QuantTrader users: Please update your software! See instructions at the end of this newsletter.*

Paradigm Shifts

Ray Dalio of Bridgwater and “All Weather” portfolio fame has published a very interesting article. Entitled ‘Paradigm Shifts”, he takes a long term outlook and makes a case for gold:

“….I have observed there to be relatively long of periods (about 10 years) in which the markets and market relationships operate in a certain way (which I call “paradigms”) that most people adapt to and eventually extrapolate so they become overdone, which leads to shifts to new paradigms in which the markets operate more opposite than similar to how they operated during the prior paradigm.”

He continues to argue that the current paradigm is that of central bank intervention, low rates and boosted equity returns:

“…it is highly likely that sometime in the next few years, 1) central banks will run out of stimulant to boost the markets and the economy when the economy is weak, and 2) there will be an enormous amount of debt and non-debt liabilities (e.g., pension and healthcare) that will increasingly be coming due and won’t be able to be funded with assets.”

His argument is that when this times comes, the easiest and least controversial way for governments to decrease this unsustainable debt will be by depreciating the national currency. Thus he concludes, gold which is a hedge against fiat currency, can be an excellent diversifier to a portfolio. You can read his original article here.

Some may argue that this excellent article was published to excuse Bridgwater’s Alpha Fund’s negative YTD return, when the SP500 has returned 20%. Still it is a great lesson on how to look at the debt cycle and how to accept our own biases as we tend to adapt and overextend existing market patterns and thus putting our capital in unforeseen risk.

So how is gold doing? As mentioned in our previous newsletters, the gold price is breaking upwards with YTD performance of 9.8%.

Below is the chart of the dollar index ETF (UUP). As we know, the index is anti-correlated to the price of gold. In other words when UUP is up gold is down. We would expect UUP price to be falling. Interestingly the dollar index is at a decade high. Part of this is due to Euro weakness. Still it will be interesting to see how the UUP/GLD relationship will play out in the coming years.

Coming back to the present market, central banks have placed us back into ‘risk on’ mode with the S&P500 passing the 3,000 mark. Below are the current U.S. Treasury yields. As you can see the Fed (as well as the ECB, Bank of Japan and the Australian central Bank) has once again managed to lower rates with the 10 year barely passing 2%.

| Date | 1m | 2m | 3m | 6m | 1y | 2y | 3y | 5y | 7y | 10y | 20y | 30y |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 01/02/19 | 2.12 | 2.16 | 2.12 | 2.10 | 1.98 | 1.85 | 1.81 | 1.84 | 1.93 | 2.06 | 2.37 | 2.59 |

Daily Treasury Yield Rates as of July 29, 2019. source: treasury.gov

In the geopolitical front, tensions escalated between the U.S. and Iran after two oil tankers in the Gulf of Oman were attacked and Iran shot down a U.S. drone. In Hong Kong, hundreds of thousands of citizens flooded the streets to protest a proposed bill that would allow for the extradition of Hong Kong citizens to mainland China. In the UK, Boris Johnson is threatening a no-deal Brexit. Global warming is starting to take centre stage as heat waves hit northern European cities. In Big Tech a trend towards regulation continues as the “Keep Big Tech Out Of Finance Act” targets Facebook’s cryptocurrency Libra .

Coming back to the markets, although we may discuss and formulate a long term outlook, it is rules based investing that helps us make informed choices based on shorter term facts rather than opinion. Going back to our strategies, for July our top ones were the Leveraged Gold-Currency Strategy (+1.9%), the Maximum Yield strategy(+ 1.3%) and the Leveraged Universal Investment strategy (+1.3%).

QuantTrader users:

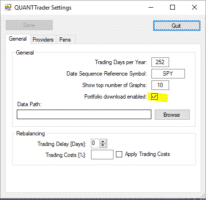

- We have updated the Nasdaq 100 and Dow 30 constituents lists.

- Please check the “yellow” box under “System”-“Settings”-“Portfolio download enabled” so that Q Twill automatically download the 4 new ini files.

We wish you a prosperous 2019, and look forward to a vivid discussion. Visit our site for daily updated dashboard.

Now there is talk US bonds may go negative in yield in the future. How does that play out in Europe where some have had negative rates?

In Europe we’ve gotten used to negative rates for quite some years now. What’s new is that now even 30 yrs bonds are negative, and even 10yrs in some of the peripheral countries which are considered higher risk.

One practical implication is this here, you will now get paid to take a mortgage: https://www.bloomberg.com/news/articles/2019-08-18/negative-mortgages-set-another-milestone-in-a-no-rate-world

My sister just financed a new home at 0.5% for 25 years, the half of a percent being rather the processing fee, that’s unthinkable for the older generation – me included. As an effect we also see house prices in all major cities exploding, also rentals.

Opposite side is that in Europe, especially Germany, people are still used to having their money in savings accounts, or capital saving programs of pension plans, where a complete generation is now losing wealth in plans which were promoted to create wealth. An public pension plans, mostly defined contribution, are cutting their forecasts month by month, while many are completely underfunded.