From individual Strategies to Portfolio Optimization

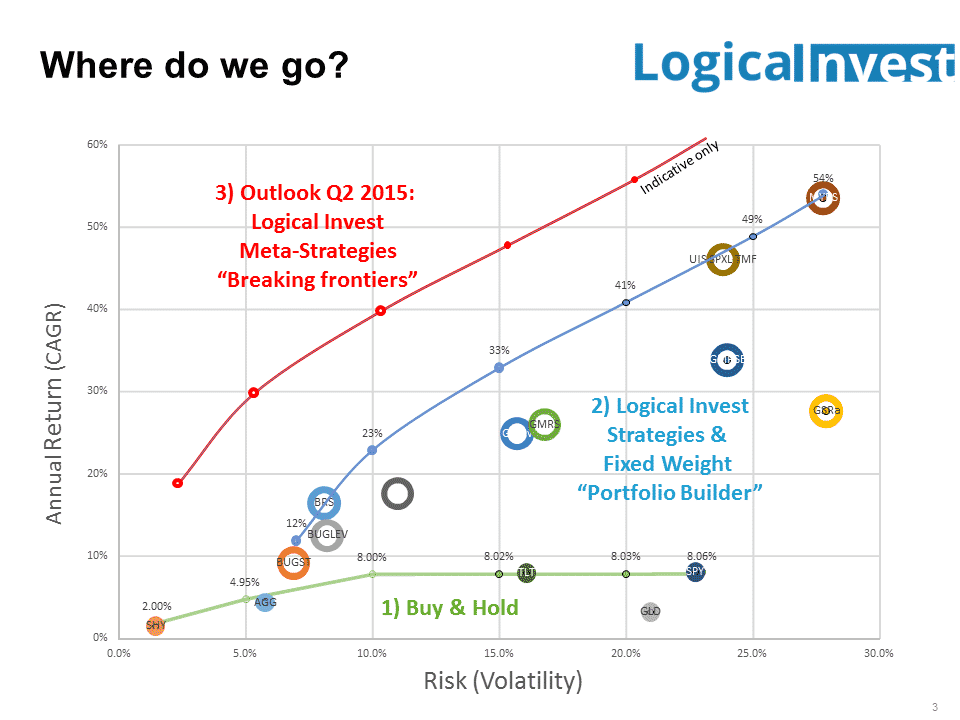

Based on the interest of our followers and our own investment philosophy, we have gradually evolved from offering single quantitative strategies towards blends or portfolios of strategies. The way we visualize our own development cycle might be best summarized in a chart:

Where are we on this path and where are we heading? We believe we have now a stable set of ‘core-strategies’, which cover a broad spectrum of both risk/performance but also trading and hedging instruments. We will continue our research on new strategies, and will also in future come up with smart ideas in that area. However, we are currently increasing our effort in blending these strategies into portfolio solutions. The “Portfolio Builder” with fixed-weight allocations is here only the first step.

Developing a dynamic Strategies of Strategies (or Meta-Strategies) which smartly allocate with changing weights among a set of our strategies is one of the projects we initiated since the four of us met in mid 2014. Our thought: Quickly reacting to or even anticipating changes in the market environment by changing horses on the fly, better dealing with changing correlations of markets and constantly challenging whether one of our strategies has lost ‘steam power’ should be even better than simply allocating funds with fixed weights or even worse discretionary among strategies.

To continue the enhancement of our tools towards this vision, we’ve given our fixed-weight Portfolio Builder a major overhaul and implemented many of the requested features.

Key features for portfolio optimization

Some of the new key features for portfolio optimization are:

Equity lines according to most recent strategy review

Our subscribers know that we review our strategies periodically, either because we find improvements for the execution (change of IEV to FEZ in the Global Market Rotation), or introduce newly developed algorithms like the adaptive allocation using maximum modified Sharpe Ratio.

On the strategy pages we explain these changes transparently, and show both trading signals and equity lines as the strategy has evolved, thus using a ‘fixed history’. However, for establishing a ‘forward-looking’ portfolio of strategies, the historical backtest of the most recent version should be used, to have a true picture of the performance to be expected. Therefore, the new portfolio builder now uses slightly different equity lines, which we hope will not be any cause of confusion.

Weekly data points with daily updates

To improve the granularity of the performance statistics and equity lines, the online Portfolio Builder is now based on weekly data points, and updated automatically around midnight EST. Our trials to use daily data failed due to performance issues, but an Excel version with daily data will be released within the next days.

Due to the different inception date of the strategies, we harmonized the start date of the portfolio builder to 2008. The Maximum Yield Strategy is extended using Global Market Rotation data prior to its inception in 2011.

Additional Performance Statistics for portfolio optimization

Upon request we have included the following performance statistics:

Maximum Drawdown (weekly level): Maximum peak-to-through decline of the strategy. Please see here a discussion about monthly versus daily versus realized drawdown.

Average and Maximum Duration (of drawdown): Average / maximum number of weeks the strategy was in drawdown before recovering the previously reached historical peak.

Sortino Ratio (weekly downside risk assessment): The Sortino Ratio is an alternative measure to the Sharpe Ratio to assess and compare a strategy or portfolio.

