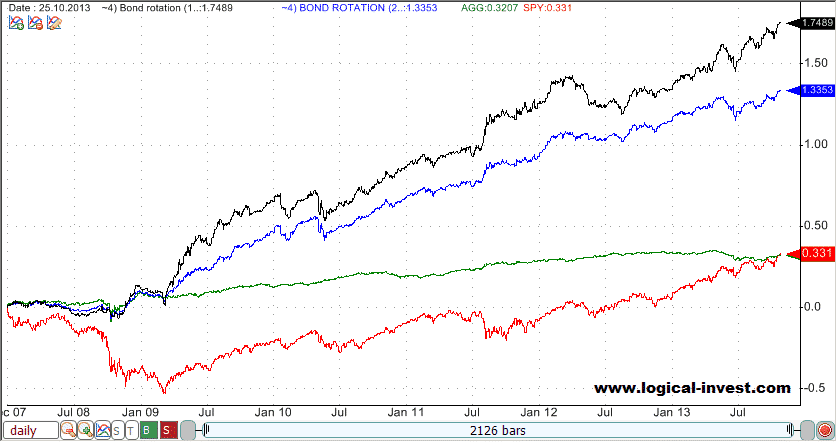

You can employ this strategy perfectly in your 401k investment, because it outperforms the stock market by more than double and this with one third of the volatility or risk. This means that since 2008, the return to risk ratio is about six times higher than an investment in the SPY ETF which tracks the S&P 500. Even this year, when many investors are selling bonds due to increasing yields through FED tapering, the bond rotation strategy has delivered positive double digit returns.

The Bond Rotation Strategy (BRS) – an ideal 401k investment

The BRS Strategy invests in the top one or top two ETFs out of a selection of five bond ETFs which is then rebalanced on a monthly basis. The backtested returns of the strategy since 2008 is very impressive compared to a traditional “buy and hold” strategy, thus making it ideal for any 401k investment. The data below refers to the returns for holding the top two ETFs in the strategy. The figures in brackets show the returns for holding the top ETF only. The top two ETF strategy has a slightly better return to risk ratio than the top one ETF strategy. So, for larger amounts of 401 investment money (> 100’000$), I would advise investing in the top two ETFs rather than simply holding one.

- Annual performance (CAGR) = 15.7% (19%) compared to S&P500=5.4%

- Total performance since 2008 = 133% (175%) compared to S&P500=33.1%

- Volatility (annualized) = 6.75% (9.45%) compared to S&P500=24.7%

- Return to Risk Ratio (Sharpe Ratio) = 1.79 or 1.68 compared to S&P500=0.25

- Alpha compared to AGG = 62%

Strategy performance 2008-2013

Black – Top one Bond Rotation Strategy

Blue – Top two Bond Rotation Strategy

Green – AGG iShares Core Total US Bond (4-5yr)

Red – SPY SPDR S&P 500

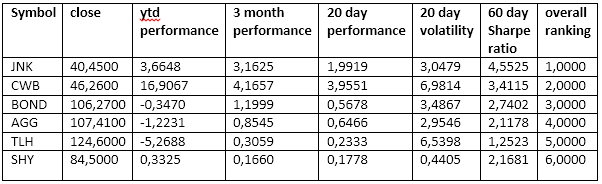

The Bond strategy ETFs are:

- AGG – iShares Core Total US Bond (4-5yr)

- BOND – PIMCO Total Return ETF

- CWB – SPDR Barclays Convertible Bond

- JNK – SPDR Barclays High-Yield Junk Bond (4-7yr)

- TLH> – iShares Barclays 10-Year Treasury (9-11yr) U.S. Treasury Bonds

- CASH or SHY – Barclays Low Duration Treasury (2-yr) U.S. Treasury Bonds

Why is it important to rotate the bonds rather than employing a “buy and hold” strategy in your 401k investment?

In May 2013, the U.S. Federal Reserve Chairman, Ben Bernanke, stated in a testimony before Congress that the Fed may taper its bond-buying program known as Quantitative Easing in the coming months. Most bond investors see investing in Treasury bonds as the safe or risk-free option, however, in 2013 long term US Treasuries like TLT have been down more than 12%.

