ETF’s have not been in existence very long. Thanks for your efforts.

John, yes, World Top 4 and GMRS have a relatively high correlation to other equity strategies and bit less of return in the last years compared to them, this is why they are picked less in the optimization – especially in the highly constrained versions.

The portfolio builder data is updated daily, there are buttons in the Excel tool to update through macros. The online version is automatically updated each night after the close. Here is the link to the underlying daily return data of all our strategies, if you want to do some number crunching by yourself: https://logical-invest.com/wp-content/csvrepository/PortfolioBuilderExcel.csv

Question by Gerry by email, I post answer here for the benefit of other readers: “I was interested in your comment that the minimum drawdown doesn’t include bonds

What happens if you put all the portfolios together and adaptively allocate to just the components of individual portfolios that meet your goals( max return,min vol,min drawdown etc).

Also what about adaptively allocating between portfolios as well as within for a given objective.and in what time frame does that become inefficient .

This gets very complicated as well as expensive for commissions and burdensome to do every month with these ideas but it’s interesting to think about.also is there a point of diminishing returns when thinking in this way.

Thanks

Gerry

——————-

Bonds are actually not so conservative as perceived, look at TLT (+20 years) which has an annualized volatility of +15% and a +20% drawdown in 2013 (and +15% in 2011 and 2015). Our Bond rotation strategie is much smoother with an annualized 7.1% volatility and only a 10% max drawdown, but even that is not enough compared to the Gold-Currency strategies which served better as diversifier recently.

Will work on the adaptive switching with fewer strategies as you line out. With a low-cost broker as IB the comissions should not be so much of a trouble, but indeed it´s quite complex.

Hello Alex,

I’ve been using your portfolio builder (PB) spreadsheet since you briefed it at the AAII last year. I’ve used it regularly to develop high Sharpe / low drawdown portfolio guidance and have eagerly anticipated many of the innovations you planned to implement.

Just prior to the Portfolio Heat Map, you mentioned “for keeping things easy all options can be found in a separate link displayed at the end” .

I seem to miss the link for that reference – would you kindly provide the link.

Regards, Richard

Hello Richard,

thanks for your comments, indeed you are the Top1 portfolio builder expert since 2015, appreciated and count on your critique to further improve the tool.

Sorry for the glitch in the wording, instead of the link to other portfolio pictures I later opted to include above video to show all options in a logical sequence: https://www.youtube.com/watch?v=lVyCYHsALu8

All preconfigured portfolio options are also also updated in the tool, look at the drop-down menue on the main tab.

Here two short video clips on how to use the excel tool:

1) How to select one of the 15 preconfigured portfolio options from the main menue: https://youtu.be/G-s8s3kUEGg

2) How to do manual changes to a preconfigured portfolio option, here substitute Gold/Currency strategy by Bond Rotation in a volatility constrained portfolio: https://youtu.be/Q9M-ATTFTV4

For me personally this is the use I most give the tool. Pick a portfolio option I feel comfortable with in terms of volatility and historical drawdown, and then change the allocations to underlying strategies until I´m convinced I can stick to the portfolio for a longer time. While I do stick 100% to the strategy signals without any manual intervention, I do from time to time review the portfolio configuration. That´s where the “art” part comes in after the math in the strategies….

There’s no sound in videos (?)

No, just as visualization. But we can do a live webinar if there is interest.

Hello Alex,

I admire your work and see the value in your approach and the mechanisms you’ve developed to implement it.

While each of the 11 strategies have their qualities, a portfolio of strategies resolves to a monthly ETF mix, in practical terms, to meet one’s portfolio objectives (e.g., Max CAGR / DD < 10%).

Here is how I think of using the Portfolio Builder (PB) tool. My usual question is simply: in what ETFs, and at what weighting, should I be positioned for the next month that will give me the best likelihood of achieving my particular portfolio objectives. The PB workbook and Solver routines provide advice to help me answer that question. The strategy weightings derived from PB are inserted into the Consolidated Strategies workbook which calculates the ETF holdings advice for the coming period.

So, we adapt to changing market conditions by updating our ETF holdings each period to maintain the best prospect of achieving the portfolio objective, based on the “portfolio of strategies” weightings from the PB Solver solution. The composition of the “portfolio of strategies” produced by PB changes slowly over time for a given objective, but each strategy’s ETF composition often changes somewhat each period. I’ll go back and tweak the holdings sometimes if there are too many ETFs or if some are minimally represented to reduce trading friction.

