Enhancing Harry Browne’s Permanent Portfolio

- The Permanent Portfolio is a simple, diversified portfolio

- You can construct it using 3 ETFs: SPY, TLT and GLD

- We enhance it by allowing variable allocations and monthly rebalancing

- We offer a free subscription so you can implement it in your own account including 401k or IRA

What is the Permanent Portfolio by Harry Browne

Harry Browne’s intention was to find a solution for the money “you need to take care of you for the rest of your life”. He called it the Permanent Portfolio because he believed that once an investor sets it up, they never have to re-arrange the allocations even if the outlook of the markets change.

He argued that this mix of assets should assure “your wealth will survive any event, including an event that would be devastating to any individual element within the portfolio”.

The portfolio consists of 25% Gold, 25% in the S&P500, 25% in Treasuries and 25% in Cash.

According to Harry Browne:

- Stocks should do well in periods of economic growth.

- Gold should do well during inflation, protect from currency devaluations and do fine during growth.

- Bonds should do well in deflation, ok during prosperity.

- Cash would protect from losses in a recession as well as deflationary environments.

As simple as this may sound, it is excellent advice. The Permanent Portfolio is one of the first and simplest type of Tactical Asset Allocation (TAA) portfolios. The strength of TAA’s come from combining uncorrelated asset classes that do well in different economic environments. The aim is to protect wealth and compound returns over the years. The purpose of this portfolio is not to outperform the market.

We will look at three versions, including our proprietary one that aims for higher returns.

- Version 1: No rebalancing, set and forget approach

- Version 2: Yearly rebalancing

- Version 3: The Logical Invest Enhanced version with monthly rebalance and variable allocation weights

The Buy and Hold Permanent Portfolio

No rebalance. Just buy 1/4 the S&P 500, 1/4 Gold and 1/4 long term Treasuries.

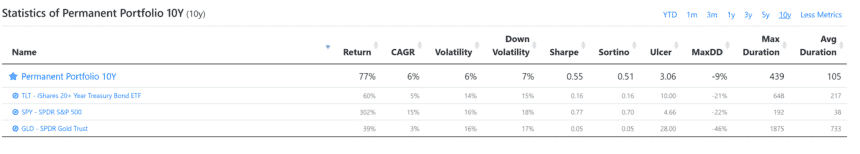

A 10 year backtest with fixed allocations (no rebalancing at all) shows a 6% average yearly return. The most important aspect is very low volatility and maximum drawdown of -9%.

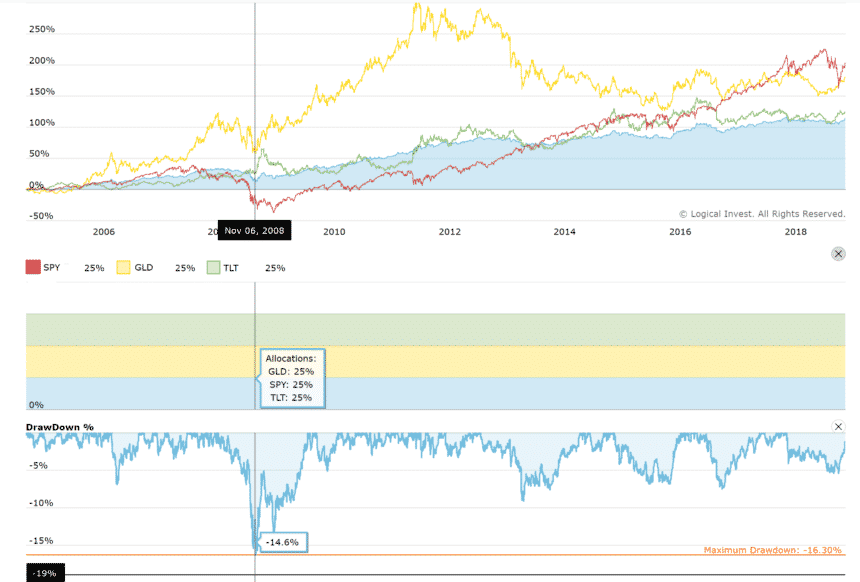

Going further back to 2005 we see that during the 2008 crisis the strategy suffered a bigger drawdown at -17 %. The compound average annual growth rate (CAGR) is 5.76%.

