Logical Invest in Bearish Mode Since January

At the start of the year, before the CORVID-19 outbreak was known, we updated our strategies to better withstand a possible bear market or large correction. You can read the details here.

A Two-Stage Correction

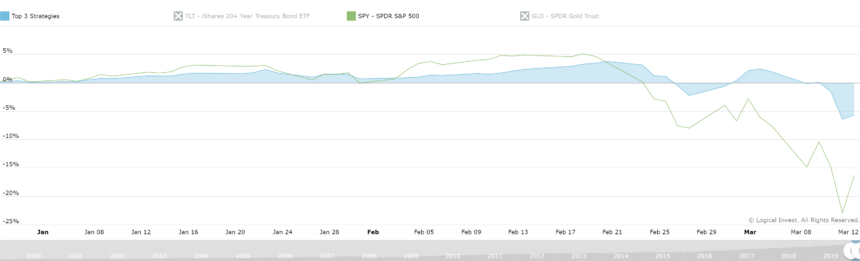

In the first stage, hedges like gold and Treasuries worked well. Although the SP 500 took a free fall, the 30-year Treasury ETF went parabolic up as the 10-year yield touched 0.6%. Gold also reacted to the upside, although more modestly. Overall, the typical LI portfolio held up well. This stage lasted for more than 12 days giving a window of safety for investors before the second stage.

In the second stage, as the realization of the magnitude of the coronavirus crisis became apparent, panic selling ensued. The SP500 hit limit down. Margin calls started hitting leveraged positions forcing investors to raise cash from all sources, including gold and Treasuries, to avoid liquidations. When everything sells at the same time, something that we also saw in 2008, cross-asset correlation rises and nothing works but cash (or short positions).

The Logical Invest Top 3 Strategy

This strategy invests equal-weight in each of the three best performing strategies from the previous look back period. From the chart you can see that the Top 3 Strategy was flat up until March 10, while the SP500 was down almost 15%. It is currently sitting at a -5.7% loss YTD.

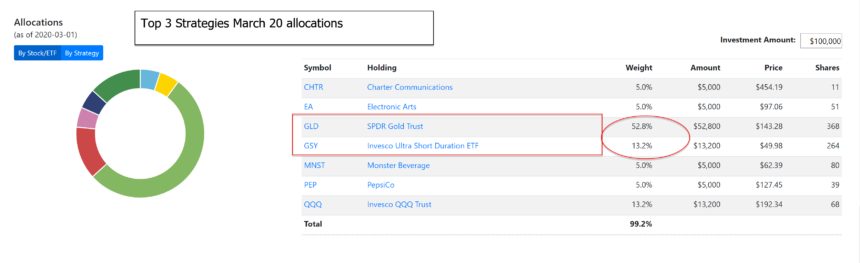

The current portfolio has a 52.8% exposure to gold and 13.2% in short duration bonds (cash).

What to Do During High VIX Levels?

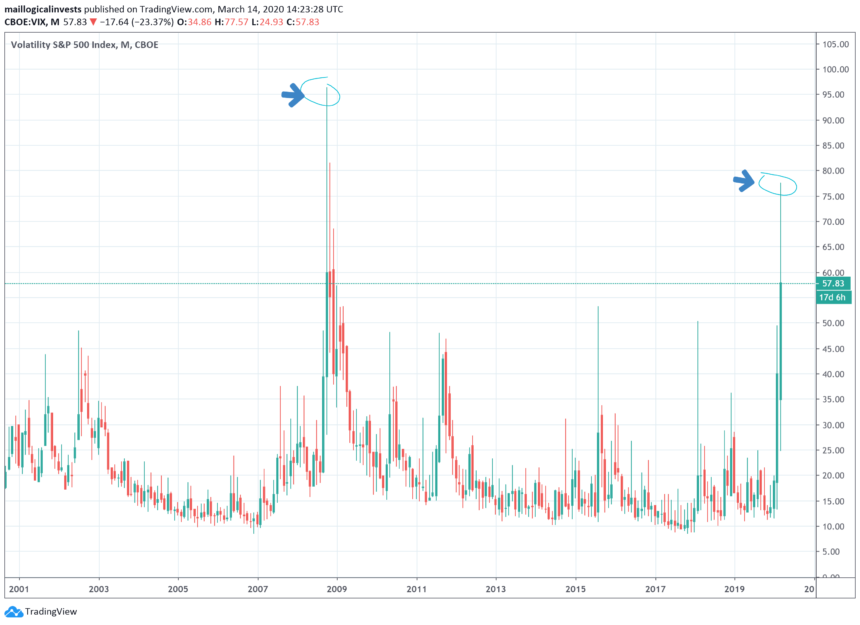

The VIX peaked at 78 and is now sitting at around 55. This has not happened since the 2008 crisis where VIX touched 95.

