Performances

Best performers for the month were the Maximum Yield Strategy (+17.5%) followed by the US Market strategy 2x.

End of year performance

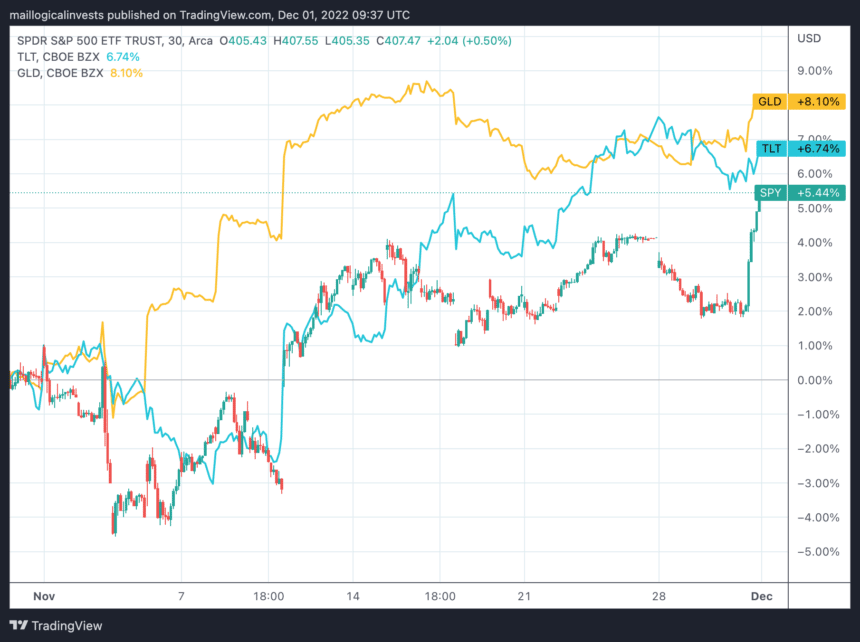

November ended on a good note as the SP500 added 3% on Wednesday, closing the month at +5.4%. The 30 year Treasury ETF (TLT) rose an impressive +6.7 % . Gold was up 8.1%.

How is it that all three asset classes were up during that same month?

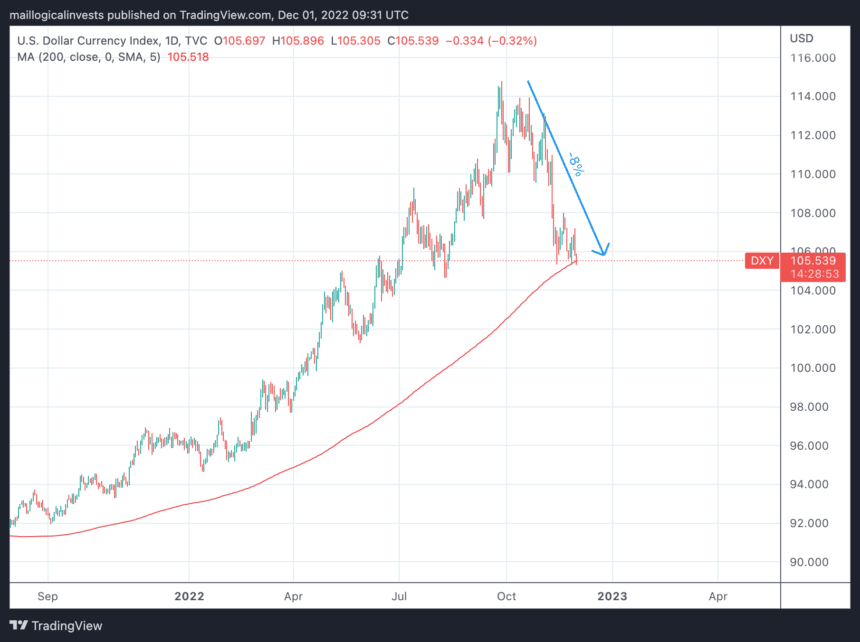

The answer is in the dollar index. When the price of DXY falls, it is common that the three, usually non-correlated asset classes, will rise in tandem.

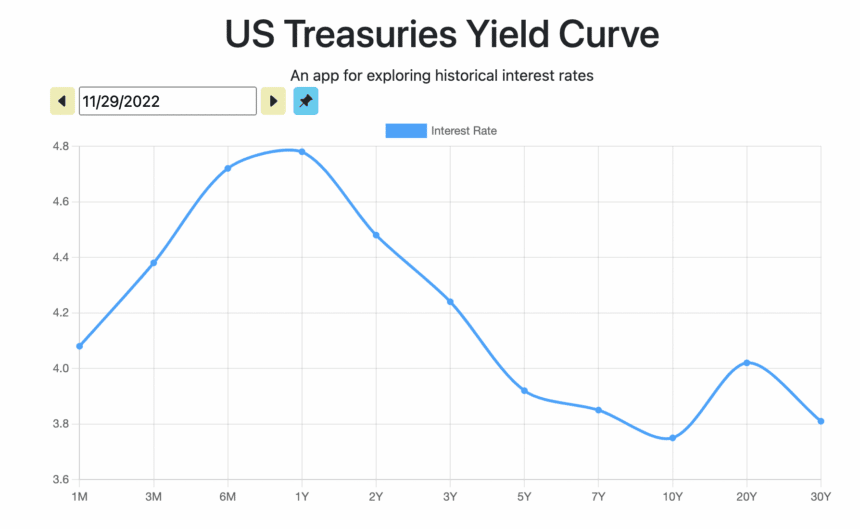

We should note that although 30Y yields fell to 3.8%, 1Y Treasury yields did not follow and remained at 4.8%. You can see this resulted in a highly inverted yield curve.

What that means is up to interpretation. Let’s not forget we are moving into an equity-bullish Christmas season.

Let us know what you think in our forum.

The Logical-Invest team.