Logical Invest

Investment Outlook

March 2016

Market comment:

February was another high volatility month, however it now looks like the world markets are slowly recovering.

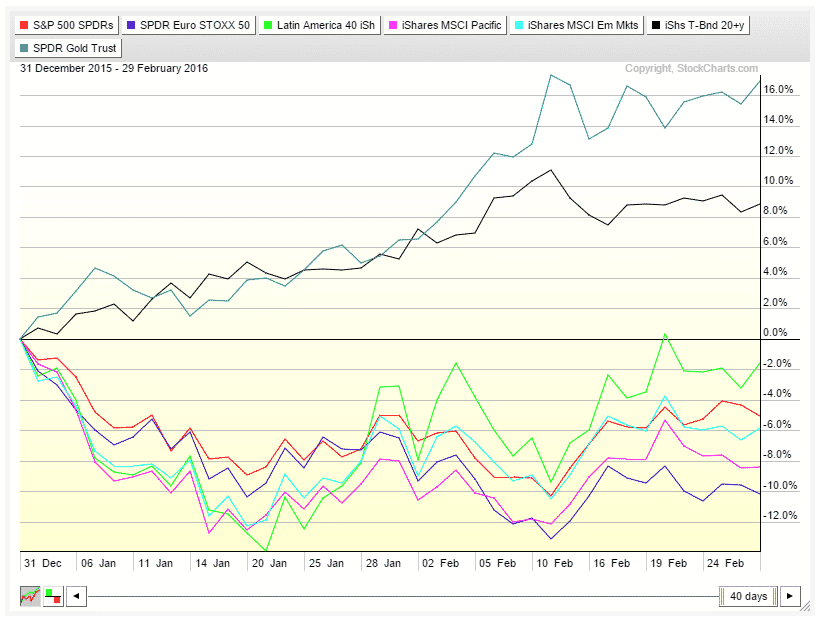

Here is a Year-to-Date chart of the world markets together with the defensive TLT (long duration Treasury) and GLD (Gold) ETFs.

Last year, the normal inverse correlation of both TLT and GLD to equities failed to materialize for quite a long time. We had several months where Equities, Treasuries and Gold went down simultaneously. This was a very unusual and difficult situation for our strategies.

This uncommon situation, where correlations between safe heaven assets (Treasuries and Gold) and Equity did not work as expected was due to the rare occurence when the FED tries to change to a regime of rising rates after years of falling rates. By now, it seems that this transition may not materialize in the near future, at least not as originally planned. This is very good for both Treasuries and Gold.

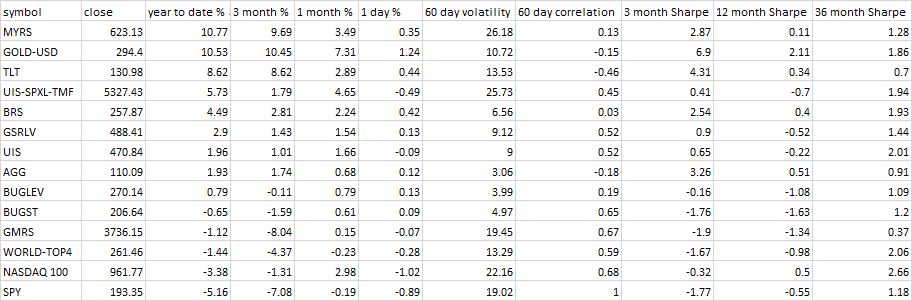

Looking at the market from this correlations-based point of view it seems that so far this year everything is back to normal again. The stock market went down and the defensive treasuries and Gold went up. This is all we want. It allows our strategies to profit and outperform even during market corrections. Year-to-Date, most Logical Invest strategies are doing quite well. Only the most aggressive equity momentum strategies are still slightly negative, but this can change very fast if the market recovers.

The new Gold strategy did very well this year and we think that such a strategy provides excellent diversification because it profits from the worldwide trend of central banks to fight deflation by printing more and more money. Every country tries to weaken their currency more than the others, and the winner of this will be precious metals, because these cannot be artificially duplicated.

So, all together we are quite optimistic going forward and we hope that we will have a good month of March.

Logical Invest, March 2016

Strategy performance overview:

Symbols:

BRS – Bond Rotation Strategy

BUGST – A conservative Permanent Portfolio Strategy

BUGLEV – A leveraged Permanent Portfolio Strategy

GMRS – Global Market Rotation Strategy

GMRSE – Global Market Rotation Strategy Enhanced

GSRLV – Global Sector Rotation low volatility

NASDAQ100 – Nasdaq 100 strategy

WORLD-TOP4 – The Top 4 World Country Strategy

UIS – Universal Investment Strategy

UIS-SPXL-TMF – 3x leveraged Universal Investment Strategy

AGG – iShares Core Total US Bond (4-5yr)

SPY – SPDR S&P 500 Index

TLT – iShares Barclays Long-Term Trsry (15-18yr)