Logical Invest Strategy performance

All our strategies were positive for the month with the big winner being the Maximum Yield Strategy with 11.5% return. Below are the March returns as well as the year-to-date performances. As expected the Crypto & Leveraged Top 2 Strategy tops the list with 18.9%.

Our most popular strategies, such as the NASDAQ 100, the UIS strategy, and the Top 3 strategies, have averaged 5-6% returns so far. While they have fallen behind the pure SP500 performance, which is currently at 9% year-to-date (YTD), there are benefits to following these strategies rather than solely holding plain equity or a few individual stocks. One advantage is that in the event of a market correction, it is likely to be less severe since all our strategies incorporate a hedge. Recently, this hedge has been in the form of the #Cash sub-strategy, which is currently invested in a GSY, a money market fund.

The Way Forward: Embracing the Inflation Hypothesis

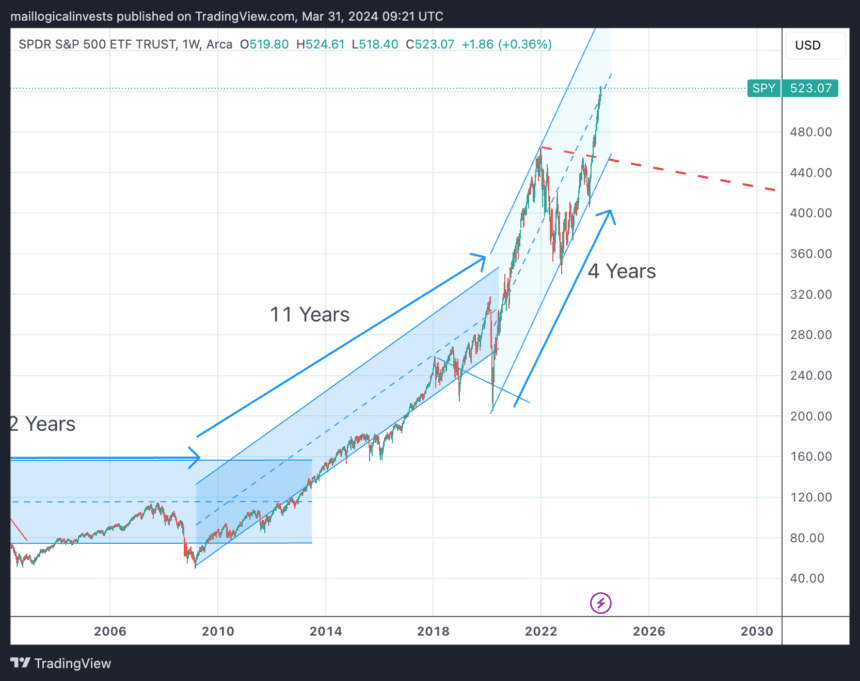

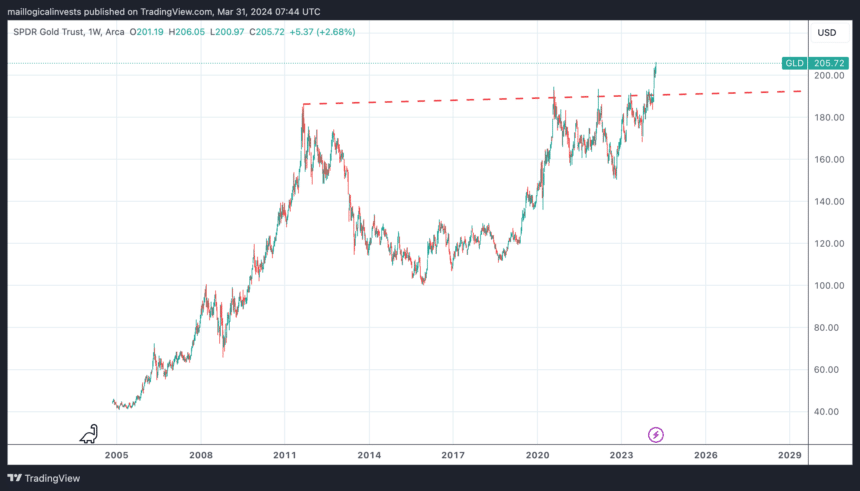

As we enter the fourth year of this decade, it is an opportune moment to evaluate the validity of certain long-term hypotheses. A hypothesis that we have looked at before suggests that we have transitioned from a low-rate environment to a long-term inflationary phase. In such an environment, holding stocks and commodities is favorable, while being in cash or bonds is disadvantageous.

Thus far, this hypothesis seems to be holding true:

- The S&P500 is reaching new highs.

- Gold has broken a 13-year cycle and surpassed the $2000 price target.

- Bitcoin has surpassed the $70,000 milestone, driven by new ETF launches.

- Bonds have shown underperformance, while cash has performed moderately well, especially with a 5% risk-free interest rate for a 1-month Bill, but still lagging behind equities.

- An anomaly is observed in agricultural commodities such as grains and soybeans as well as Natural Gas which have experienced a sharp decline, potentially due to supply-side factors like the lifting of restrictions.

If we are indeed in a long-term inflationary period, history shows that it’s best to be invested in equities and commodities. Despite the consensus leaning towards anticipated rate cuts in June, the actual implementation remains uncertain.

If unsure, consider employing a strategy like the Top 3 strategy, which may underperform the SPY in bullish markets but could help diversify from equity losses in the event of a market downturn.

Let us know what you think in our forum.

The Logical-Invest team.