Many investors are liquidating their portfolios with huge losses. They sell all asset classes from equity to Treasuries and gold. I will explain here a better strategy to cut losses.

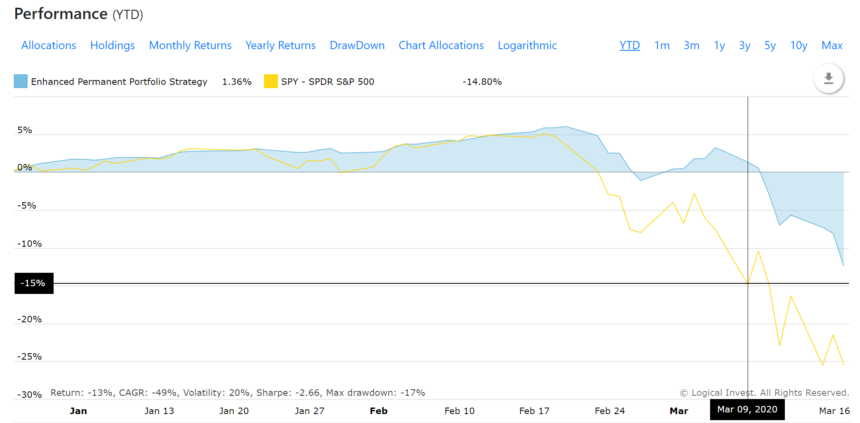

Below is a chart of our Logical Invest Permanent Portfolio Strategy which invests in the 3 main assets: equity (SP&500), Treasuries and gold. The strategy uses a variable allocation of Treasuries and gold to hedge against equity losses. As you can see in the below chart, this worked well during previous market corrections below 20%.

The next chart is a year-to-date view of the coronavirus market correction. Here you can also see that until the correction reached -15% the hedge worked well and the strategy still had a positive performance. This alone should tell every investor how important a hedge is. It gives you enough time to exit from your investments without big losses.

However, the correction went on and markets began to panic. Investors began to sell everything including safe havens gold and Treasuries to cover losses and respond to margin calls.

At this moment the strategy is down 12% and many investors are thinking of liquidating their positions and going to cash.

In fact, there is a better way to deal with losses due to the record-high market volatility of all these asset classes.

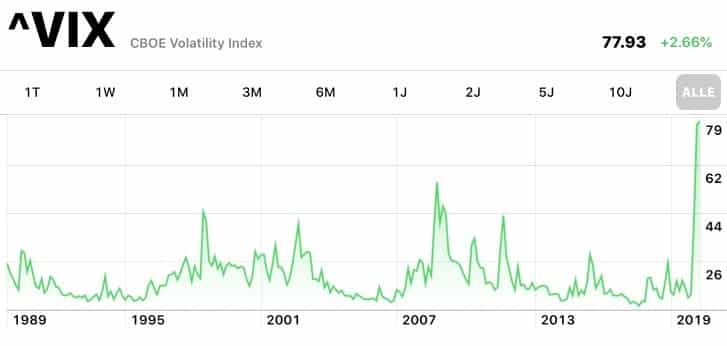

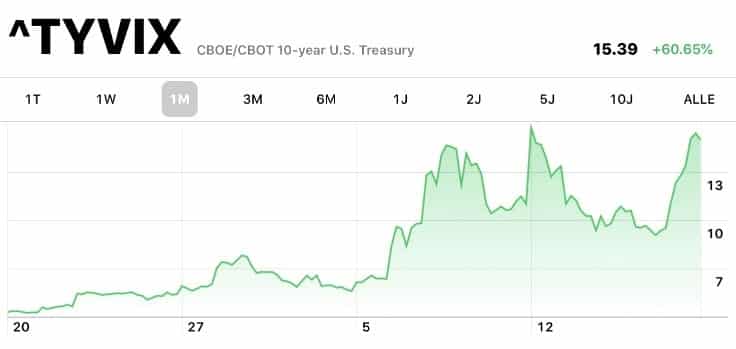

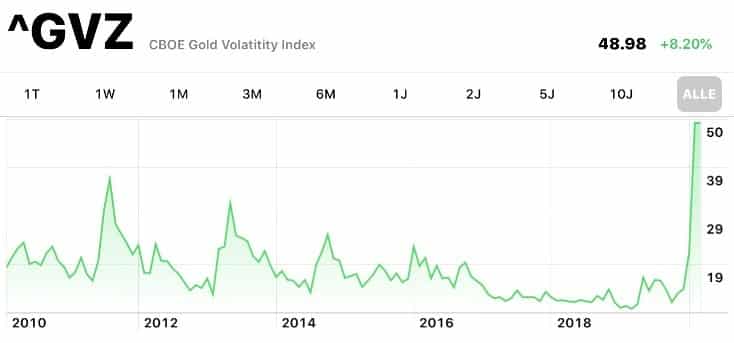

Here is an overview of the volatility of different asset classes:

SP&500 the volatility reached 86

10 year Treasury volatility reached 18

This record-high volatility also means that option premiums reached record levels. One way to protect your portfolio is to sell holdings in SPY, GLD and TLT and also sell far-out ATM (at the money) put options of these same assets. You can also keep SPY, GLD and TLT and sell ATM calls. 1 call per 100 shares. This would be a covered call and is the same as selling naked puts. Here is an example:

- You have $100,000 in SPY which is about 400 shares at a price of $240.

