Summary of our Gold ETF vs Currency investment strategy:

- The Gold-Currency strategy trades a Gold ETF vs 3 major currencies.

- It is based on the negative correlation between the Gold ETF and the U.S. dollar Index.

- It is an excellent addition to existing equity or bond portfolios as it holds very little correlation to either.

- It can be traded using ETFs, Futures or even low-margin/low-cost FX pairs.

Subscribe for $30 / month.

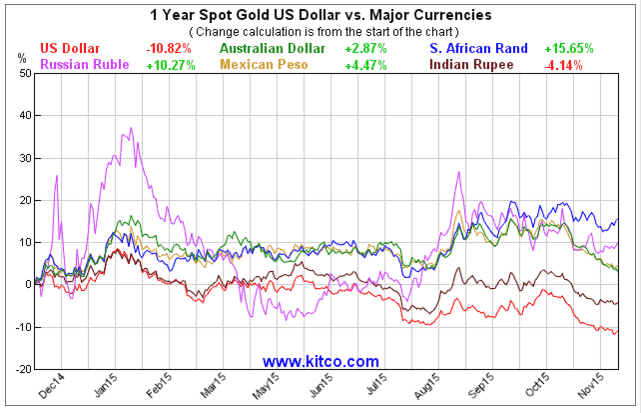

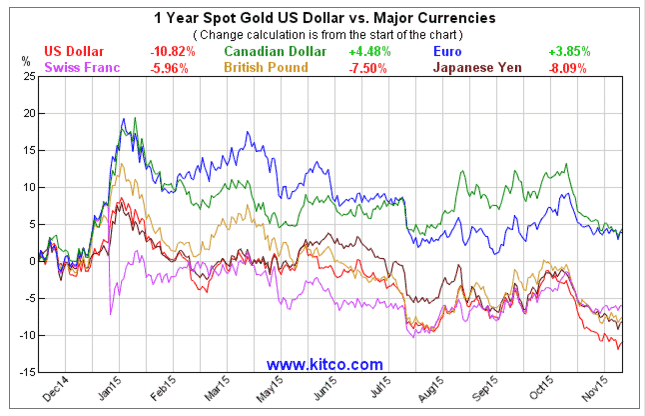

Gold peaked on September 2011. It has been in a downfall since then. During the last 12 months alone, Gold lost more than 10% in US$. It is therefore understandable that Gold has not been very popular for US investors, which reflects in the trading volume of the Gold ETF.

Gold ETF value depends on USD to Gold relation: How valuable is Gold in USD terms

For European investors, however, Gold was up by 3.85%. For Russians it was up 10.8% and for South Africans an astounding 15.6%.

