Invest in VIX volatility using ZIV

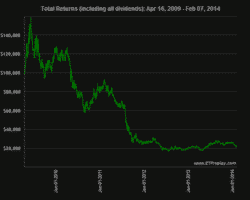

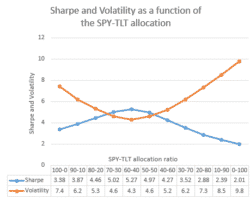

Update January 2017: The recent performance of investing in volatility can be seen here. You are probably wondering how we could achieve yearly performances of more than 50% with some of our rotation strategies. The reason is that the Maximum Yield Rotation Strategy and the Global Market Rotation Enhanced Strategy are investing in inverse volatility. Invest in inverse Volatility So, here are now some facts to show you why I like inverse volatility so much. … Read more