All assets drop in unison.

Federal Reserve holds interest rates steady, says tapering of bond buying coming ‘soon’…

CNBC, September 22nd 2021

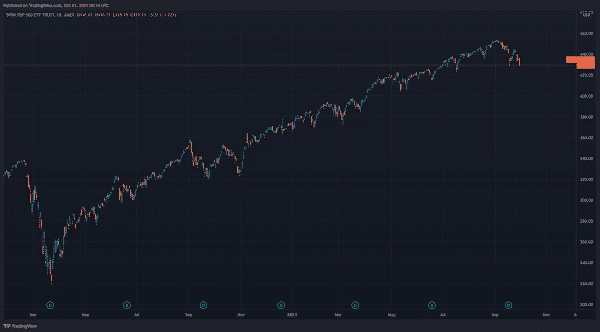

September was one of these months where all asset classes came out negative regardless of what they represent. It is no coincidence that the FED issued a statement about future tapering of it’s stimulus program. The S&P 500 fell by -4.7%, the long term Treasury ETF lost (TLT) -2.9% and gold -3.2%. Looking at the chart of SPY ETF below, we could be looking at a continued correction or sideways motion.

Evergrande

Another reason for the correction in Equities was news of a possible default of one of China’s biggest real estate developers, holding north of $300 billion worth of liabilities. It seems that unless Beijing steps in to prop up the “too big to fail” developer, a possible default would send shockwaves across Chinese and world financial markets.

Without being an expert in Chinese economic policy, it seems lawmakers are faced with conflicting tasks. On the one hand the Bank of China provided additional liquidity last week and vowed to “maintain the healthy development of the real estate market…”, signalling it may intervene. On the other it stated it wants to “safeguard the legitimate rights and interests of housing consumers.”

To put the last statement in perspective, President Xi Jinping has called for China to achieve “common prosperity”, seeking to narrow an abysmal wealth gap that threatens the country’s economic rise. Practically what that means is that the government may go after the extreme rich as well as tech companies and real estate developers in an effort to curb extreme economic inequality and redistribute wealth towards the middle class. It also means a willingness to reverse the rise in home prices which have climbed past the reach of middle class people (ring a bell?).

It is still unclear how this will play out but it is a subject worth following.

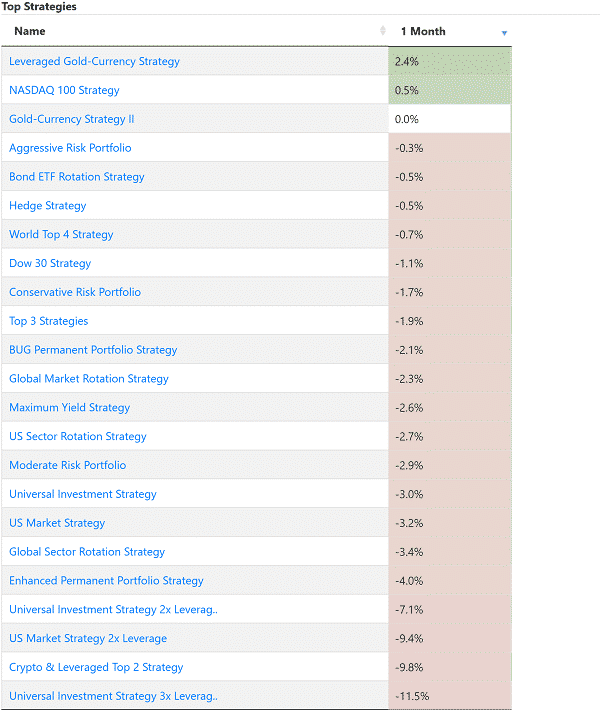

Strategies

Our strategies did not escape the direction of the market, most taking a hit for a month.

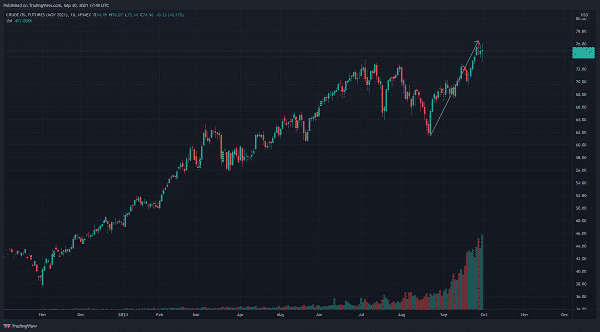

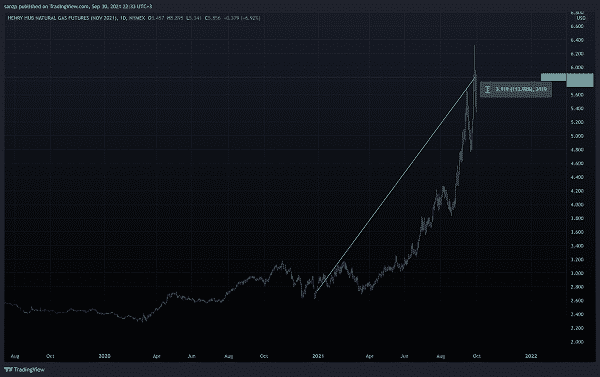

In the new Green Economy, is Oil king?

The one exception was the energy sector, with XLE rising by 8.9%. Oil futures recovered from a September correction and shot up some 20% from the lows towards the $75 mark while natural gas prices have doubled since the beginning of the year.

Please join the forum and discuss the recent changes in the markets, our portfolios and LI strategies.

The Logical-Invest team.