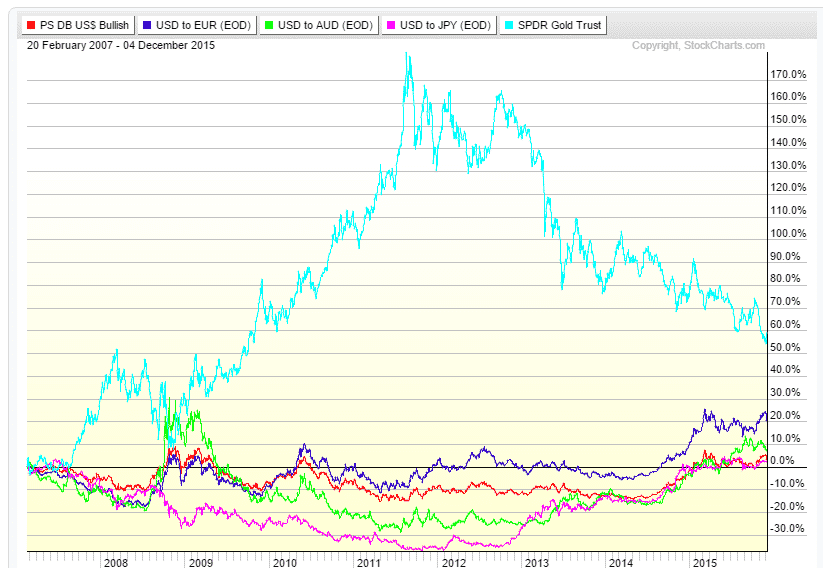

As you can see in the above charts, gold performance depends on the denominating currency. Gold is traded in US$ and so a strong US$ is negatively affecting the gold price. In fact Gold can be seen as a currency which has a strong negative correlation to the US$. The USD to Gold relation or in other terms how valuable is Gold in USD terms is therefore key in this strategy.

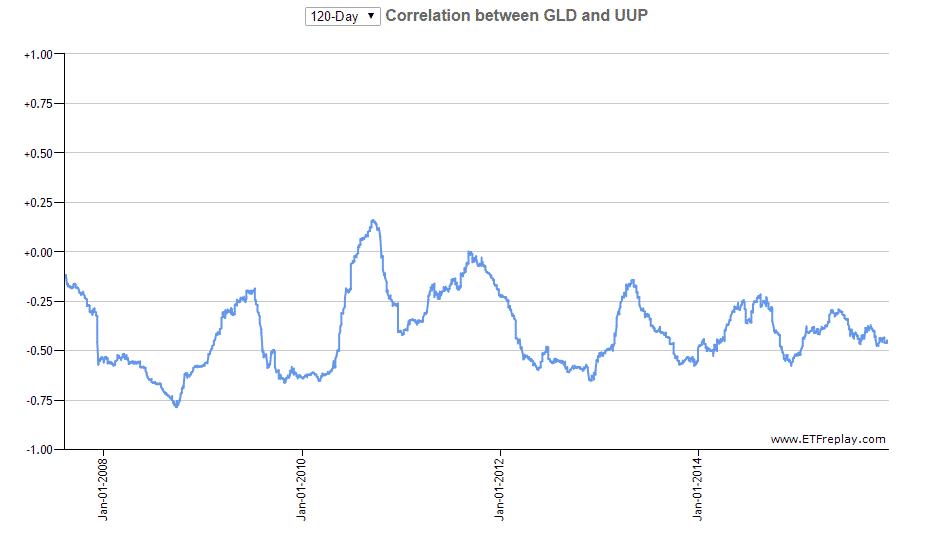

The below chart shows the correlation between Gold (ETF: GLD) and the US Dollar Index (ETF: UUP)

Gold ETF vs. Currency Rebalancing

Good rebalancing strategies often include negatively correlated assets. Our Universal Investment Strategy works using the negatively correlated ETF pair SPY – TLT. In a similar fashion one can construct a well working GLD – UUP strategy.