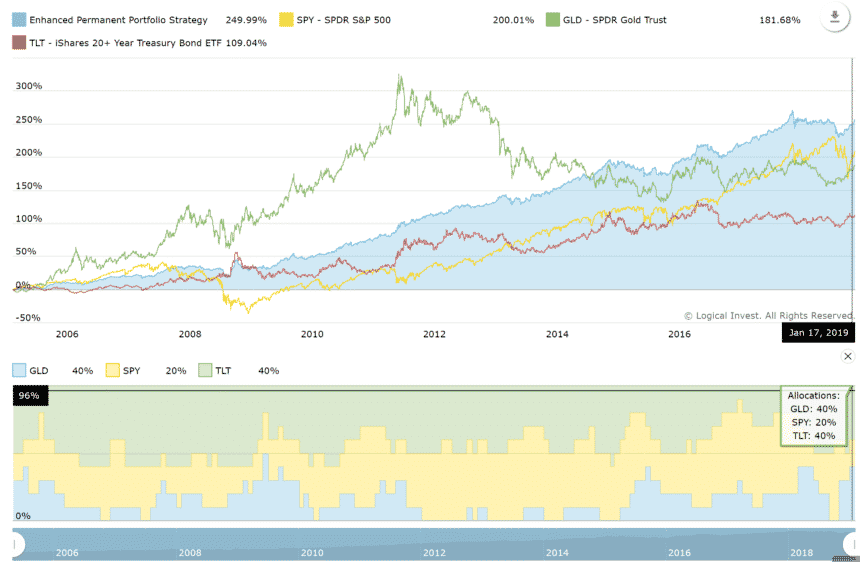

The above graph includes the 2008 crash, the S&P 500 bull market (2009 -2019), the Gold Bear market (2012-2016) and the start of rising interest rates (2016-2019).

The Permanent Portfolio re-balanced once a year

In this version we re-balance the portfolio every year and bring it back to the original allocations. If the value of Gold has risen and Treasury prices fell we could end up with a 35% GLD, 25% SPY and 15% TLT portfolio. At the turn of each year we rebalance back to 25% each.

The 2005-2019 backtest is slightly better with CAGR of 6.21% and a maximum drawdown of 14.4%. A viable strategy even for a taxable account.

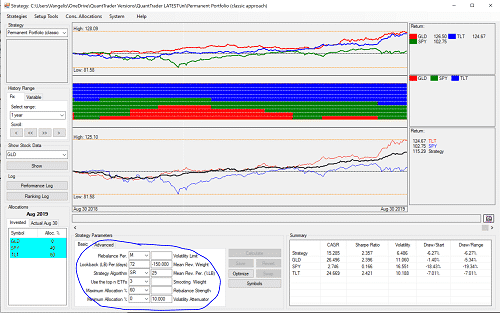

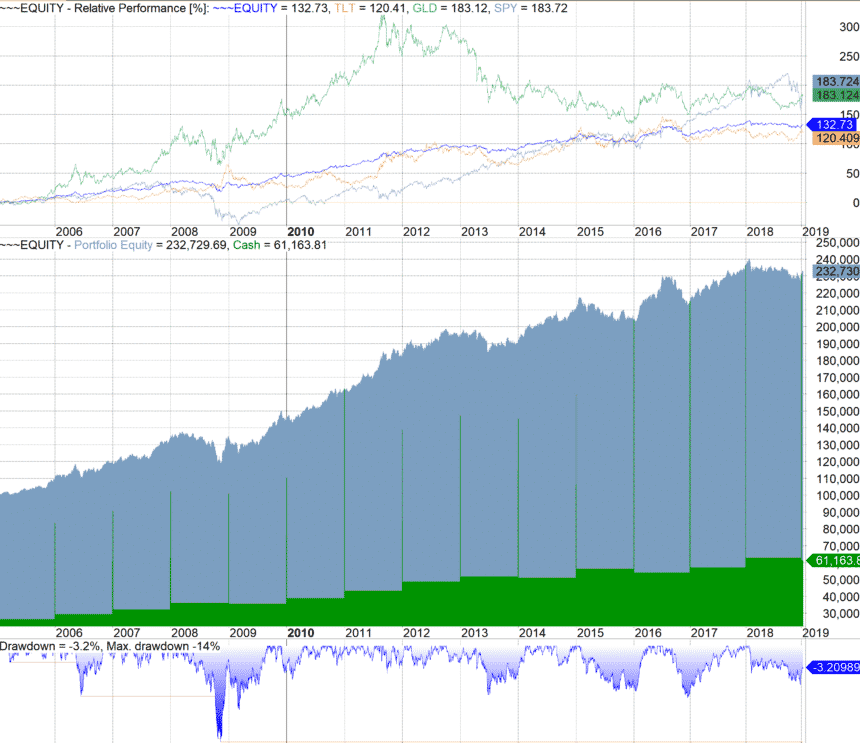

The Logical Invest Enhanced Permanent Portfolio (EPP)

We changed 2 things:

- Rebalance monthly

- Our algorithm determines the allocations to the three asset classes.

The algorithm considers recent history and how each asset class has performed. We use a combination of momentum, mean reversion and correlation to determine each month’s allocations.

On the bottom pane you can see the variable allocations across SPY, GLD and TLT.

The EPP backtest from 2005 to 2019 gives a CAGR of 9.6 and a drawdown of -13%. The enhancement comes with a cost to simplicity. The strategy rebalances monthly and is best suited for investors that self-direct 401k and IRA accounts.

Free access to the Enhanced Permanent Portfolio

You can find the Enhanced Permanent Portfolio and the above updated graph on our site. We provide free monthly strategy signals for the EPP as well as the U.S. Sector Rotation Strategy.

Do you provide any additional information how you combine momentum, mean reversion and correlation to determine allocations?

You can find the settings in our QuantTrader software under Permanent portfolio (classic approach)