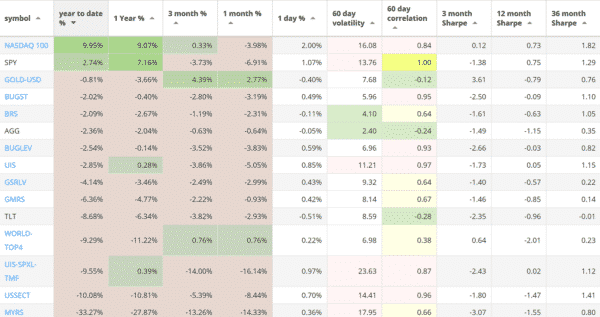

Our top 2018 investment strategies, year-to-date :

- The NASDAQ 100 strategy with +9.95% return.

- The Gold-USD strategy with -0.81% return.

- The BUG strategy with -2.02% return

SPY, the S&P500 ETF, returned +2.74%.

Market comment:

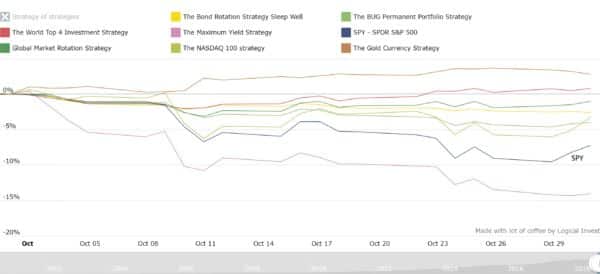

October was not a good month as the S&P 500 had a mini-crash and an ‘official’ correction touching the -10% mark from the September highs. Other markets followed the drop leaving many foreign markets in the red for the year. Our strategies were affected as well. Let’s take a look at how they reacted to this correction.

The Logical Invest strategies use hedges to dampen the effect of corrections. Although the amount of hedging can vary, having even a small hedge is a drag on performance when equities do extremely well. This is what has happened this year as the SP500 has outperformed every other major asset, including most of our strategies. On the other hand the hedge should help lower draw-downs, which in turn helps achieve higher long-term returns. Creating a ‘hedge’ is not that simple, though. What used to be an excellent hedge, namely Treasuries, is now in question as a long term bear market on government paper is a possible scenario.

Our hedging mechanism has evolved as markets have changed. We started with Treasuries. Then we added Gold to compensate for rising yields which could signal inflation. And finally we included a ‘short’ component, namely shorting U.S. sectors.

The last sub-strategy uses 3x Inverse ETFs to ‘go short’ the weakest U.S. sectors. Unlike Treasuries and Gold, the Short USSECT is a ‘pure’ hedge and will almost always move opposite to the SP500. The downside is that historically going ‘short’ the market is a losing strategy and can only be used for short periods of time.

Each month the HEDGE sub-strategy will pick one of the three components. For October it picked the Short USSECT component, which in turn held ERY, the 3x Energy Bear ETF. HEDGE was up 13% for the month.

Unfortunately our more aggressive strategies did not do so well and had substantial losses, partly due to the crash and partly due to TMF falling as well. Our Maximum Yield continues to be in the red for the year while our 3x Universal Investment strategy gave up all positive gains to end up at -10.8 % YTD.

Our only positive performer this month was the Gold-USD strategy (+2.77%) that took advantage of both a rising gold and a falling Euro.

We wish you a healthy and prosperous 2018.

Logical Invest, November 1, 2018

Strategy performance overview:

Visit our site for daily updated performance tables.

Symbols:

BRS – Bond Rotation Strategy

BUGST – A conservative Permanent Portfolio Strategy

BUGLEV – A leveraged Permanent Portfolio Strategy

GMRS – Global Market Rotation Strategy

GMRSE – Global Market Rotation Strategy Enhanced

GSRLV – Global Sector Rotation low volatility

NASDAQ100 – Nasdaq 100 strategy

WORLD-TOP4 – The Top 4 World Country Strategy

UIS – Universal Investment Strategy

UIS-SPXL-TMF – 3x leveraged Universal Investment Strategy

AGG – iShares Core Total US Bond (4-5yr)

SPY – SPDR S&P 500 Index

TLT – iShares Barclays Long-Term Trsry (15-18yr)