Up, up and up

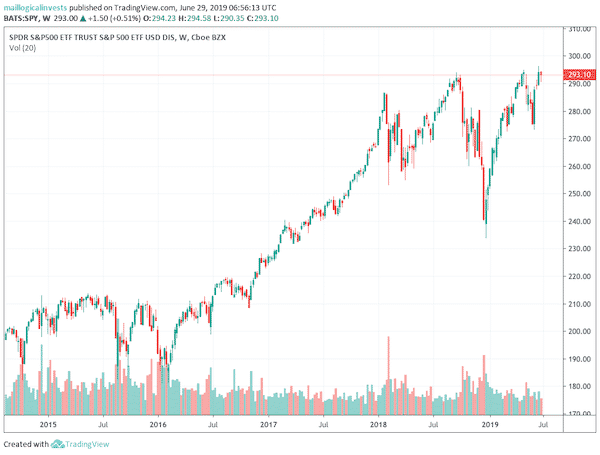

The FED is at it again! With Fed’s June 19 statement, expectations for three rate cuts were set, one possibly coming as soon as this month. This made the markets rally again erasing any previous losses and propelling the S&P 500 back to it’s previous high. The index seems to have priced in the move, which leaves us at a somewhat uncomfortable position: The possibility of the markets actually doing well which may cause the FED to schedule less than 3 rate cuts. Which would cause a market correction. Which would force their hand again to cut rates. Which would cause equities to rally… And so on and so forth.

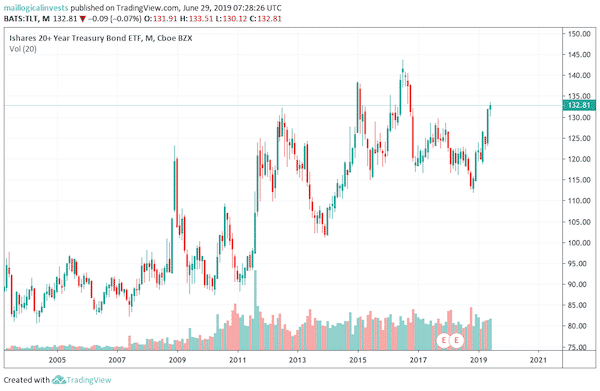

Although we considered “TYF 4” ( as in “Thank-You-Fed” #4) as the title of this month’s newsletter, we ended up with the somewhat childish but more informative title. It refers to the three main asset classes rising in tandem: The S&P500, Treasuries and Gold. SPY is up 6.95%. GLD had a surprising +8.0% breakout move. TLT managed to print positive at +0.94% for the month.

Watch the new multi-asset highs and compare how that looks vs how the market ‘feels’. Despite the widespread threat of an imminent recession that the flat yield curve has brought, defensive portfolios that include safe-heaven assets should be doing well.

Leaving equities aside, it may be more constructive to watch how other assets move, and specifically gold. Will it sustain the breakout despite the very low (theoretical) inflation and the strong dollar?

As for Logical Invest, all our strategies came in positive for the month. Our top 2 were the Leveraged Universal Investment strategy (+11.68%) Maximum Yield strategy(+ 8.8%) while the NASDAQ 100 strategy earning +4.4% and the Enhanced Permanent Portfolio +4.1% for the month.

Bitcoin shows it’s true colors

Bitcoin has gone parabolic once again, shooting up from 8500 last month, to a high of 13860. True to form, it almost touched 14K with a beautiful +20% move that made anyone watching feel they were missing out on the greatest bull ever. It then rewarded late joiners with a -3000 instant crash to 11400 before shooting back up to 13300, pretending it’s going even higher, getting more people aboard, before dropping slowly allowing the ‘smart’ late-comers to buy the mini-corrections.

Surprisingly it kept correcting to a total of 4000 to punish those smart and not so smart traders alike. A friend who is an experienced equity trader, threw in the towel! “What kind of market is this…”, he texted.

We wish you a prosperous 2019, and look forward to a vivid discussion. Visit our site for daily updated dashboard.