Don’t bid farewell in May and hit the hay, just hedge your way and stay in the play…

As we enter a seasonally sluggish period for equities it may be best to stay in the markets but use our hedged strategies to gain exposure to alternative assets such as gold, volatility, TIPS, crypto and foreign markets.

See our main strategies ranked, here: https://logical-invest.com/app/testRank.php

Access our full list of sub-strategies ranked here: https://logical-invest.com/app/asset_list.php

Outlook

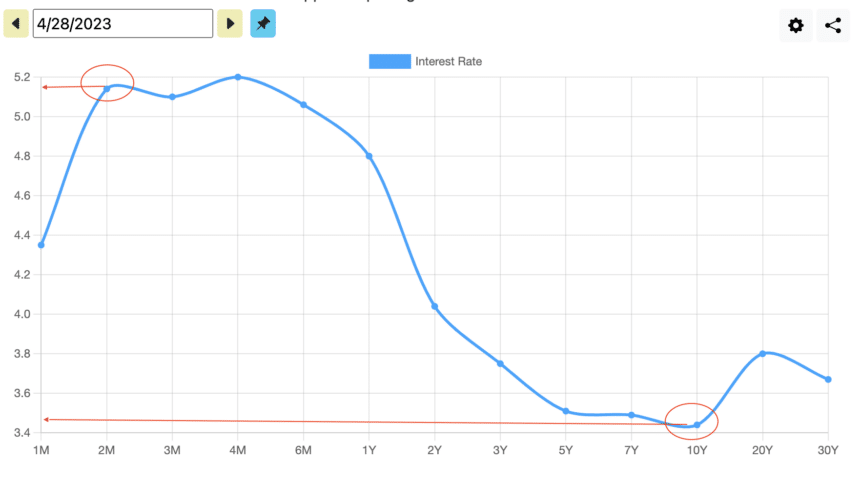

As U.S. regulators are trying to clinch a sale of First Republic Bank over the weekend, the prevailing expectation is that the Federal Reserve will raise interest rates by 0.25% on Wednesday, adding to an already elevated 5%. A steeper hike might stifle the markets, but a lack of action could also be construed as the Fed’s concern over potential banking issues. In either scenario, the persistently inverted Treasury yield curve may signal an eventual market correction.

Logical-Invest Strategy performance

April witnessed modest market performance, with the S&P 500 Index ETF (SPY) gaining 1.6%, the 20+ Year Treasury Bond ETF (TLT) inching up by 0.3%, and the Gold ETF (GLD) increasing by 0.9%.

Most of our strategies were positive for the month. Our risky Crypto & Leveraged Top 2 Strategy, rebounding from a disastrous 2022, recorded an 7.4% growth for the month, culminating in a impressive 32.3% year-to-date performance.

The Maximum Yield Strategy added another 3.7% (17.9% YTD), while the Leveraged Gold-Currency Strategy returned 1.8%.

Let us know what you think in our forum.

The Logical-Invest team.