Back to normal?

All strategies came in positive for the month with a range of returns from a low of +2.8% to a high of +14.5% for the Maximum Yield strategy. Year-to-date figures are mixed but reasonable around a mean of -2%. The S&P 500 is down -9% while emerging markets (EEM) are down -19%.

Looking at the table above, it does not reflect a world where whole economies are frozen, cities are in lockdown, retail shops are closed and to top it all, oil prices turned negative.

“The most bizarre market rally in history?”

One of our favorite and long standing subscriber, who also happens to be a veteran of our Leveraged Universal Strategy, wrote in the forums:

I have been sitting in disbelief over the recent market rally over the past month. There is absolutely […no] logical explanation that explains how stocks are rallying when most companies are virtually shut down. Airline, Cruise, Casino and Theme Park stocks zoom 10, 20 or 30% higher while closed down…

As John Maynard Keynes said: “Markets can stay irrational longer than you can stay solvent.”

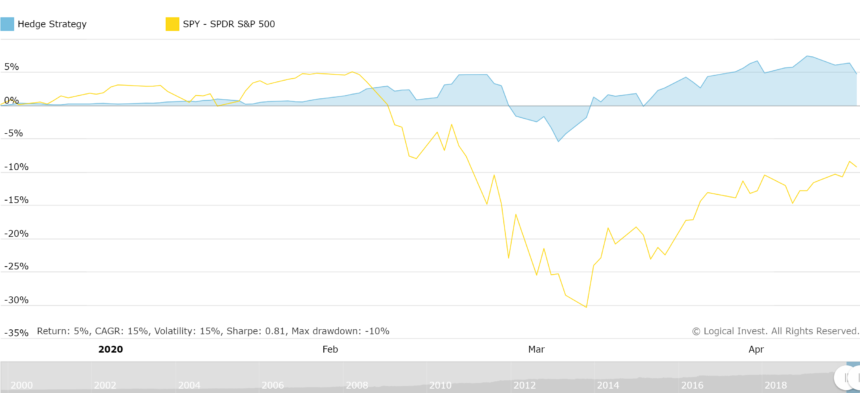

We remain cautious. Looking at the data, our obvious winners has been our Gold-Currency Strategy II and no other than our HEDGE sub-strategy.

The first has delivered 6.6% by just switching from Gold to ultra-short duration paper (GLD-GSY). The second returned 4.8% picking from 3 safe heaven assets: Treasuries, gold and cash.

This sub-strategy is what we use to hedge our equity-based strategies and is the reason why many have returned to their previous highs. It can also be traded as a stand-alone strategy.

Strategy changes and updates: Bond rotation (BRS) and BUG strategies

The recent crash has exposed weaknesses on two of our Bonds-based strategies, especially the Bond rotation strategy. They were the only remaining “old type” strategies which are not forcefully hedged but could freely select ETFs. They performed well in the past years, so we did not change them thinking that it is best to ‘never change a winning horse’.

Unlike our other strategies that carried a permanent hedge, BRS was invested 100% in equity-like ETFs: PCY (Emerging market sovereign debt ETF) and EWB (Convertible Securities ETF ). When the crash came, there was no exposure to true safe heavens like Treasuries or gold. The severity of the correction to non-Treasury bonds was so extreme (discussed in the April newsletter) that it created the bigger than expected correction.

We are now updating both strategies so they are also always hedged, using our Hedge sub-strategy. The allocations to the Hedge will be between 40 and 60%. The change will take place starting May 1st.

Three popular Portfolios

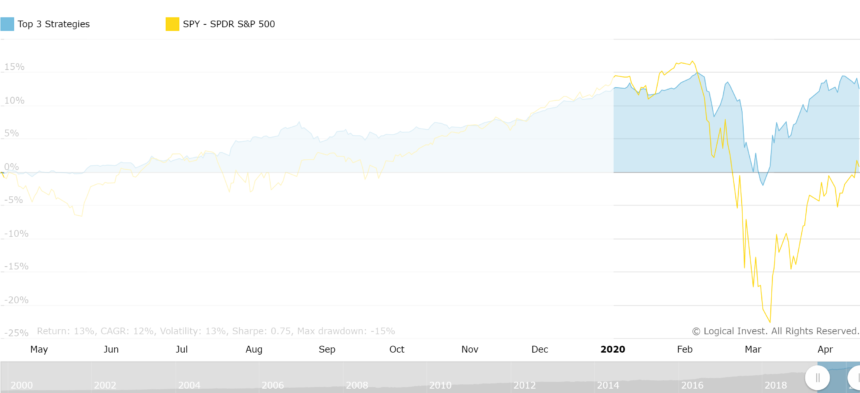

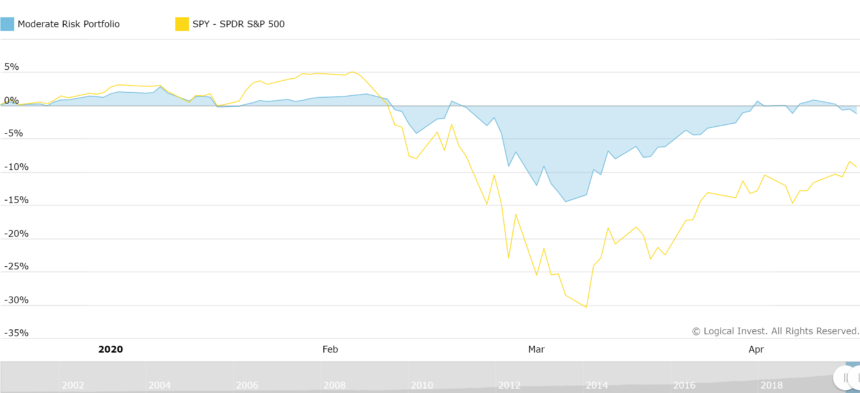

Our whole philosophy is based on multi-strategy Portfolios. Following up on last month’s newsletter let’s take a look at the same three popular portfolios and how they behaved in this surge.

The top 3 Strategy and Portfolio: +1.5% vs -9.2% (SP500) Year-to-date

The strategy (MST3) picks the best risk-adjusted performers and allocates 1/3 of capital to each. It is a dynamic portfolio that runs on our proprietary QuantTrader software and has the capability of picking different strategies each month based on our custom risk/return criteria.

The portfolio already managed to return to pre-crisis performance levels.

The DD15 Portfolio: +3.4% vs -9.2% (SP500) Year-to-date

The Moderate Core Portfolio: -1.2% vs -9.2% (SP500) Year-to-date

Our moderate Core portfolio is an ‘all-around’ choice.

Please join the forum and discuss the recent changes in the markets, our portfolios and LI strategies.

Stay safe.

The Logical-Invest team.