Welcome 2021 – What strange times we live in

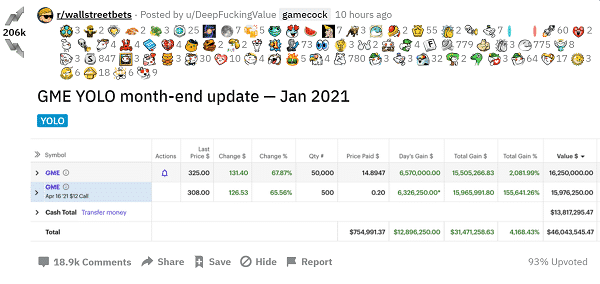

Below is the daily and total PnL (+$31,471,258.63) as publicly posted on reddit by user “u/DeepFuckingValue” who allegedly started investing 50K into the now infamous GME stock. If you follow his older posts you will realise he is a solid researcher who formed a thesis about an undervalued stock with unrealistic short interest. He shared his thesis publicly and was somewhat disregarded but stuck to his position.

This somehow was turned into a movement with young investors across the globe (the now infamous ‘wallstreetbets’ group counting 6,9 million ‘degenerates’) getting together in reddit to prop up the price of the GameStop stock. An then it became a David vs Goliath story, where a ‘socialized David’ crashes the sinister Goliathic Hedge Fund that was unethically shorting GME.

But the story continues: The ‘Evil Empire’ eventually wakes up and starts it’s large war machine to face this little investor rebellion. On a snap, the rules of the game change, turning broker Robinhood into the Sheriff of Nottingham. GME trading is halted but only for buyers not for sellers. Other brokers follow suit. What ensues is 4 million (at the time) young investors, from California to Germany to South Korea glued to their screens in disbelief as the ‘powers to be’ crash their stock from $400 to $190, while their peers in reddit, on the other window, scream ‘HOLD THE LINE!!’ But, alas, their ‘Buy’ button is disabled. A reminder of ‘who-is-the-boss’.

What is happening behind the scenes is a very different story as Hedge funds are ‘eaten’ by bigger funds, Robinhood seemingly commits suicide and new players are coming in on both sides to profit.

What is interesting to see is that younger investors, the so-called (ex) Robinhood crowd, are well aware of the 2008 crisis, even though they were not invested themselves. They experienced the repercussions to their families and remain sceptical of wall street.

Logical was born out of the 2008 crisis. We have developed tools to facilitate participation in this game and come out positive, despite the fact that it is biased against retail investors. We hope new investors do not get disappointed or crashed but rather get incentivized to participate and create a better market.

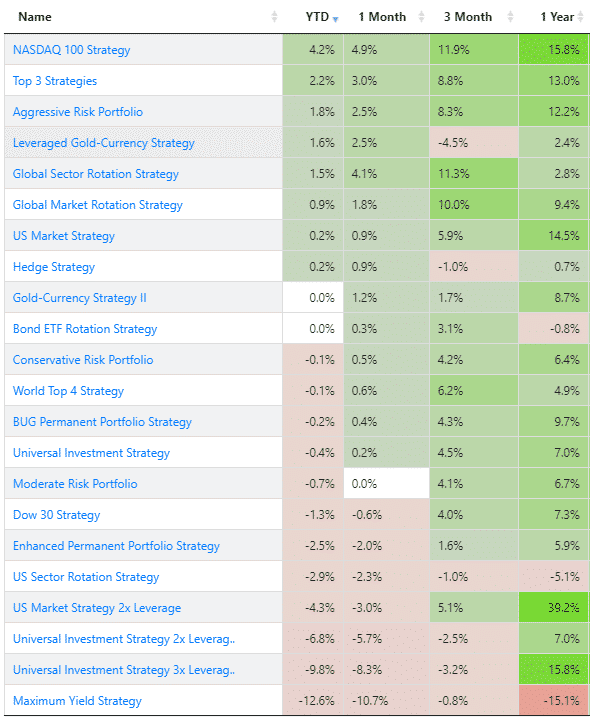

Strategy performance

The SP500 fell by -1% for the month. Gold and Treasuries took a hit as well at -3.2% and -3.6%. Emerging markets, on the other hand, came out positive at +3.2%.

Some of our strategies outperformed sine they were in part positioned in foreign equities and hedged using GSY (cash) and TIP (+0.3%). Our leveraged strategies, on the other hand, use the simplified hedge strategy (pick GLD or TLT) were hit more as both ‘safe-heavens’ fell.

Please join the forum and discuss the recent changes in the markets, our portfolios and LI strategies.

The Logical-Invest team.