- Now you sell these SPY shares and also sell 4 SPY put options with a strike of $240. Remember that one option is for 100 shares.

- I would sell January 15, 2021 options which trade at a premium of about $40 which is nearly 17%!!!!

That’s all. Now you just wait until everything normalizes. The outcome scenarios are the following:

- If SPY goes up you will realize a maximum profit of 17%

- If SPY stays the same but volatility goes back to normal values, you will realize a profit of about 10% because of the volatility drop. Upon expiry you will get the whole 17%.

- If SPY is between $200 and $240 you will still make a profit. If the price on Jan 15, 2021 is at $220, which is 10% lower than now, you still make 9% profit.

- If SPY is below $200 on Jan 15, 2021, then you get back your 400 SPY shares for a price of $200 which means that your losses are 17% smaller than they would have been by just keeping your portfolio.

You can do the same for GLD and TLT ETFs. GLD premium is about $16 which equals about 12% and TLT premium is about 11%.

If you own the Permanent Portfolio strategy which is down about 12%, you may be able to cover all your current losses before January 15, 2021 if prices only go up a little from here. If prices go down further you can reinvest at about 11% to 17% lower prices than the current levels which should be a good place to start the next bull market.

Logical-Invest

Frank Grossmann

Note: Stock options involve risk and are not suitable for all investors, please see our terms.

Thank you for reminding that. Could the option premium be somehow utilized for monthly rebalancing strategies as well?

Eg. I am now holding a quite substantial portion of GLD hedge, which is not working well (as the selloff is present everywhere)? Or just sit, wait and hope?

Yes, instead of using ETF long positions you can also sell far out (> 9 Months) put options of SPY TLT and GLD. Best is to use Leap options which are normally the January options.

I personally would sell delta 25 options. A problem may be the spreads of these options. I personally sell these once and keep them for a long time. If I have to increase or decrease the allocation, then I would do this buying or selling the difference using ETFs or better Futures (ES, UB, GC). For Gold you can also use London Gold XAUUSD with the disadvantage that this will not neutralize GLD margin. Using such options you can increase the yearly profits of such strategies considerably.

Frank, quick request. Can you elaborate the monthly re-balancing with an example? I understood the part of selling puts instead of buying log positions; so for a position of 50% SPY and 50% TLT; you sell the equivalent puts in both SPY and TLT. If the next month allocation changes to 40% SPY and 60% TLT; how exactly do you rebalance?

Instead of adjusting the put position I would just sell some SPY ETFs or better ES Futures until you have the right exposure. You can also sell some liquid 45 day call options with a high delta and tight spread. This would also behave like a SPY short position. These far out LEAP options have relatively large spreads, so I would rebalance and/or roll only about every 3 month.

Dear Frank, thanks for your idea.

I ask your opinion about this variant about SPY:

instead of sell 1 year (or so on) ATM put options (IV 40%), what about to sell 1 month ATM options (IV 64%) and roll them every month ?

Same question, at this point, for the 1 week option selling (IV 83%)

Thanks and best regards.

Corrado

*IV = Implied Volatility

I would not do this because these shorter term options change delta very quickly, so if prices go up you will quickly go from delta 50 to 25 and if you then roll again to a delta 50 option and prices go down the same amount you end up at delta 75. The result is a loss because you had the bigger exposure going down. I did it myself and it never worked. Using long term options you normally don’t need to readjust your exposure too often.

Also at these huge volatilities you need to capture as much premium as possible which you can only do with longer term options.

Although this seems like a great idea in principle I’m not sure it’s a strategy that can be utilized by everyone. For instance my portfolio is in a self directed brokerage account that is linked to a 401K. This is not something I can do as any options trading, including covered calls, requires a marginable account. Also, I don’t believe you can “leg into” a “covered call”, by that I mean sell a call if you already own the stock. You must Buy the stock and sell the call in the same transaction so they are forever linked till expiry. This is really just a technicality as you’d sell your stock position to enter the covered call.

You may be right, also option selling is not something an absolute beginner should do, as there are just too many parameters (Greeks) which can change your initial allocation. So such option positions need to be observed constantly.

Guys, but why not using a small percentage of etn like VXZ or VXX to hedge portfolio together with GLD and treasuries?

Hedging with VXZ or VXX is very expensive. Look at the charts, they are only going down. In fact it is like hedging with put options. You pay a very high premium every month. Over the years you pay more for this insurance than you would have lost during the market corrections. We could never backtest a profitable strategy whit such a hedge.

I know it’s expensive, but even a tiny percentage, like 1% of portfolio that can increase (thanks to your algorithms) with the right conditions, should work well and hedge when nothing else can do it.

I don’t have your software, but it came to my mind and it’s just a nice idea to try, it would also be interesting if you make an article about it

I also found out that etfs like SCO or SOIL (used to short crude oil) act as a hedge against market corrections without the huge contango of instruments like VXX or VXZ