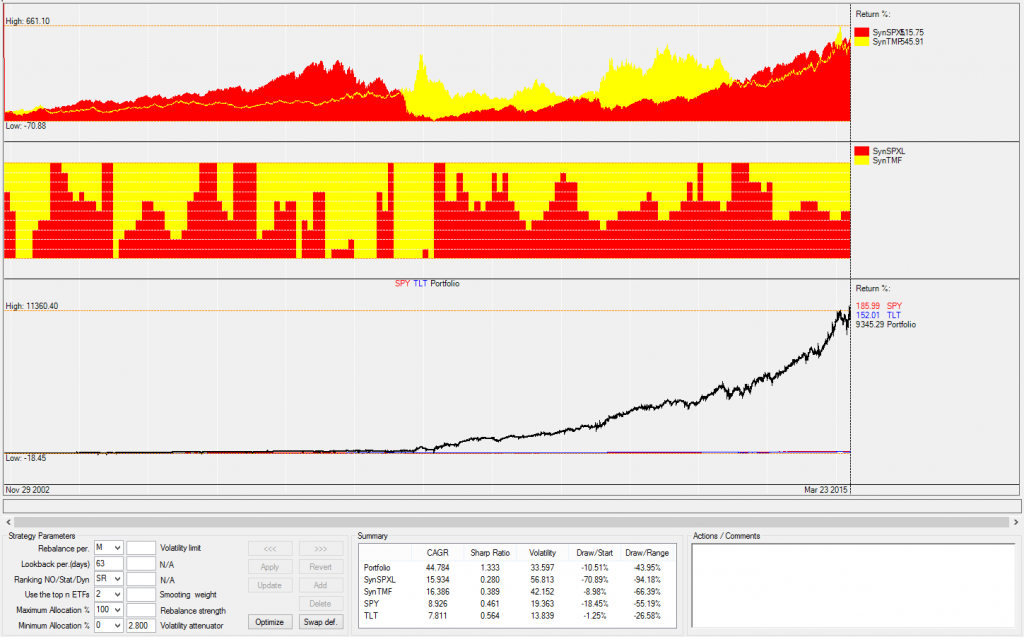

By request of several followers, we have now included the version with 3x leverage of the Universal Investment Strategy using synthetic SPXL and TMF data from 2002.

Portfolio Builder now with leverage

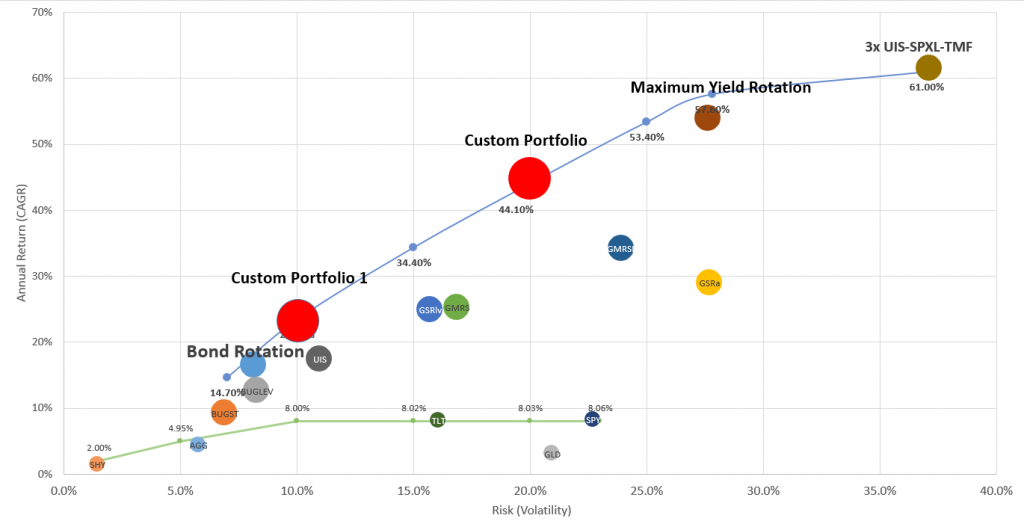

We’re about to publish a full article on this exciting option for this weekend, but want to pre-alert you about this upcoming adition. While this is a very aggressive strategy with leverage, it blends very nicely with a 10%-20% allocation into a portfolio targeting Maximum annual return with a 10% or 20% volatility constraint. We have therefore also updated the optimized portfolios, and by another request included the MaxCAGR with volatility constraint of 20% and 25% volatility.

