Hedging starts to work again

So far in 2025, most of our strategies have outperformed the S&P 500.

After a fierce two-year U.S. bull market where simply holding the SP500 outperformed almost all other diversified strategies, hedging is beginning to work again, indicating a more uncertain market.

This shift could be attributed to the evolving geopolitical landscape, or perhaps market uncertainty surrounding U.S. policy (debt ceiling, tax cuts, interest rates, etc.). Regardless, traditional hedges like gold (GLD) and Treasuries (TLT) are starting to perform better and appear less correlated with equity.

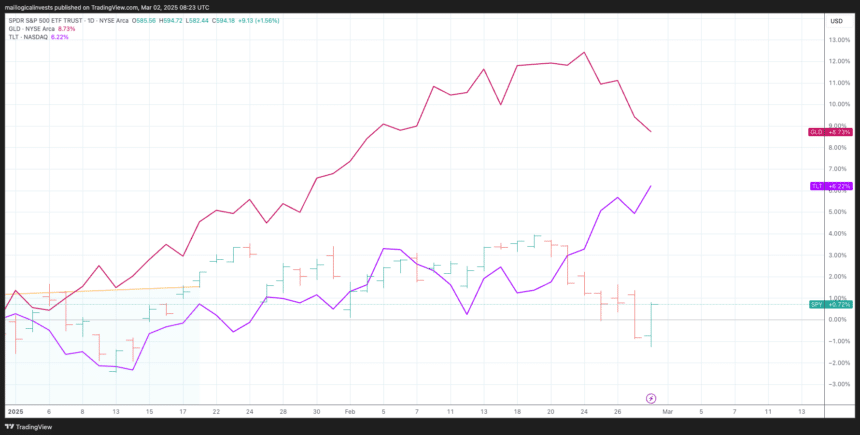

Below, you can see the year-to-date performance of SPY (bar graph) compared to GLD (red line) and TLT (purple line).

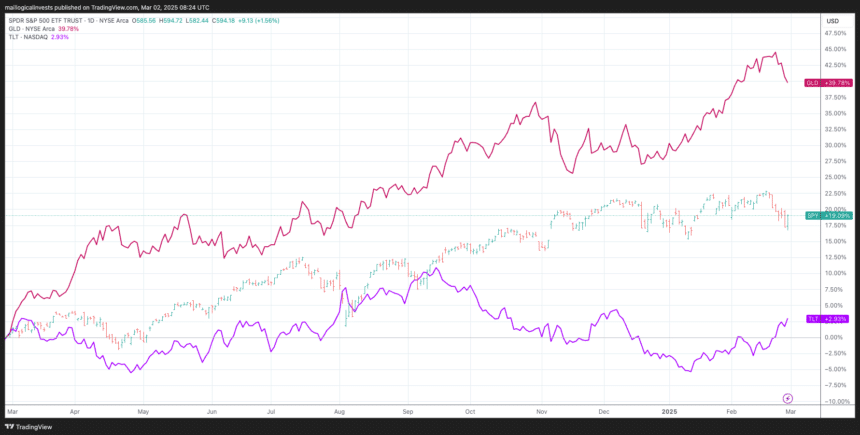

The following chart shows the performance of these three assets over the past year. Gold has been an excellent hedge (and return boost) against equity corrections, although its behavior during a full-blown correction or liquidity crisis remains to be seen. During the last SP500 correction this past week, gold also declined, but TLT compensated.

It’s possible that Treasuries may begin to perform strongly again, at least in the short to medium term. If this occurs, our Hedge sub-strategy will eventually recognize this trend and allocate a portion of capital to Treasuries.

A changing environment

Unless you’ve completely disconnected from the world (and honestly, that doesn’t sound half bad…), you’ve likely noticed the rapid shifts in the geopolitical landscape. The new U.S. administration is implementing significant policy changes, particularly in areas like tariffs and foreign relations. Put simply, as the U.S. (at least in principle) steps back from its role as the “world police,” other nations may or may not fill the resulting void. This could lead to fundamental changes in the balance of power between countries, which will inevitably impact our investment strategies.

Use our models to validate your own decisions

Our strategies and portfolios adapt objectively to changing market conditions, eliminating emotional bias. They can also inform or validate your own investment decisions, enabling market participation with built-in protection and reduced emotional influence.

Share your thoughts in our forum!

The Logical-Invest team.