We’ve received a couple of request in the last weeks whether it is possible to create a “Portfolio of Portfolios” in our Portfolio Builder. For example, to create a portfolio holding several of our Core Portfolios plus a custom portfolio in a fixed-weight or custom blend. Or to combine a one of the portfolios in the Portfolio Library with a single strategy or ETF.

Cases for this include:

- You like two of our preset portfolios and cannot decide which one to go for

- You estimate your risk/return preference to be between our Max 10% and Max 15% volatility portfolios

- You want to use one or several of the preconfigured portfolios but have an additional holding (Short-term bond, Cash, Gold, etc) in your account you want to reflect.

Of course this all is possible, it just works a bit different!

Here a quick guide using our Portfolio Builder:

All our portfolios are fixed weight blends of our strategies, that is, the allocation percentage to the strategies does not change over time. This in contrast to the strategies, where the allocations to the ETF does change over time. That means, you can simply create ONE portfolio with the weighted allocation percentages of the “sub-portfolios”, “strategies” or ETF you want to use.

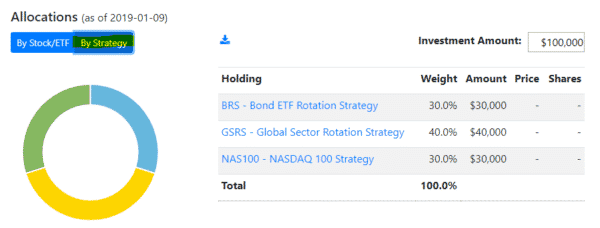

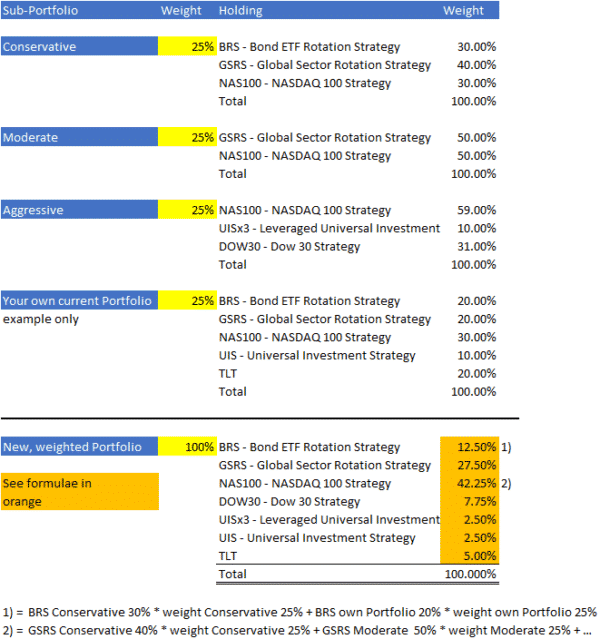

Let’s construct a rather complex example just to cover all possible cases: We want to allocate 25% each to our three Core Portfolios and to a previous saved custom portfolio, which in turn holds allocations to our Universal Investment Strategy and TLT – probably a bit overdone, but let’s use it. In Excel the fixed-weight allocations would look like this – note that you can select between “By Stock/ETF” and by Strategy” on the details page of each portfolio or strategy – here how these look for the Conservative portfolio:

Now with a bit of math in Excel we have to add up the weighted allocation of each of the future holdings at strategy level, plus our TLT holding. For example in the case of BRS we will calculate the product of the 25% holding of the Conservative portfolio times the BRS weighting of 30% and the 25% holding of the custom portfolio times the BRS weighting of 20%, that is: (25% * 30 + 25%*20%) = 12.5%, and the same for all other constituents of our new portfolio. In this Excel sheet you can see the formula of below screenshot.

So in this example, holding a portfolio of 12.5% BRS, 27.5% GSRS,42.25% Nasdaq 100, etc would be the same as investing 25% in each of the assumed portfolios, strategies and ETF.