A couple of questions for you:

1. The PB workbook uses 1805 trading days, a little over 7 years. So, how best to account for the prospect that the near future may not look a lot like the last 7 years on average? While we can review the portfolio of strategies one month at a time using a Solver solution, they change slowly. Maybe we should more heavily weight recent performance?

2. You mention “a typical 50-80 days lookback” in your article, but the optimization takes all 7 years into account. I am not clear on how the "50 – 80 days" work in.

I appreciate your comment on how you personally use the tool, and further insights into the "art" involved would be welcome.

BTW -Your workbook design and Excel code is very instructive for me. I learned a great deal studying your code and have introduced some innovations for my own use. Thanks so much for sharing.

Thanks for your excellent work, I've found it informative and valuable and am pleased to correspond once again.

Regards, Richard

Richard, thanks for the flowers and for your additional comments.

To your questions, the 1805 days of data has been a compromise to keep the Excel formulae manageable. Have just updated the tool to get data since beginning of 2008, so financial crisis is now fully included again. https://logical-invest.com/wp-content/uploads/2016/07/Portfoliobuilderexcel-v.040.xlsm

With the “typical 50-80 days lookback” I refer to the lookback window most of our our strategies use in determining the trend momentum, e.g. to trigger switches of ETF allocations. What I´m saying is that short term drops in the market like Brexit do not trigger sudden changes in our ETF allocations – and all our backtest show there is no need. Any other measure like working with stop-loss orders or shorter lookbacks lead to whipsaw losses.

The “art” of managing my portfolio is hard to explain as such. My point is that emphasis needs to be put that beside all the math and rational convincement one needs to keep the emotional aspects in mind. If you have a hard time keeping calm during drawdown phases with too agressive portfolio setups this affects your emotional stability and might lead you to dropping out exactly the wrong moment.

Alexander, thanks for your work. What do you think (ballpark) the minimum portfolio amount would be needed to implement the Max Sharpe portfolio using futures?

Jason, thanks for the interesting question. Due to the big number of instruments and some prices in the ten thousand range you´d probably need a $1 million portfolio to run all strategies efficiently.

We´ve done some work in the past for hedge funds using a mix of futures and some ETF depending on liquidity of the instruments, one learning is that due to roll effects and different pricing logic the signals for such a portfolio differ significantly from a pure ETF version. On the other hand they offer new options for harvesting roll-effects – especially when curves are in contango.

Further backtesting would be necessary and is complex due to the needed past future chains, so this is something we normally rather do for institutional investors with deeper pockets than most retail investors (including myself..). But hey, we never say no .. certainly fun and worth the effort!

Here a link to a good overview of future contracts.

Alexander, thanks for the response. I thought it could be interesting to offer the portfolio from retail ETFs all the way through managed futures institutional investors. Sorry to go off topic, but I inquired through the website question form a couple of times, I wanted to know a little more about Frank’s experience constantly shorting the last month VX contracts, is he still doing it? What have the results been? Are there any further nuances he has figured out?

Thanks, Jason.

Frank will come back to you once back in town next week, sorry if we missed your earlier requests.

Alex,

Do you think you will have the new strategy switching system referenced in the “Summing it up” section above ready for August 1, 2016?

John, sorry but do not think so. We have the systems developed but still testing and finishing up the necessary changes to our site. Due to vacations this will take some more weeks.

I am interested in the “strategy switching system” as well…As John stated above. Thanks Alex for your efforts.

Hello Alex,

A heads up – It seems Portfolio Builder is not updating quotes past 7/20.

Regards, Richard

Thanks Richard, a script stopped inexpectedly, fixed it.

hello, Is strategy switching system referenced in summing it up section ready ? Could you provide any pointer/link ?

thanks.

Hello, yes, we´ve published several already, see here for example:

https://logical-invest.com/401k-backtesting-morpheus-etf-strategy/

https://logical-invest.com/spdr-etf-sector-rotation-strategy-model/

https://logical-invest.com/top-performing-etfs/

https://logical-invest.com/forums/topic/showing-off-the-best-strategies-and-portfolios/