Here a preview of the full backtest since 2002 of the version with leverage

A visualization of the new portfolio options with blends of this strategy with leverage:

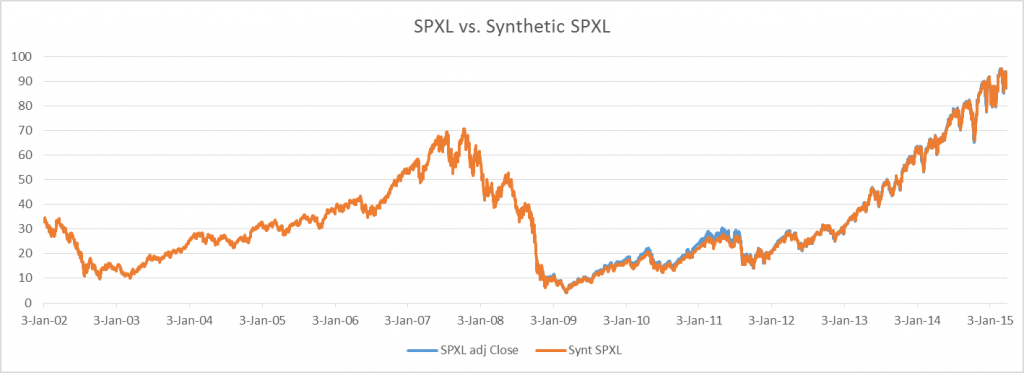

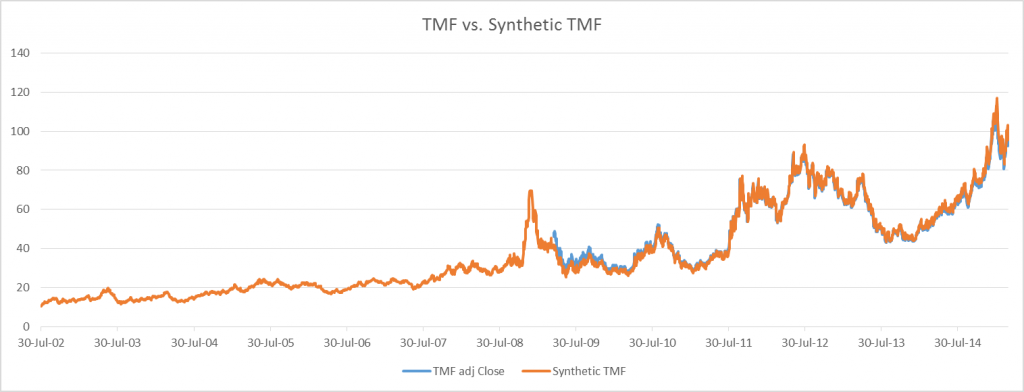

And the timeseries of the synthetically constructed SPXL and TMF /3x leverage) since 2002 (both ETF have an inception date in 2009). We will explain the methodology of this more in detail in the upcoming post.

Stay tuned for our next post, but review the portfolio options in our Portfolio Builder before, which now includes the version with leverage. A team of followers and us is working on an advanced offline Portfolio Builder, which offers additional features to optimize and customize your portfolios, as well as full daily return and equity data. This is still in development, but feel free to preview and join the team if interested.

If you are new to our site, here an overview of our Universal Investment strategy:

“The SPY-TLT Universal Investment Strategy (UIS) is one of our new core investment strategies. Probably the most basic of all rotation strategies, is the switching strategy between the S&P 500 US stock market (SPY) and long duration Treasuries (TLT). The SPY-TLT ETF pair is very interesting, because most of the time these two ETFs profit from an inverse correlation. If there is a real stock market correction, then Treasuries like TLT have always been the assets where money flows in, rewarding holders with nice profits.”

Hi, I’ve been using SPXL 50% TMF 45% VXX 5% since 31 Oct 2014 and am up 20%. Is VXX necessary ?

Hi Alex: Can you provide a status on the improved “Meta”/dynamic portfolio enhancement?

Thanks

Eric,

we’ve finished the necessary changes in our platform, and are currently setting up the versions we will initially publish. See here how we will present them, especially the allocations to strategies (UIS/MYRS in this example) and then the consolidated allocations at ETF level: https://logical-invest.com/strategy/meta-strategy-example/ Note this is an arbitrary example to show the platform, not the real performance we’re aiming to achieve.