At these levels of volatility, it is more gambling than investing. Volatility sensitive investors like ourselves know that these levels are not sustainable and a reversion to the mean will eventually happen. We prefer to avoid these extreme markets as players become irrational and short-term swings are large enough to damage accounts. There is nothing wrong in waiting in cash until volatility returns to normalcy, VIX (roughly) below 20-25.

Is This a Correction or the Start of a Bear Market?

It would be a lie to say that we know. Lately corrections have been triggered by various political decisions like tax laws, tariffs, etc. In the past virus outbreaks have not been long term negative for markets, but this time is different as whole cities and countries are put in lockdown. Stepping away from the actual event, one can argue that the markets have been fragile for a number of reasons.

- We have been in a continuous bull market for almost 12 years.

- The Treasury yield curve reversed some time ago, a sign of a pending correction.

- Interest rates are negative in major economies which limits central banks’ corrective options. The ECB did not cut rates, probably because they could not. How do you cut when rates are already negative at -0.5%?

We are certain there will be worldwide support for the markets as has been in the past. We may even see the S&P 500 index returning to previous levels. Weaknesses in the system is apparent so the risk is asymmetric to the downside.

An Alternative to Holding Equities

It can be dangerous to sell equities at this level because there may be a quick bounce up, but nobody knows when that might happen and if there will be more downside first. An alternative approach is to replace equity positions by selling a 2 month, at-the-money SPY, SPX or ES put option. Because of the high volatility, these options will pay about 10% of premium in two months if the stock price does not go below this level. If it goes down, then the investor gets their stock position back at a 10% lower price.

This assumes the investor is familiar with options and the broker allows shorting options.

What Next?

What is important is for investors to protect profits. We will monitor markets this coming week to see how much central bank, government and liquidity intervention is able to calm markets. There is no reason to trade aggressively in this environment and cash is again, king.

Logical-Invest.com is not a registered investment advisor and does not provide professional financial investment advice specific to your life situation. Logical Invest is solely an algorithmic market analysis tool that produces trade signals according to the set of funds provided for analysis. Your registered use of this site and our services is considered equivalent to your signature as evidence of your acceptance of our Terms of Use, and Privacy Policy.

I think Gold and Treasuries dropped because of margin calls. Either way, the Top 3 Strategies performance of -5.7% is a lot better than the S&P 500’s 15% loss. Challenging times to say the least!

I’ll speak for the 3x leverage strategy, which comes with great risk/reward:

The strategy allocations were spot on, however, the TLT/TMF breakdown from the NAV is a big concern. I’ve read several articles saying TLT fell as much as 5% below NAV, meaning TMF fell 15% below actual value. That’s a big hit to the portfolio and a big reason for concern in this environment. It causes you to lose trust in the hedge, especially when you see it occur for three straight days. I was concerned it would breakdown even more with all the talking heads saying they’ve never witnessed such wide bid ask spreads in the safe bond market.

At the exact same time, Gold is plunging. I didn’t mind the small allocations I had in stocks plunging, that was to be expected, but watching the allocations work the first week of the month, then totally collapse the second week became frustrating and concerning. Makes you think there is some sort of market manipulation and then you start thinking how much more money could you lose before it’s all over.

So when markets went limit down at the open Thursday, along with rates still rising and gold plunging, I couldn’t take it anymore. I know the 3x leverage ETFs are like playing with fire, the lower they go, the harder for the comeback. That’s the same for portfolio value too. So, I hit the panic button because I was so mad to be positioned right, and then seeing everything freaking breakdown.

Now I know its only mid month, and by the time March is over, the strategy could finish very positive and it most likely will now that I’m sitting on the sidelines wondering how 4 years of faithful investing in this strategy has turn into this. I’m really hoping it was just a small glitch in the ETF structure that is to blame. I’ll know soon enough.

It’s weird feeling sitting in cash and watching now. I’m not used to this, but I guess I’ll learn something from it and dip my toes back in sooner than later.

With the VIX spiking to record levels, it seems a short volatility strategy may work best going forward like the Maximum Yield so I might jump in there for April onward. Lots to decide going forward.

Thanks for all you guys do here at Logical Invest. It’s not your fault, but I just had to vent my frustration.