If you are a European investor and using Interactive Brokers (U.K.) as your broker you were in for a surprise this past week: Most major U.S. ETFs like SPY, TLT, GLD are unavailable for trading to retail traders.

From justETF: “The culprit is PRIIPs – a set of EU investment regulations designed to protect consumers (PRIIPs stands for Packaged Retail Investment and Insurance Products).

PRIIPs require fund providers (including ETFs) to produce a Key Information Document (KID) that enables investors to compare the risks, rewards and costs of different investment products.

European-domiciled UCITS ETFs were ready with their new KIDs when PRIIPs came into force alongside the MiFID II rules at the beginning of 2018. However US-domiciled ETFs did not comply and, as they mostly serve the US market, producing EU-approved information at their own cost is not a priority.”

We hope that this is a temporary problem and that a solution will be found. Until then we are looking at CFD’s as an alternative for Europeans traders using LI strategies. Contracts Of Difference are available at IB U.K. for most major U.S. ETFs. The spreads and commissions are at par with the ETFs themselves ($0.01 spread, $0.05 commission) so they seem like a viable choice although there is a financing charge (current USD rate +1.5%) for holding positions overnight.

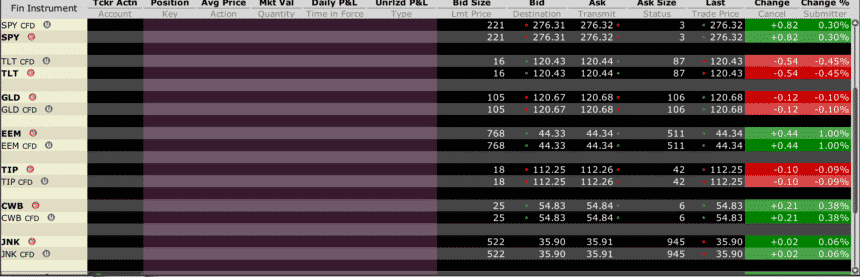

Here is a snapshot of some major ETFs and their respective CFDs:

You can read more about CFD’s here:

https://www.interactivebrokers.com/en/index.php?f=1170

If you have any comments or feedback please post them at the forums: https://logical-invest.com/forums/topic/european-markets/

It was a real negative surprise i immediately contacted the customer service which are very helpful at IB to find out what the problem is. I hope there is a solution soon it concerns almost any ETF like MBS ETF`s which i used a lot and are very important for any of my strategies and for most other investors too.

Were you contacted by IB? I’m also using this broker, and I’m from UE, but I have no information that I cannot trade ETFs

OK. I can see it now. Big problem for me now…

I have looked into this. The following is what I know so far. None of this is investment advice, and I do not accept any responsibility or liability for the following.

This will not go away anytime soon. European retail investors just cannot legally trade ETFs and other derivatives that have not provided KIDs (Key Information Documents, a three-page summary of features) as required by the PRIIPs regulation. Most US ETF issuers will probably not provide these ever. So trading these ETFs or ETNs will not go back to normal. For now, IB lets you only close positions that you already had before they flipped the switch on these ETFs. I see three possible solutions (full disclosure: none of which I have been able to fully validate or even implement yet):

1. An upgrade to “professional client” status under MiFID II. The PRIIPs regulation does not apply to those. That requires meeting two of three criteria (an account in excess of EUR500,000, at least 10 PRIIPs transactions in each of the last four quarters or proven professional capital market expertise). IB has indicated they might offer this to eligible clients, and I have requested this status change, but I have not had a final response yet. This will be by far the easiest and best solution, but it will only be available to larger traders.

2. Establishing an offshore trading vehicle, like a small hedge fund. That should, according to an IB sales person, work, but it requires expensive structuring (setting up a Cayman trading entity will cost between US$3000 and 10000, plus additional annual maintenance costs, depending on the structure you choose and the provider you use). Also, you need to be very careful to find the right structure to avoid additional taxation. I have not had a final confirmation on this from IB, either. If this works, it will in theory be available to all traders, but will only make financial sense for fairly large accounts.

3. Emulating ETFs with other derivatives, such as CFDs (where available) as suggested by LI, or alternatively futures or options (for instance, I can trade SPY futures and options, but not SPY itself on IB). I have done a test: I could indirectly buy 100 SHY, which is also blocked, by buying an ITM call and exercising, but I cannot sell SHY directly now. Will probably have to buy an ITM put and exercise to get rid of it. This works now, and for all traders, but it may have fairly high costs. Options, CFDs or futures are not always available and option spreads for many ETF options are fairly high.

So I guess LI should explore using ETFs that have a KID and/or model the additional cost of using ETFs in their strategies, as that will likely be the fix for most subscribers going forward.

Thank you for all the detailed info Johannes!

I now have confirmation that IB will upgrade eligible customers to professional client status if they so request. So alternative 1 works.

Is it already available (upgrade to professional status)?

Yes, at least I got that upgrade.

Great to hear that. Could you elaborate a bit about the process? Have you applied via support?

Just write an IB ticket requesting the upgrade. They will then send you a form which you fill out and return. Then they decide (criteria are as in my first post sub. 1). All can be done by Email. I had the account size as well as the transaction number with IB, so there was no issue with evidence. I don’t know what happens if you have used another broker.

Thanks a lot, please keep us updated on this!

Actually I am very surprised that this move did not cause more significant churn among European retail investors. To the best of my knowledge either buy-and-hold or rule based ETF investing, mainly in the diverse and cheap US ETF universe, is the most viable and popular investment strategy for this segment. If that is all gone why aren`t all the forums full of people looking for workarounds?

