2020 – a.k.a the year from hell (but not for investors)

1918 – The Spanish flu pandemic.

By now, most of us have such pictures of ourselves or our loved ones so that our grand-children can show their kids some 100 years from now.

It has been an extraordinary year by any measure. The events of 2020 are unprecedented and beside the spread of COVID-19 include, amongst others:

The Australian wildfires burned through 47 million acres of forest, killing some 3 million animals.

The U.S. in turmoil: President impeached, protests throughout the land, a contentious election.

The Beirut civilian explosion that injured thousands.

Megan and Harry quit the Royal family.

Oil future prices turned negative.

The path after a pandemic

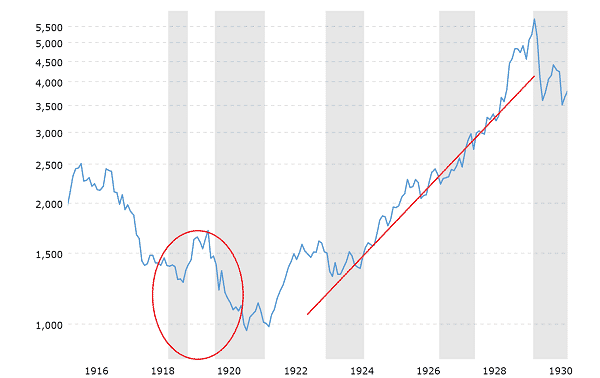

Out of curiosity, we pulled out a chart of the DJA during and after the spanish flu pandemic (1918-1919). Needless to say, circumstances are different since that pandemic coincided with the end of the first World War (1914-1918) that caused massive devastation in itself.

From the chart it is safe to say that investors who entered the market during or right after the pandemic (1918-19), did well for themselves until the market peeked 10 years later, in 1929.

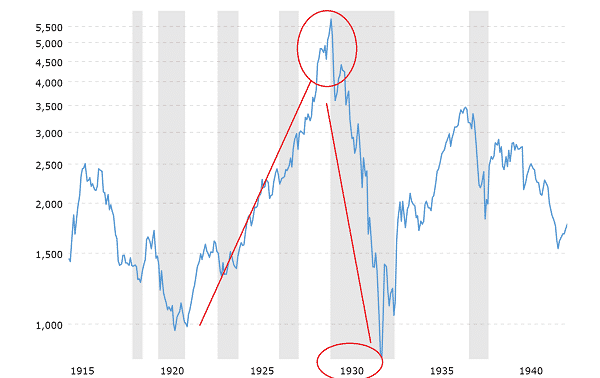

The continuation of the chart shows what every retiree fears: A 2-year reset of a 10-year long investment.

Can we conclude anything from the above charts? Well, two things. First, a great devastation can be the start of a solid long-term equity market. Often this is due to monetization that happens as government steps in and ‘prints’. Subsequently this creates inflationary pressures that help inflate risk asset prices, including stocks.

Second, markets are dangerous places that can multiply wealth 5-fold in 10 years only to wipe all gains in less than two. So you need some type of protection. Since it is very hard to time the market you need a hedged long term strategy.

Strategy performance

We started 2020 being conservative by allowing our algorithm to increase the amount it can allocate to hedges such as Bonds and gold. This proved prophetic as COVID-19 spread through Europe and the U.S. bringing a 30% crash on March 2020. Most of our strategies came in holding hedges which dampened the effect substantially. At the time no one knew how things will turn out and it seemed the economy would get worse. It turned out the market rebounded despite whole sectors of the economy screeching to a halt.