This has caused many investors to worry about the future of bonds and many of them have sold their US bond positions due to low yields and falling prices, preferring instead to invest in the rising US stock market.

However, one big advantage of the bond market as opposed to stock markets is that there are lots of different categories of bonds with very different correlations.

At the current time, there is no reason to rotate out of bonds into the stock market in your 401k investment. Bonds are still a very safe and broad asset class to invest in with lower levels of volatility and higher levels of safety than investing in equities. I would advise everybody who is investing larger amounts of money to invest a portion in bonds. The amount would depend on an individual’s age and risk profile with a higher amount in bonds for older clients or those with a lower risk profile.

If you look back at the last 20 years, then you will see that there are always bond classes which have performed well in any market situation, especially during big financial crashes. The stock market is not as diversified. During the 2008 subprime mortgage crisis, almost all stocks went down globally, however, had you been invested in Treasury bonds, then you would have made very good profits.

But, it is crucial to choose the right bonds to invest in. Some bonds, like convertible bonds or high yield junk bonds, have a very high correlation to the stock market. At the moment, these bonds are rallying in tandem with the stock market, albeit with lower volatility. Some bonds, like US Treasuries, are “safe haven” investments and they are usually negatively correlated to the stock market. At the moment, with the US stock market rising, it is preferable to hold non-US government bonds such as junk bonds or convertible bonds.

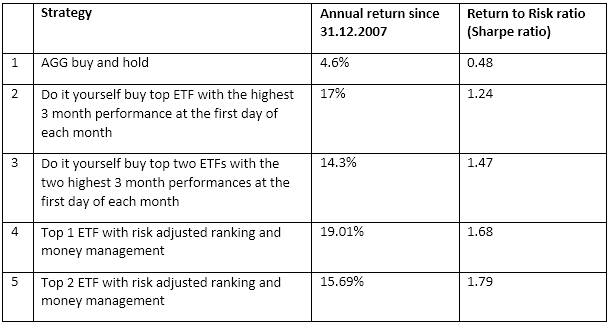

A “Buy and Hold” Bond Diversification Strategy Vs. the Bond Rotation Strategy in your 401k investment

If you hold a mix of all the various bond classes together in your 401k investment, you get a very low volatility bond ETF like the AGG iShares Total Aggregate US Bonds ETF. Unfortunately, mixing all these classes together will result in quite poor returns. The AGG ETF has had an average return of 4.5% per year since 2008. If you subtract inflation of around 2% and a decent interest for your invested capital, you are left with nearly zero return on your investment. I do not think it makes sense to use a “buy and hold” strategy such as buying an aggregate bond ETF like AGG, unless you are happy with a return on your investment of around 2.5% above inflation. It makes much more sense to use a bond rotation strategy.

It is a little bit like mixing all the world stock markets together. In that case, you would get the ACWI iShares All World Index ETF which returned on average 3.9% per year over the last 10 years. However, if you rotate between different world stock markets using various region specific ETFs with a solid system like the Global Market Rotation Strategy, then you can rack up yearly returns of up to 40%.

Many advisers call this diversification in your 401k investment, though the mixing together of stocks or bonds through a “buy and hold” strategy as sound financial planning, but I think it’s hogwash. If you really want to accrue good returns, then you must rotate or adapt your investments from time to time according to momentum and world economic cycles.

This bond rotation strategy is a simple one. You can do it yourself quite easily. Just look at the end of every month to see which of the above 5 bond ETFs had the highest return and invest in that ETF. Using this method would have made you an average of 17% per year.

Here is an overview of different bond rotation techniques:

As you can see, this simple do-it yourself rotation strategy has a three times better return to risk ratio than a “buy and hold” investment and requires only a minimum amount of work. In the table above, you can see that the return is not the only factor when deciding to employ a strategy. Keeping the risk low has equal importance to seeking a high annual performance. This is why I always judge a strategy by it’s return to risk ratio (the Sharpe ratio). Risk is calculated by looking at the volatility of a strategy. Low risk means low volatility or smaller rises and falls in ETF prices. You should be aiming for smaller rises and falls, as this will let you sleep well at night.

