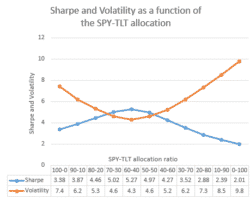

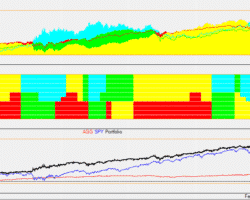

Diversification is a cornerstone to successful investing. In simple form, when measurably diverse assets are combined in a portfolio, the investors portfolio risks are reduced without any sacrifice of returns. This is a rare “free lunch”, it is well accepted part of modern financial portfolios, and to stay financially healthy it is important not to skip lunch. When one asset is going down while the other is going up, the portfolios risk is reduced without the normal penalty of risk/return trade-offs. We take advantage of that when our systems dynamically blend things like the S&P 500 and treasury bonds, which often exhibit negative correlation to each other (which is ideal).

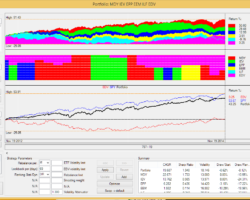

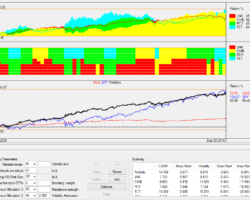

Applying Portfolio Diversification to Strategies: Our subscribers can take this take a step further. Our investing algorithms take on a blend of the properties of their underlying assets combined with the “alpha” edges from the investing rules. The returns of each investing strategy should be thought of as an asset, which are different and unique from the underlying holdings. So holding a portfolio of strategies functions much like holding a portfolio of assets. To evaluate the risk profile of the strategy, we examine the history of the returns of those strategies, much like when holding a basket of stocks the historical returns of each stock would be evaluated.