As we are prepping to publish models based on Bitcoin and Ethereum cryptocurrency assets, we are publishing preliminary research on trading assets that track Bitcoin and Ethereum on traditional U.S. based exchanges. We exclude futures which can easily be traded via CME contracts.

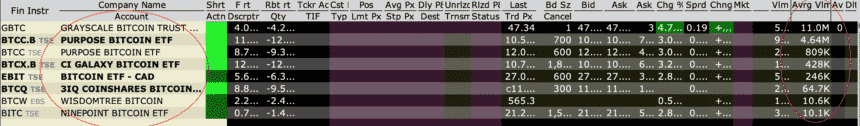

Using Interactive Brokers as a reference U.S. brokerage these are the main available instruments (not including futures) for trading Bitcoin Funds (as of May 8 2021).

Bitcoin Instruments:

As expected the most traded instrument is the Grayscale Bitcoin Trust (GBTC) followed by the Canadian Purpose Bitcoin ETF (BTCC.B at TSE).

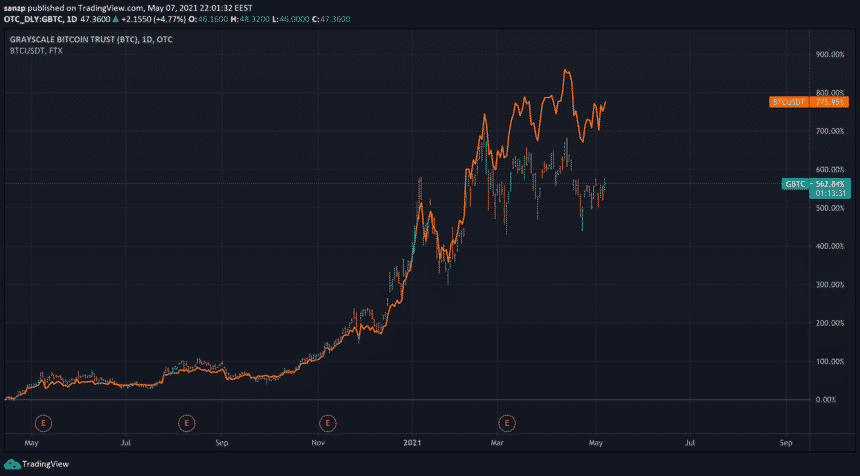

How does GBTC compare to the actual Bitcoin price:

Although in the past GBTC may have been trading with a premium, recently (since May at the chart) GBTC tracked BTC quite well. Around March 2021 it gained a premium (it fell less on the March correction and has stayed higher since then). After that it tracks BTC fairly well.

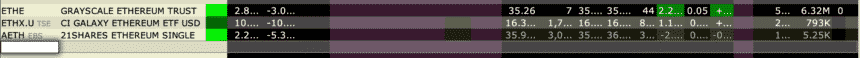

Ethereum Instruments:

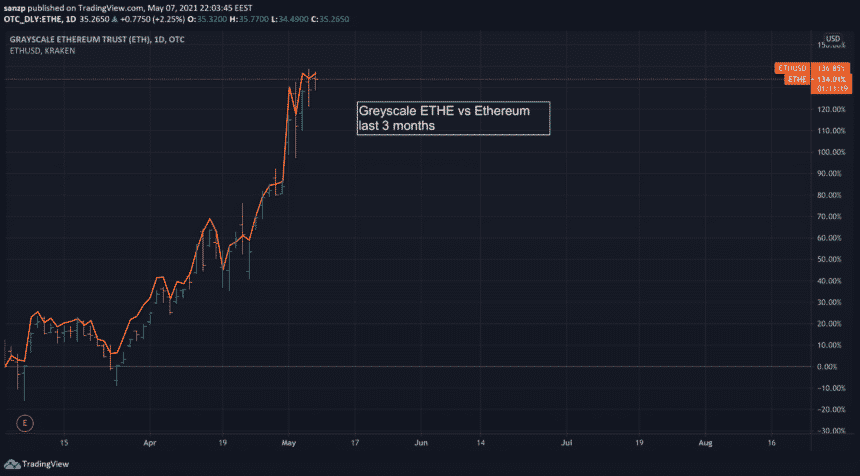

Again the most traded instrument is the Greyscale Ethereum Trust (ETHE).

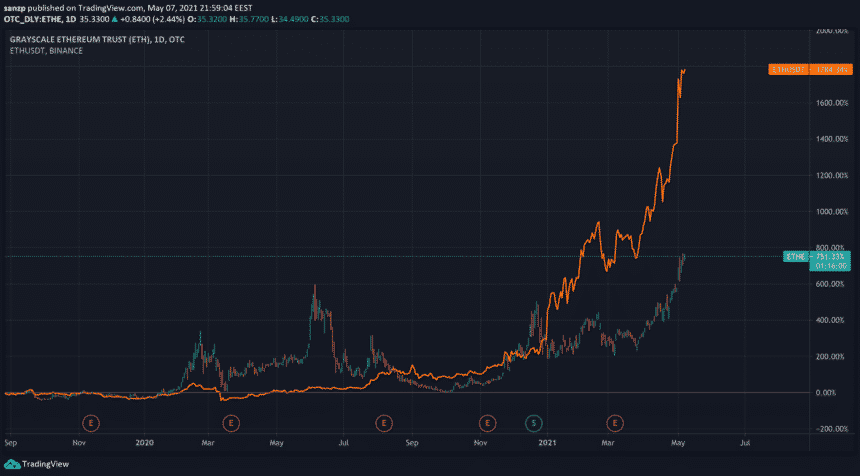

ETHE is a new product and has not tracked the Ethereum price in the past so ETHE will not provide reliable data for backtesting an Ethereum strategy.

In the past 3 months it tracks the Ethereum price well and can be used to provide signals given a less than 3-month lookback period.

Conclusion:

Given the lack of an U.S. based ETF, Greyscale’s Bitcoin (GBTC) and Ethereum (ETHE) Trusts can be included in a portfolio that tracks the two major crypto assets. These instruments are currently available at major brokerages including interactive Brokers and Schwab.

If your brokerage supports them feel free to add the info in the comments.

Happy trading!