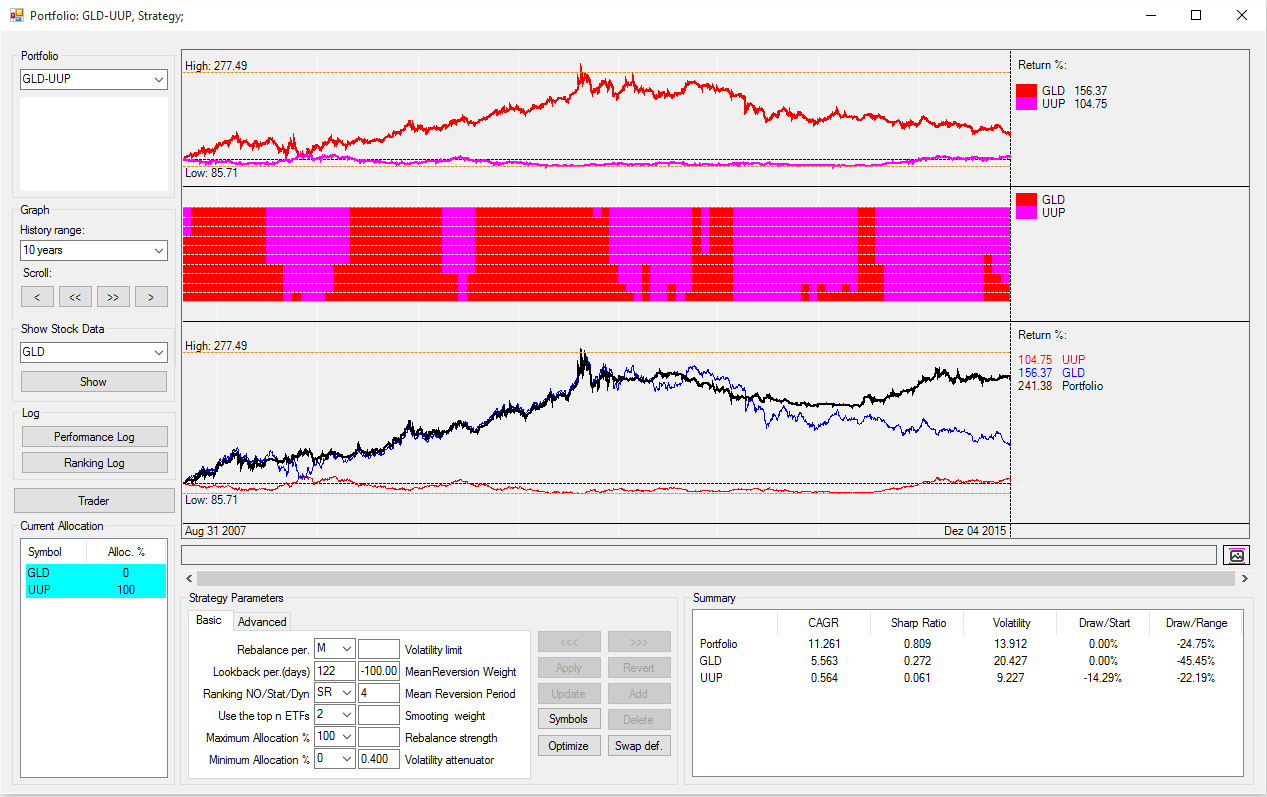

In the chart above, you can see that by combining the Gold GLD ETF with the UUP Dollar Index ETF the strategy changes the allocation between the two quite effectively. The resulting portfolio value (the black line) is, for the most part, following the asset which is doing better at that certain time period. During 2008, for example, we had a 25% correction of Gold. As you can see in the middle allocation pane the strategy switched to UUP.

By the way it is interesting, that during many corrections the US$ was the better safe haven then Gold. Many times Gold was going down during the initial phase of a market correction because investors needed liquidity to cover losses and as a result sold Gold. Only during the final phase of a correction when investors sold all equity the money flow went into Gold driving the price higher.

From 2012 on when Gold began its correction, the strategy remained for the most part allocated in the U.S. dollar index.

The strategy had an annual return of 11% and a Sharpe ratio of 0.8 during the last 7 years since UUP is on the market.