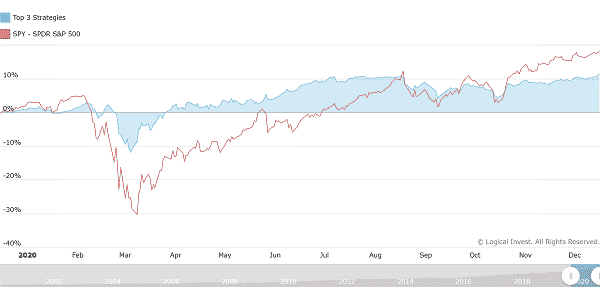

Our strategies rode the recovery but of course the performance was less than being purely long equities. Overall most strategies performance was respectable, decreasing risk and coming out the year at around 10-12%. If you are only looking for pure performance, there are our leveraged strategies that have again outperformed the index but with a considerable level of risk.

A typical example is our Top 3 Strategy. The strategy selects the top three performers from our core strategies, based on the most recent 6 month performance, and allocates one third to each of them.

You can see how the strategy dampened the crash of March to less than 15% but it has also limited the upside to the recovery ending the year at +12%.

What inflation you ask? The year of Bitcoin

We think because of the combined effect of monetization to the tune of 9+ trillion by central banks, structural changes in how a business is run as well as a state-subsidized green economy, we will eventually see inflation. To be clear, we don’t use inflation’s typical meaning but rather refer to the real loss of purchasing power of a portfolio vis-a-vis other goods/services/assets. In fact if you happen to be a 20-something developer being paid in crypto, you are already experiencing this first hand.

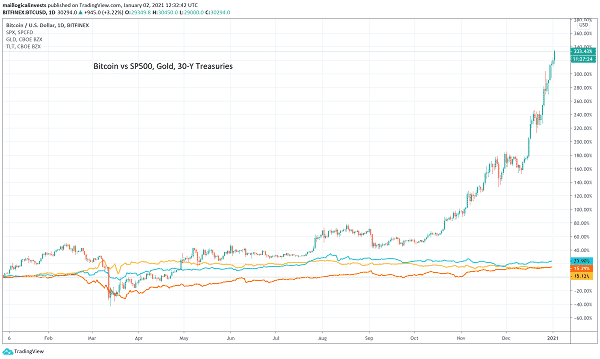

Amazing as it may seem, this is the 2020 chart of Bitcoin vs the Sp500, gold and Treasuries.

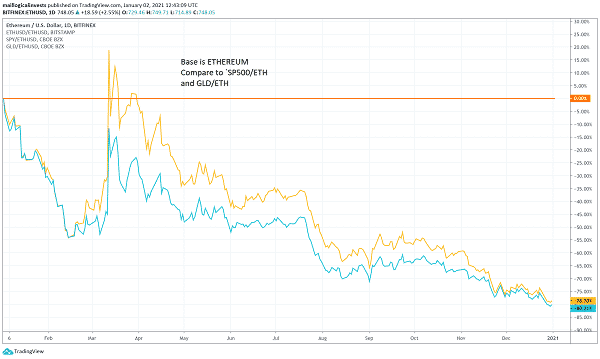

If you are a young blockchain developer being paid in ether (ΕΤΗ), your base currency is ETH. From that perspective you start to treat the dollar as ‘fiat’ money and are looking at your parent’s retirement portfolio as being ‘devalued’ by -80%. Even if it holds gold or stocks! So in the world of crypto, which includes start-up founders, coders, marketeers, web-designers, growth experts, twitter promoters, managers, etc a traditional portfolio is already losing purchasing power.

It is all relative. From the point of view of the younger generation, inflation is present and is eating away savings. From the point of view of a developed-nation retiree, Bitcoin is a very risky asset, has ‘no real’ value and can go to zero. An acceptable risk if you are in your 20’s but not if you are fast approaching 70.

What some large public companies are doing, including 169-year old MassMutual, is allocating a tiny (to them that’s $100 million) portion of their treasury into crypto assets. As mentioned in the past, this may be not be such a bad idea, given one understands the risks and allocate a small part that they can afford to lose.

Happy New Year to you and your loved ones. Stay healthy, strong and free.

Please join the forum and discuss the recent changes in the markets, our portfolios and LI strategies.

The Logical-Invest team.