Stocks and gold: A perfect pair

All portfolio managers dream of assets that not only grow but are also anti-correlated. Building a portfolio from such assets significantly reduces volatility, which plays a crucial role in enhancing long-term compound portfolio growth.

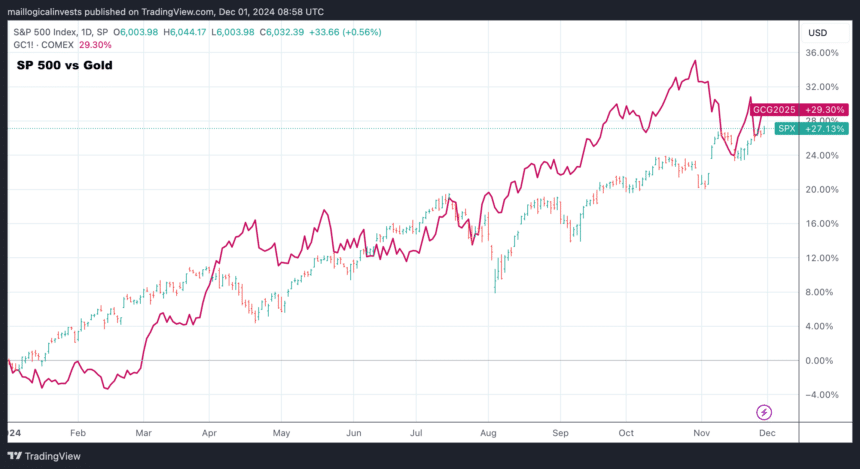

In the case of a gold and the S&P 500, 2023 has so far been that dream combination. Both have achieved a YTD performance of 28% and have done so while staying fairly uncorrelated. That means gold actually hedged the few equity corrections.

You can see that during the April-May and August S&P corrections, gold did not follow but kept a steady growth. A 50/50 stock/gold portfolio would have matched the 28% return but with a maximum drawdown of just -6%.

Going back to 2020, the U.S. Index has returned 87% while gold 71%. Going back to assumptions made back at the start of the decade, it seems that inflationary investing was the right thing to do: Investing in Equities and gold. Less so for real estate which returned around 26% (VNQ) for that same 4 years as commercial real estate was impacted by the pandemic.

Trump is back – Is Inflation back?

Ray Dalio of Bridgewater fame, recently gave his point of view on what comes next. You can read his full article on Times.com.

The article outlines the emerging vision of a second Trump administration, emphasizing a bold overhaul of domestic governance and a redefinition of international relations. Domestically, the administration is expected to adopt an aggressive approach to streamlining government functions, led by key appointments such as Elon Musk, Vivek Ramaswamy, and RFK Jr.

This team plans to dismantle the “deep state,” reclassify civil service protections, and prioritize economic efficiency over social and environmental concerns. Trump’s administration will likely favor deregulation, onshoring critical industries, and empowering pro-business sectors while sidelining climate initiatives and diversity programs.

In foreign policy, the administration is projected to pivot toward an “America first” stance, focusing on economic and geopolitical rivalry with China, deemed the United States’ primary adversary. The existing post-WWII international order may give way to a fragmented landscape defined by bilateral alliances and tactical partnerships. The U.S. is expected to pursue policies aimed at economic self-reliance, particularly in strategic sectors like semiconductors, while bolstering military preparedness.

Overall, the anticipated Trump administration envisions significant domestic reforms and a recalibrated global role for the U.S., rooted in nationalistic and protectionist policies. While these initiatives promise economic benefits for certain sectors, they also herald potential internal and international conflicts. These sweeping changes, set against the backdrop of a shifting global order, suggest a transformative yet contentious era in U.S. governance and foreign relations.

Suffice it to say that protectionist policies, such as tariffs, along with deregulation and a government overhaul, are generally equity-positive but tend to be inflationary.

Performances

Our strategies were mostly positive for the month with our most risky Crypto & Leveraged Top 2 Strategy gaining +19.7% while the US Market Strategy 2x Leverage +8.2%.

Enjoy the holidays!

We’d love to hear your thoughts in our forum!

The Logical-Invest team.