Using currency ETFs to rotate with the Gold ETF

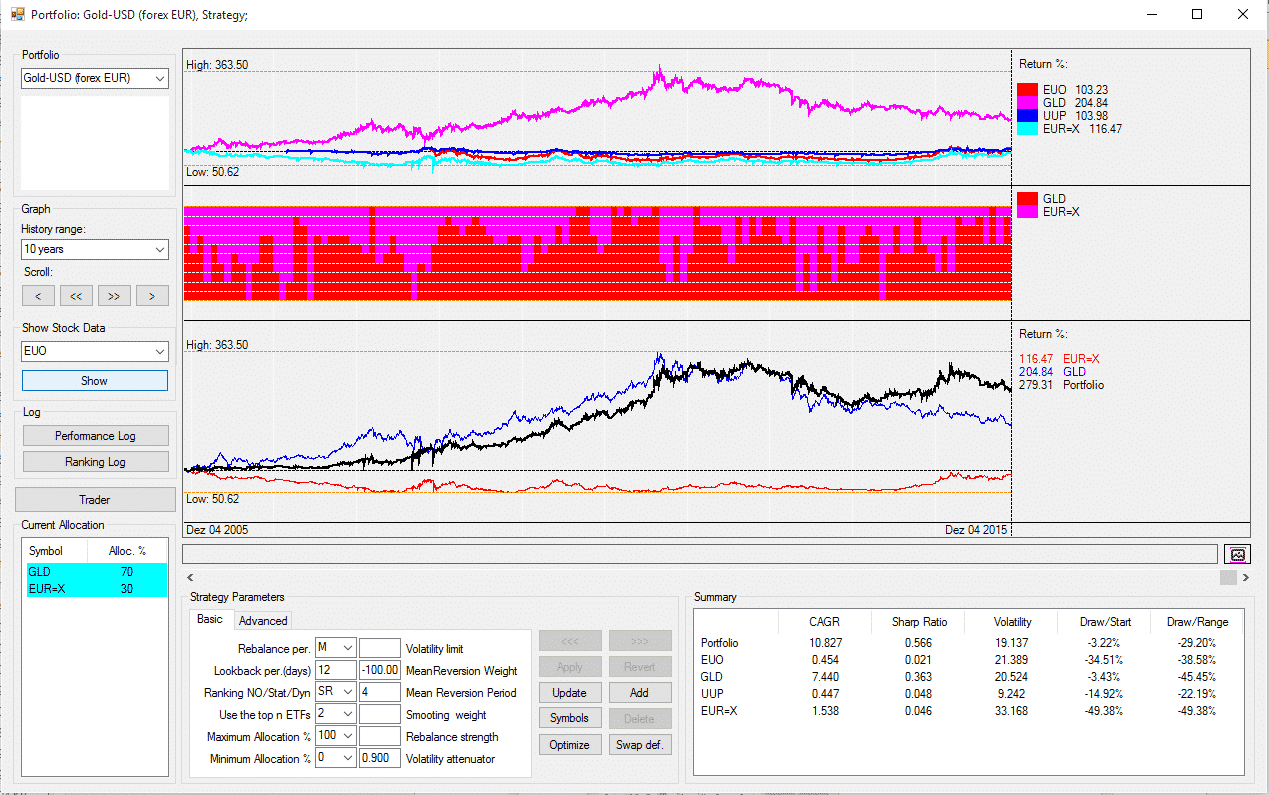

A disadvantage of the UUP ETF is, that it has only half the volatility of Gold. This presents a problem as it is better to combine assets which have about the same volatility.

Because UUP is composed by more than 50% of the USD/EUR currency pair, we can replace UUP by EUO, the 2x leveraged short Euro US$ ETF, because the two ETF’s have a very high correlation. In other words, we are going long the US$ against the Euro and increase volatility by using a 2x leveraged ETF. Although this improves the strategy considerably, there was a period between 2012 and 2013, where both Gold and USD/EUR lost value. This resulted in the strategy underperforming.

