We wish you a happy, healthy and prosperous new year! Here are a few thoughts on investing for 2023!

4.7% annual return Risk-Free

At the moment you can buy a 1-year Treasury and get 4.7% guaranteed return for the next year.

Think about that.

It’s as if you hired a manager that promises a 4.7% return and guaranteed not to loose any money, all through 2023. Would you believe him? Consider the fact that 2023 looks like a challenging environment at best.

You should expect to make >5% in 2023

Really. Yes. It is logical if the risk-free baseline is 4.7%. A multi-asset portfolio could do that. Then why does it feel so counter-intuitive?

Toto, I’ve a feeling we’re not in Kansas anymore

As we head into 2023, most investors have a conscious (or unconscious) understanding that things have changed. We are not in the same market environment we have been investing in, for the past 13 years.

In 2022 we had two multi-decade ‘shocks’ to financial portfolios.

The first shock was long term Treasuries loosing almost 1/3 of their value. The 20+ year Treasury ETF (TLT) had a drawdown of -41%, which is large and uncommon by historical standards and devastating to an investor’s emotional expectations. After all bonds are supposed to be safe. This, coupled with Equities shedding some 20% and gold being pretty much flat, contributed to most static portfolios suffering historically abnormal losses.

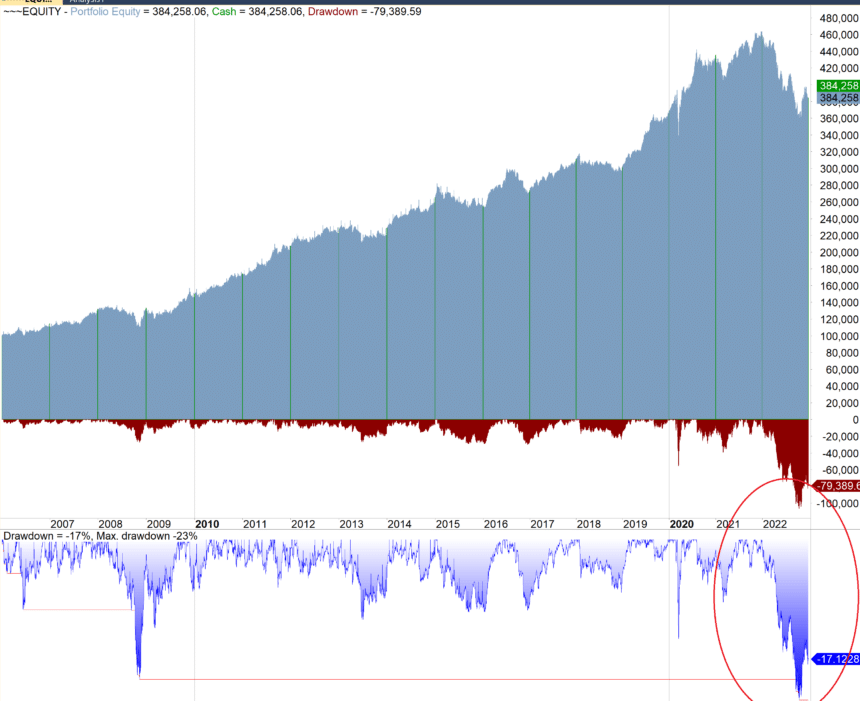

Below you can see the Equity for a portfolio that is 1/3 Equities (SPY), 1/3 Treasuries (TLT) and 1/3 Gold (GLD), re-balanced yearly.

For 2022 it experienced it’s biggest drawdown at -23%, larger than the one during the financial crisis of 2008.

The second shock was an official inflation of more than 8%. This created a feeling that we are now at a great disadvantage. We were forced to seek out a minimum 8% return, just to counter the -8% loss in purchasing power.

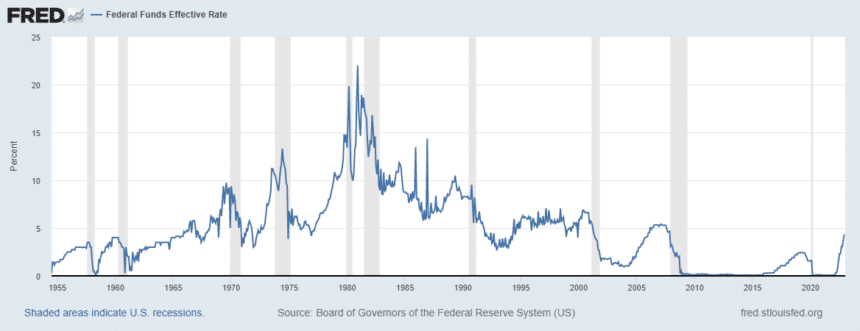

And of course, the main reason we all feel we are not in Kansas anymore, are interest rates on short term paper, jumping above 4% after being almost zero for 10+ years. Below is a graph of federal funds from 1955 to present. You can see that from 2010 to 2021 they were mostly stuck at zero.

In context the move higher seems to be getting us back to historically normal rates. It makes sense that this trend may not reverse and become a new normal.

Multi-assets LI Portfolios could do well. Why?

a. A base 4% rate when strategies go to short term paper ETF GSY, which currently yields 4.1%.

b. The FED is decreasing the amount of rate hikes which means bonds could temporarily recover or at least create a cushion against Equity movements. In other words, we could return to negative correlation between bonds/equity, a must for multi asset portfolios to work well.

c. The dollar index may continue falling from historical highs which benefits gold and risk assets, including developed and emerging market equity and bonds.

d. In a sideways, choppy market (which is what most analysts expect for 2023), momentum-based, rotational strategies (picking from sectors or foreign assets) may outperform the SP500.

A note for younger investors

2022 was a humbling experience for many younger investors and traders. The astounding rise of Cryptocurrencies (Bitcoin, Ethereum, alt-coins) as well as tech stocks (Tesla) during the pandemic, created life-altering wealth amongst younger investors and traders and threatened to change the distribution of wealth from the older generation into a the younger one. Especially in cryptocurrency, the amount of wealth created in NFT’s and other related assets was enough to hook anyone into trading and create a fearless, leverage-based investing style.

2022 was a crash – literally -course in markets and how they disrespect risk taking. A lot of wealth was lost and a few rare lesson were learned.

Investing is a long term project. The goal is to survive the next day so you can participate in a net positive game. It is not as easy as it sounds. Following some basic rules helps. So does managing risk. Survive, and new opportunities will always come.

Let us know what you think in our forum.

Happy new year from The Logical Invest team!

The Logical-Invest team.