At logical-invest.com, we try to minimize risk in our rotation strategies by looking at the volatility of an ETF, so getting better return for your 401k investment. Higher volatility will reduce the ranking of an ETF.

A second concept, which I have introduced recently is active money management within an 401k investment. Without money management, you just reinvest all your capital at the beginning of each month in the top two ETFs. You can do this by investing 50% of your capital in each of the top two ETFs. This is strategy 3 in the table above.

Money management means, that you adjust your investment whilst taking current market and ETF volatility into consideration to lower risk. For example, on the last day of 2008, during the subprime crisis, the strategy would have invested 50% in cash, 17% in the TLH ETF (10-20yr US Treasuries) and 33% in the AGG ETF (US Total Bond Market). There was a higher investment in AGG to reflect the lower volatility or risk of as opposed to TLH. This type of money management allows you to reduce volatility and therefore the risk of the strategy by reducing the amount of money which is invested in turbulent market periods. It is clear, that if you are only 50% invested, you reduce volatility and risk by a factor of two.

At the moment, market volatility is low and the Bond Rotation Strategy is 100% invested with 50% in CWB Convertible Bonds and 50% in JNK Junk Bonds. No cash is held.

This is a sample of a monthly ETF ranking list (ranking as of Nov. 6, 2013)

The additional risk and money management gives us about 2% additional return with a lower risk. This probably does not seem high to you, but it means for example that instead of using your own money, you can run this strategy with CFDs (contracts for difference). CFDs are more or less the same as the corresponding ETFs, the only difference is, that you borrow the money from the bank. The borrowing rate is normally about 2% per year. So, 2% more return and a quite low risk strategy means, that you can run this strategy with CFDs for free, or that you can for example buy CDFs for 3x your available capital which allows you to leverage your investment. Your capital is then used just as security margin to cover losses and the borrowing interest is paid by the higher return of the strategy.

You write:

“Just look at the end of every month to see which of the above 5 bond ETFs had the highest return”

highest return over what time period??? (for ranking purposes).

3 month return

Hi, Frank:

I really enjoy your articles and investing strategies. Thank you for publishing your findings for the “small investor.”

I had a question regarding money management in the “Bond Rotation Strategy.” Can you please elaborate on the following statement in your paper:

“For example, on the last day of 2008, during the subprime crisis, the strategy would have invested 50% in cash, 17% in the TLH ETF (10-20yr US Treasuries) and 33% in the AGG ETF (US Total Bond Market). There was a higher investment in AGG to reflect the lower volatility or risk as opposed to TLH.”

My questions are:

1. How did you know to go to 50% cash?

2. How did you calculate the ratio of AGG + TLH (i.e., 17% AGG + 33% TLH)?

Any help on this topic would be greatly appreciated.

Thank you for your time and Happy New Year,

Jason

Frank please comment on Jasons questions.

Peter,

the statement on the ‘active money management’ refers to the equal volatility mechanism, so when one of the ETF was above a certain volatility threshold its position was scaled down and the strategy partially in cash (50% in the example). The allocation into the other ETF is the result of the scaled down remaining allocations, e.g. 17% AGG + 33% TLH.

Keep in mind that this has now evolved into what we consider now a real “adaptive allocation”, where the strategy does not switch “binary” between the ETF, but gradually changes the allocations; so this now incorporates the prior volatility control.

See here for a more detailed explanation of how they work.

Frank,

I assume your performance of the BRS includes dividend distributions. However if I’ve is rotating into a new fund at the beginning of the month, how is the dividend captured if the ex date is also the same day you rotate? Seems to me you would have to hold a first of the month investment with the same ex date thru the first week of the following month to properly capture the dividend. Please explain how this nuance is accounted for in your performance tracking. Thanks

We use dividend adjusted prices for the BRS strategy calculation. Normally bond ETFs anticipate the dividend payment, so that you don’t have to wait until the dividend payment date. If it would not be like this, then you could do easy money by buying the bond ETF one day before dividend payment, cash in the dividend and sell the ETF a day later.