Hi all, CFD financing is with IB much more expensive than 1.5%. Just talked to IB assistance, the reference table is here:

https://www.interactivebrokers.com/en/index.php?f=1595&p=cfds1

1.5% is the reference benchmark and it’s not relevant, for USD quoted CFDs the cost starts at 3.432%. Very bad and not sustainable for many LI strategies like Bond Rotation to which i’m subscribed. Rotation day is coming, with no alternative solution i’ll be forced to stay on the sideline, hoping LI guys could at least give payment exemption of any form.

Anybody else has any viable workaround for Bond Strategy with 50K capital allocation?

Text from IB chat support is following (“*******319” being me and “Farhan S” the IB representative):

*******319: can you show me the link were the financial costs are explained?

Farhan S: Sure, absolutely

http://www.interactivebrokers.com/en/index.php?f=1595&p=cfds1

*******319: i’m confused by the second line in the table, were there is (BM +/- 1.5%). To what is referred to

(BM +/- 1.5%)?

Farhan S: that’s a benchmark – it’s irrelevant in this instance

*******319: ok, so in trading CFDs that are tracking US based ETFs i will be charged 3.428% accordingly to

the table and based on the volumes?

Farhan S: Correct

IB Share CFD’s

Thanks Fabio for contributing this information. You are right many strategies are not viable at these rates in the long run. I was hoping to use CFDs these as a temporary solution until some solution is given by the brokers or ETFs issuers.

I now have confirmation that IB will upgrade eligible customers to professional client status if they so request. So alternative 1 works.

Johannes, Thanks for the excellent information.

After many years of faultless use of IB I have had some other issues since they disabled the US ETF’s. They also cut out one of my accounts from CFD’s which made life a bit miserable last week.

I have raised a ticket to change to Prof status as I meet the criteria but I have not seen any action yet. Did you manage to do the status change over the phone or just via raising a ticket?

For those who cannot obtain prof status in IB, I also trade via Tradestation, been using them even longer, since 1996, and here I have had no issues and have access to all ETF’s despite the fact I maintain only “accredited Investor” status. Only issue vs. IB is that their transaction fee is a little higher and you need to segregate equity from derivative accounts. Also I cannot fund equity account via sepa transfer in Euro only via USD wire and so incur charges. The derivative account I can fund in EU via Euro sepa.

Just the ticket. It took a few days. The service representative needed to deal with another IB department. I do not know further internals.

Hi all,

Just tried to undertake the monthly rotation and I ran into the same inability to purchase US ETFs with Interactive Brokers UK.

For those unable to convert their accounts into Professional Status (and the impracticability of operating CFDs) perhaps we need to find EU or UK based alternative ETFs until the situation (hopefully) changes.

For example, instead of SPY, one could use ‘VUSA’ which is a Vanguard SP500 index fund quoted in GBP.

Unfortunately, this is where my ideas finish as there are no similar leveraged ETFs domiciled in the EU.

This leads me to think that it may be helpful for LI to consider developing some strategies based on EU-only available ETFs.

For US Treasury Bonds there is the iShares $ Treasury Bond 20+yr UCITS ETF USD which is quoted on the London Stock Exchange.

I found this via: http://www.morningstar.co.uk/uk/etfs/ and looked for the broad ETF type I wanted (e.g. Fixed Income ETFs) and then within the categoey I wanted, searched for EU-domiciled or traded instruments having US underlying assets similar to those contained within the LI portfolios.

For people interested to use Xetra Frankfurt listed ETF this is also helpful: http://www.xetra.com/blob/1193366/4871305f6013a06db7de3bb5b952d79e/data/etfs-etcs-etns-all-tradable-instruments.xls

More here: http://www.xetra.com/xetra-en/instruments/etf-exchange-traded-funds/list-of-tradable-etfs

It´s quite handy for translating US ETF to EU ones, as it references all needed masterdata, especially the Xetra symbol + .DE is mostly Yahoo symbol, the underlying index is easy to filter. Using the accumulating ETF there is no need to find dividend adjusted data.

Hi all,

I have found the following useful links to help find EU-domiciled ETFs that could be used as substitutes for US ETFs which are no longer available to EU-retail investors (due to PRIIPS legislation), in order of personal preference:

• http://tools.morningstar.co.uk/uk/etfscreener/default.aspx

Morninstar lists all ETFs by Exchange (i.e. whole universe); so sorting on the London Stock Exchange, I found the following ETFs which may be helpful:

o Boost NASDAQ 100® 3x Leverage Daily ETP

o Boost S&P 500 3x Leverage Daily ETP

o Various shares (e.g. Apple) with 2x leverage

I could not find any EU-traded ETFs similar to TMF.

• http://www.justetf.com/uk/find-etf.html

JustETF lists only EU-domiciled ETFs (rather than whole of universe). The screener includes domicile, short & leveraged ETFs.

I found the following ETFs which might be helpful in seeking alternatives to US domiciled versions:

o Xtrackers S&P 500 2x Leveraged Daily UCITS ETF 1C

o iShares USD TIPS UCITS ETF USD (Acc)

• http://etfdb.com/screener/

The screener appears to cover the whole universe of ETFs however options do not include ETF domicile, or Exchange listing and given this, ETFdb is not as useful as Morningstar or JustETF.

• http://www.etf.com/etfanalytics/etf-finder

Similar result to ETFdb – screener does not include ETF domicile or Exchange listing.

• https://www.etfchannel.com/finder/

Similar result to ETFdb – screener does not include ETF domicile or Exchange listing.

Hi, another option for us from EU is to create account with US broker.

@martin.unzeitig is it legally allowed to open an account with a US broker if you live in Germany?

I am not sure, I opened one from Czech Republic with no issues so far. I provided all informations the broker requested and they didn’t have any problem with me.

@martin.unzeitig can you please, tell us the name of the US broker where you opened the account?