Don’t Fear the Climb: Why Investing During Market Highs Can Be Rewarding

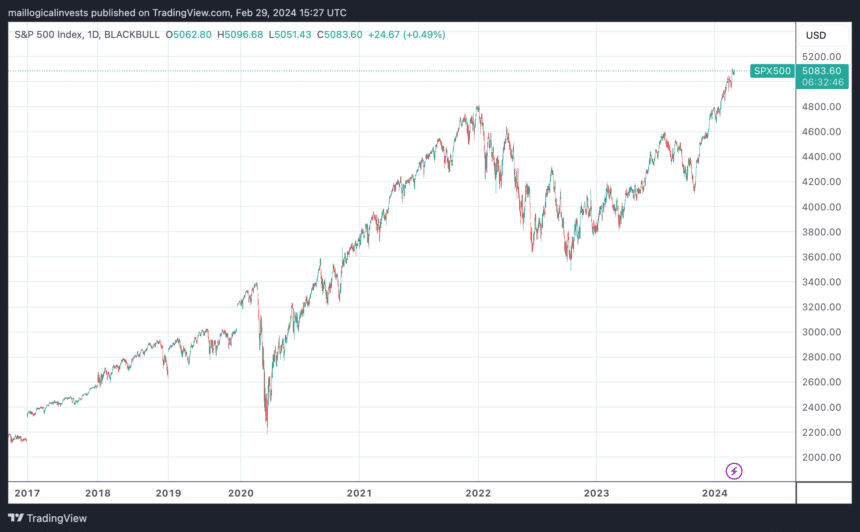

The recent surge in the stock market, with the S&P 500 reaching new highs, might leave you hesitant to invest, especially since you can get a respectable 5% return just staying on cash. However, historical data suggests you shouldn’t let the fear of a downturn hold you back.

Studies show that market highs are actually quite common, occurring 30% of the time since the 1920’s. Notably, following these peaks, average returns have been even higher than usual, returning on average 10.3% over the next year following a new high vs the normal market 7.1% average annual growth.

If you’re concerned about entering the market just before a potential correction, you can still participate cautiously by employing a well-hedged and diversified strategy. Consider the “Top 3 Strategy” which combines the three best performing strategies. While this approach might not yield the absolute highest returns, it will help mitigate significant losses.

The Bitcoin ETF revolution

While some of us were content with our 2023 returns ranging from 5% to 10%, or even jubilant if we managed 20% to 40% annually, along came Bitcoin to disrupt it all!

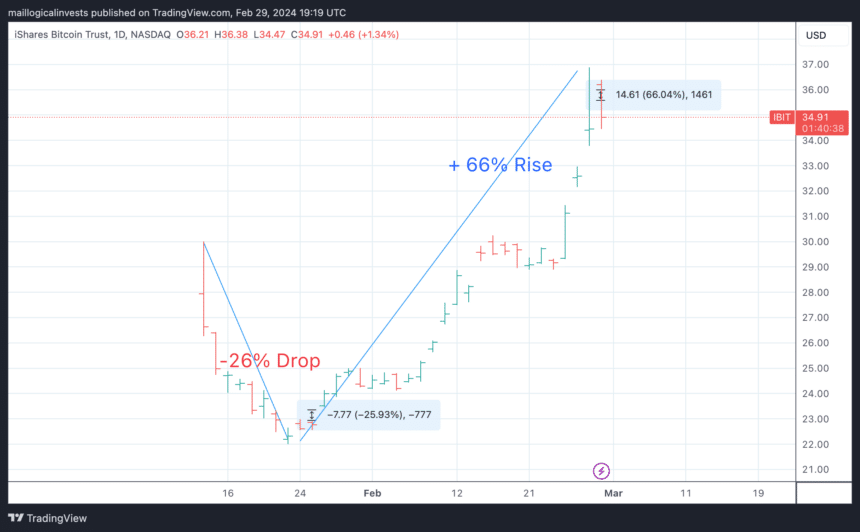

It surged by 30% in just 18 days since the introduction of U.S. based Bitcoin ETFs, leaving us feeling inadequate with our modest 5%, 10%, and 15% returns. Not only that, it left supposedly seasoned investment professionals feeling mundane and boring (which could be a good thing…).

In a mere 18 days, Bitcoin ETFs plummeted by 25%, causing new investors to lose a quarter of their investment before rebounding to soar by 66%, resulting in almost 30% since their inception. And that inception was just 19 days ago!

That’s a crash course in cryptocurrency investing! It’s akin to a rollercoaster ride where one must grip tightly as the market drops, hope to endure without crashing, and then hold on even tighter as it surges back up with intense momentum. Be prepared to be jolted, stirred, and tossed out of the market numerous times.

As I’ve mentioned before, adding Bitcoin to a portfolio can enhance it, but it’s prudent to limit the allocation to a maximum of 5%, unless of course you know what you are doing. Even if Bitcoin were to plummet to zero, you’d only lose 5%. However, if it doesn’t, the potential benefits could be significant, boosting your anticipated returns. You can delve further into how Bitcoin can augment a simple Permanent Portfolio here.

If you’re inclined to allocate a small portion to a risky strategy involving BTC and ETH, as well as leveraged SP500 and leveraged Silver, you might consider exploring the Crypto & Leveraged Top 2 Strategy (+26.8% in February).

Risks

As highlighted in our recent newsletter, we face the imminent conclusion of the “Bank Term Funding Program” (BTFP), the Fed’s emergency measure implemented to address the bank panic and liquidity crisis in March 2023. Scheduled to expire on March 11, its conclusion could potentially trigger a liquidity crisis.

Logical Invest Strategy performance

All strategies were positive for the month with the big winner being the Crypto & Leveraged Top 2 Strategy:

Let us know what you think in our forum.

The Logical-Invest team.