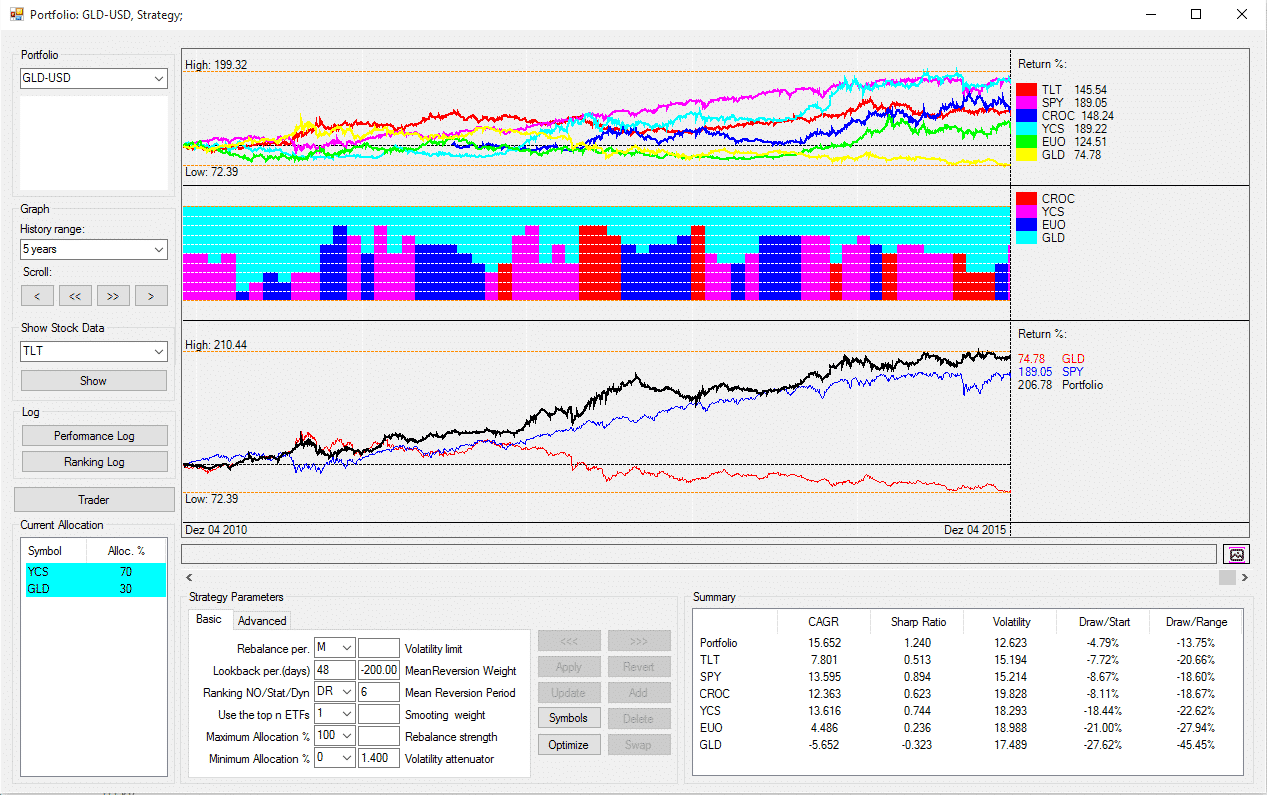

Fortunately there are 2 other 2x leveraged currency ETFs on the market. The YCS is a 2x short Yen ETF and the CROC is a 2x short Australian $ ETF. By combining Gold with the best of these 3 ETFs (EUO, YCS, CROC) we get an even better result.

Performance of the Gold ETF Currency Strategy

The resulting strategy has done very well during the last years. It produced an average annual return of 15.6% and a Sharpe ratio of 1.2.

Here is a comparison chart between these 3 currencies and Gold (as proxy for the Gold ETF).

It is easy to see that the Gold pre-2012 bull market was partly due to the weak US$ or strong foreign currencies like the Yen. Following the 2012 peak, the US$ has gained strength and Gold has entered a prolonged correction, resulting in a substantial -43% drawdown for gold buy-and-hold investors.

Execution of the Gold ETF Currency Strategy

The Gold-Currency strategy is very interesting not only because it has very low correlation to equity-treasury strategies, but also because it is very simple to execute using forex currency pairs. Most brokers offer gold as a forex instrument at very low spread and cost.

However it is important to remark that the strategy holds risks. As we have seen last week with Draghi’s speech about new Quantitative Easing measures of the ECB, forex currency rates can jump several percentage points within minutes. These moves are often based on central bank intervention or policy announcements so as to make them impossible to anticipate in direction and magnitude.

For this reason, the strategy does best when combined with other equity and bond strategies.

You can subscribe here.