Creating Portfolio of Portfolio in Portfolio Builder

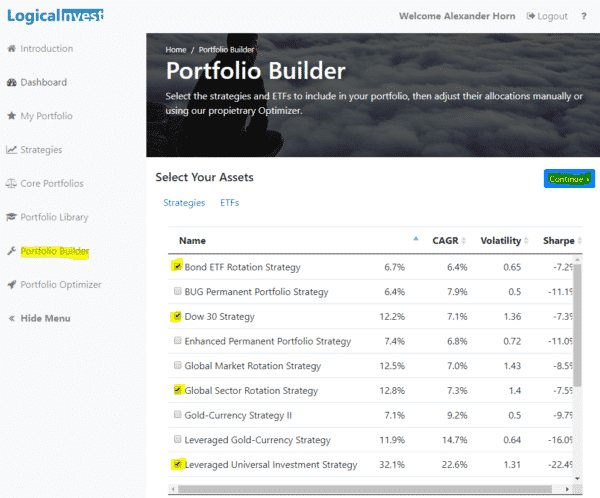

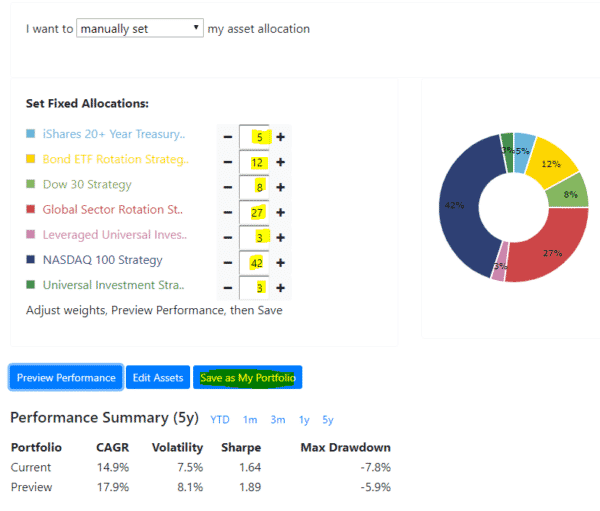

Now that we have the future weightings of our new portfolio, let’s create it using our Portfolio Builder: Select the involved assets in the first screen, click “I want to manually set my asset allocation”, adjust the weightings of each asset and click preview to see the performance statistics prior to saving your new portfolio. Please note we use full percentages, so you need to round the calculated ones as in below example:

1) Select involved assets in the Portfolio Builder

2) Adjust weights, preview and save

Et voilà, this is all that is needed to create your personal “Portfolio of Portfolios”. If you wonder whether this selection is statistically the best pick for your goal, you can further optimize it in the Portfolio Builder or Portfolio Optimizer – we leave this exercise for the next post.

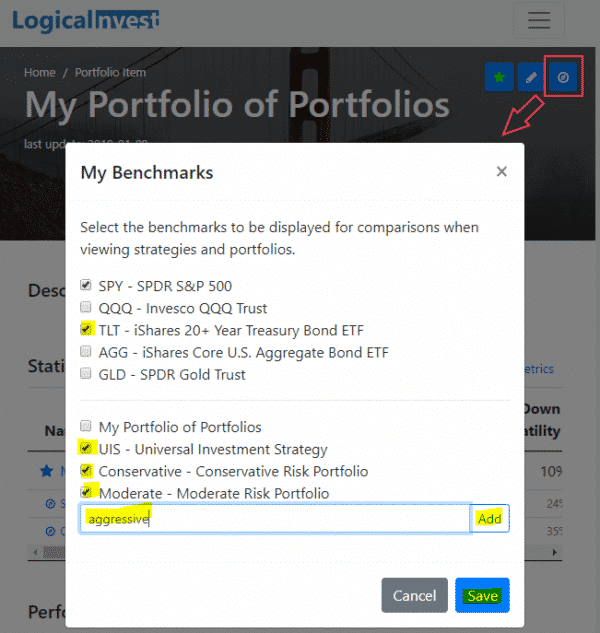

Adding Sub-Portfolios as Benchmark

To highlight the purpose and flexibility of the benchmarks you can customize on the dashboard and detail page of your portfolio: If you want to see the performance of you new portfolio compared to the underlying portfolio, you can add them as benchmarks like in the example below:

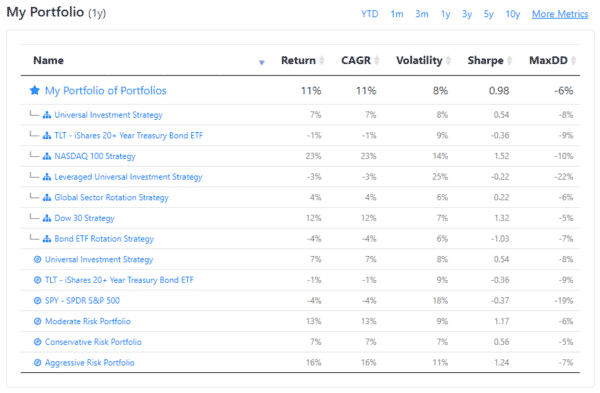

This is handy as it will show you a nice overview of your portfolio, the underlying assets, but also your benchmark portfolios ion the dashboard, the “my Portfolio” screen, and the performance report we send you by email each month. Here an example for the dashboard, again, probably yours will be leas complex.

Hope this gives a little insight into how to use our new Portfolio Builder to your own purpose, please let me know in the comments if you have further examples which might need a quick tutorial,

Best regards,

Alexander Horn

Very helpful, thank you!

The issue with this is that it will not get automatically updated as the asset mix within the underlying portfolios/strategies changes. Is that true?

Oh, yes, they do get updated.