Convenient Drop-Down Menu for most prominent Portfolio Optimizations

As introduced in our article “The power of diversification: Portfolios of Logical Invest Strategies“, you can now easily select between Maximum Sharpe, Minimum Volatility, Minimum DrawDown, Maximum Return with volatility or drawdown constrains and a variety of leveraged portfolios. We’ll update these solver optimized choices about once a month, and will share an Excel Portfolio Builder with the ability to do your own solver optimizations using an infinity of variations through easy-to-configure parameters.

Visual aid using a classical Risk / Return matrix with Markowitz Efficient Frontiers

Assessing your portfolio in the light of classical modern portfolio theory using risk / return plots and the efficient frontiers is just another tool to build your own portfolio. Just as a reminder to ourselves of why we are in quantitative strategy engineering, we compare the possible sets of portfolios using our strategies with the limited potential of using some common market proxies (Equities, Treasuries, Bonds, Commodities, Cash). Also here, while all other elements are fully dynamic, the efficient frontiers shown in the graph will be updated about every month.

Enhanced simultaneous usage by several users

To avoid the former problem of several users trying to configure their own portfolio, we now automatically forward you to one of ten random Portfolio Builders, which should reduce the probability of unwanted double work. Our long term goal and project to come up with a completely integrated online version (code name “Gold Version”) suffered some delay due to the complexity pin the programming. We ask for your understanding that this will probably take another two months. To sweeten the waiting time here some of the new functionalities: Option to save your portfolio into your account, daily one-pager update on portfolio performance with emailing option, consolidated execution signals for your chosen portfolio.

A first experimental version of the Offline Excel Portfolio Optimization Builder is available in this forum thread, where we will also document the development status. Sadly Excel does not support all advanced functionalities across all versions, so we’ll need some debugging and enhancement before coming to a stable version

We will shortly update our recent article “The power of diversification: Portfolios of Logical Invest Strategies“ with some additional insights and a first glimpse into the dynamic-weight Meta-Strategies which we are also about to release.

We’re interested in your feedback and suggestions for further improvements of our portfolio optimization capabilities. Please support us in making this a valuable tool for all ourselves.

Best Regards,

Alexander Horn

For our online readers. here also our very first video, which also contains some instructions on how to use the portfolio Builder

No volume on your video!

On purpose, there is no volume/speech this time :-) Too shy for such a bold first step. Promise improvement!

Looks great! I have a suggestion for another improvement.

One thing that would be nice, is if there was a tool that calculated the allocations based on the portfolio strategy. For example, let’s say I am doing a max sharpe portfolio strategy that consists of 40% BUG, 20% MYRS, 15% BRS, and 25% UIS. When the numbers come out each month, some ETF’;s are part of each strategy, and one has to calculate the overall allocation for an account. So if the numbers come out the end of the month and say TLT is 30% of BUG, and 50% of UIS, then I have to do an additional calculation to tell me how much to allocate to TLT (40% x 30% + 25% x 50% =24.5% in this example) so the total TLT I would allocate would be 24.5%.

It would be great if we could just select the portfolio, and somehow there was a tool that showed the current allocations (to members only of course). Or you could just publish the allocations for each portfolio strategy each month in the member area, that would also work, although that wouldn’t help with custom portfolios, but may be a good option. We of course can calculate it manually, but would be a nice feature to have :-)

Matt, yes, I know. It’s a shame we’ve not been able to come up with something like that for all subscribers. We kicked off a major coding project in Jan to integrate both the portfolio builder and the ‘signal consolidation’ like that into our site. But what can be done very flexibly in google sheets has taken our freelancer now two months already.. Not to claim him, it’s really hard, poor guy.

Pat Hill was kind enough to share the google sheet he has built for his own control: https://docs.google.com/spreadsheets/d/1Yfsr3h1B_vYUbFXZ9988Aa-YL1wxPTAdLzEf0oDJTqo/edit?usp=sharing

I will look how we can further automate this with the signals, will come back to you.

Thanks Pat Hill! Very helpful! I checked it against my positions last month. Works great!

Have taken Pat’s idea a bit further and integrated into the site: https://logical-invest.com/strategies/consolidated-signals/

This is a test version to get your feedback and improve before launching to all our “All Strategy” subscribers:

– Signals are pulled automatically, so no need to input manually

– Have structured by asset class and added sum of allocations

– Leverage comes from Strategy weightings (if >100%), so one step less

– Indicates whether margin is required

– In this step did not include alternative allocations to 3x or short ETF, will do in next step

Let me know if you propose further features, or have feedback regarding usability.

And one more: Hope to have the integrated “Gold Version” ready in some weeks, then you just save your portfolio once, and see consolidated signals and performance each time you log in.. Bear with us some weeks more, Inspiration and Transpiration!!

Nice enhancements. I especially appreciate the drawdown metrics.

WK

Great work Alex. As a new subscriber I am just beginning to appreciate the value and utility of your work and plans. I see integrating Portfolio builder and the fund allocation tool is a work in progress that will provide easier monthly rebalancing. Am eager to try “adaptable allocation” features in new versions of portfolio builder. In the mean time, thanks for all the good work and looking forward your future results.