Dollar index up, all else down

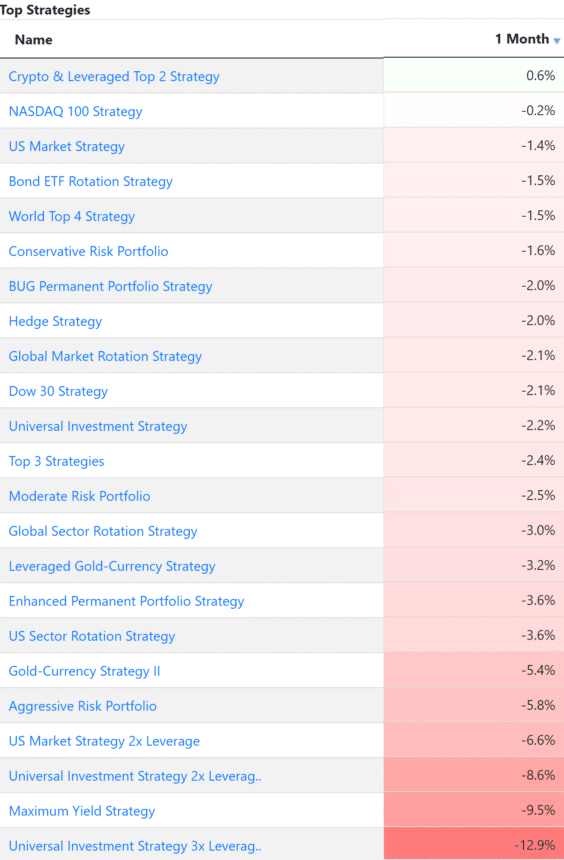

After an excellent start in January 2023, February was a corrective month for most asset classes such as equities (SPY: -2.5%), bonds (TLT: -4.9%) and gold (GLD:-5.4%). Emerging markets were down (EEM: -7.6%) while the dollar index was up (UUP: 3.3%).

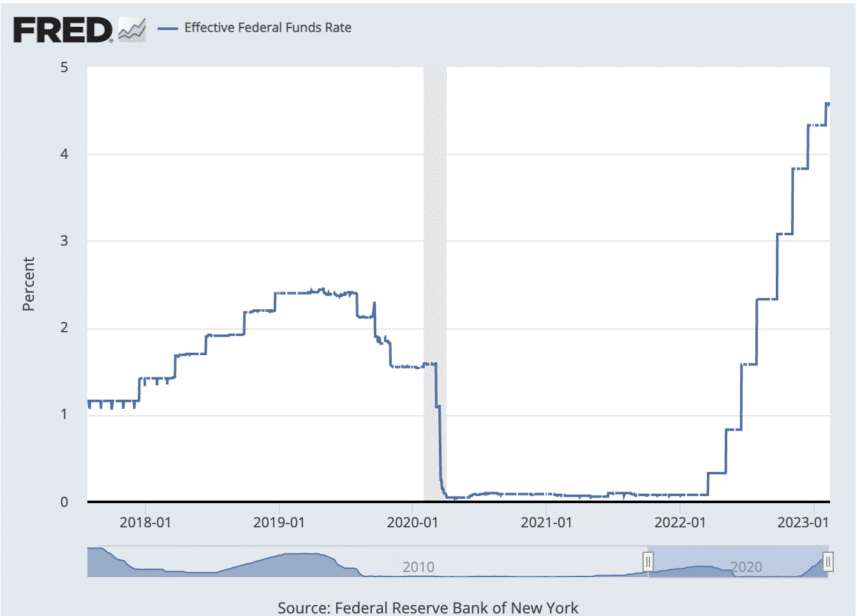

The FED raised rates by 0.25% and the ECB by 0.5%. Current rates stand at 4.75% for the U.S. and at 3% for the European Union. Expectations are that we are reaching peak inflation and that the FED will slow down or stop it’s tightening when we reach the 5% rate.

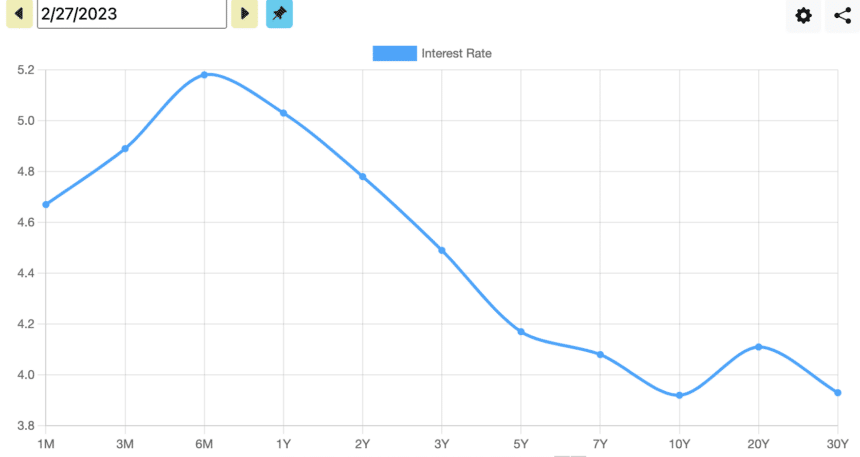

Currently the yield curve is inverted with the spread between the 6 month bill (5.2%) and the 30 year Treasury (3.93%) close to historical highs.

As we have stated in the past, inverted yield curves may precede recessions. Let’s remember that the yield was inverted early in 2020 just before the pandemic but was forced back into a ‘regular shape’ by the FED setting rates to zero in response to the threat of the COVID pandemic and what looked like a coming recession.

By pushing short term rates to zero in 2020, the FED avoided a deeper recession. Seen from another point of view, it may have pushed it out in time so as not to coincide with the COVID-induced economic shock. We may still be looking at a coming recession or long-term side-ways action.

Strategy performance

As we stated in the previous newsletter our Top3 strategy was 100% in cash at the start of 2023. For January it invested roughly half in cash and half in gold, losing 2.6% mainly from gold’s 5.4% decline. This loss is expected given most assets were down for the month. We will continue to monitor the strategy to see how it handles the changing environment.

The Logical-Invest team.