The TMV ETF should stay in place for quite some long time, and it´s a great investment to harvest time decay and avoid drawdown. The big tapering drawdowns of 2013 are past history. You don’t need to look daily at the TMV short hedge. Just keep it. The ETF TMV is a loser and if you stay short it will be a long term winner. It should return about 10-15% per year.

How to minimize a market drawdown using the TMV ETF

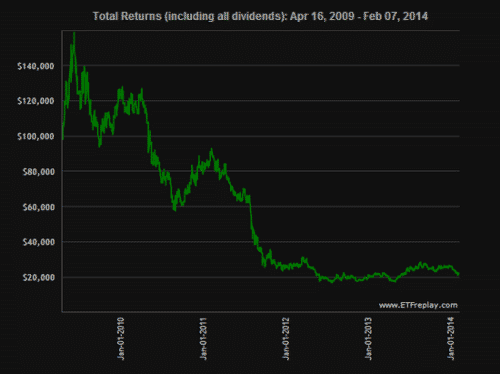

Here is a long term chart of the TMV ETF. As you see, it lost 80% of it’s value in the last 4 years. So being long TMV is one of the best way to destroy money – and this is why we short it. This to benefit from the time decay, but also to avoid market drawdown in times of market corrections.

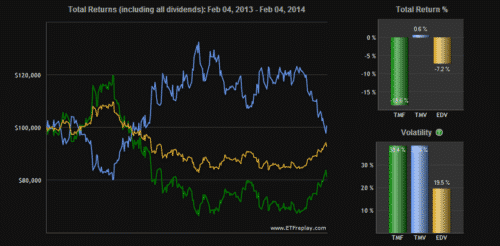

Here is a 12 month comparison with EDV and TMF. While all treasuries had quite big losses of about -7% in 2013, a short TMV position was flat over the year.

EDV -7.2%

TMF -18.2% (divide by 2 because TMF=+2x EDV) -9.1%

TMV 0.6% (divide by -2 because TMV=-2x EDV) = -0.3%

Since 2009 the average return of the ETF TMV short is nearly 20%.

With normal ETFs you only profit from Treasury yield (dividends). From this you have to substract mangagement fee and time decay of leveraged ETFs like TMF.

With the TMV ETF you profit from Treasury yield (dividends) and because you are short TMV you profit also from mangagement fee and time decay.

You can use this technique in several of our strategies. Instead of going long the TMF ETF you just short the same number of shares in TMV. Or instead of TLT just short 1/3 of the shares TMV, this considers the leverage factor in TMV.

In conclusion, this is a nice way to harvest the time decay of leveraged ETF and avoid market drawdown due to negative correlation with stocks.