The ECB’s latest interest raise ends an 8-year period of European negative rates and signals the final chapter of the zero interest rate era. On the other side of the Atlantic, the FED sees a 3.8% rate by the end of 2023.

Seasoned investors may see this as a return to more normal times, before the global financial crisis in 2008, when one could expect a 4% interest on their savings. But many analysts point to a possible stagflation regime, a period of high inflation coupled with stagnant demand experienced in the late 1970s, early 1980s.

Recession coming?

This new interest rate regime combined with U.S. inflation and the energy crisis that is sweeping the E.U. could cause both economies to walk into a recession. Especially in Europe, the outlook is bleak with E.U. as well as the U.K. governments preparing their citizens for a difficult winter, with high energy bills and possible power outages.

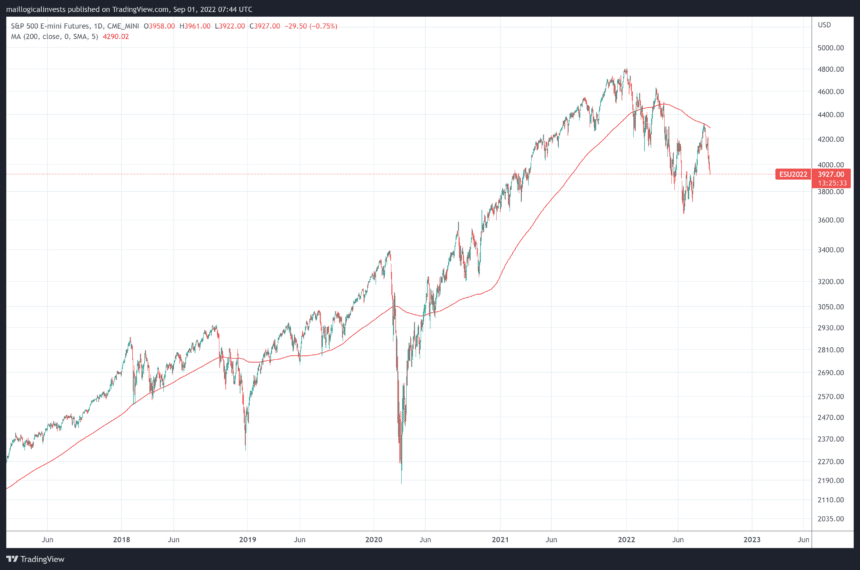

Technicals: The SP500 below the 200 day MA

Although the S&P500 recovered and had an impressive 18% rally from the mid-June low it failed to trade over it’s 200 day moving average, briefly touching it before collapsing again. As you can see above the chart doesn’t look too promising although a relief rally is possible.

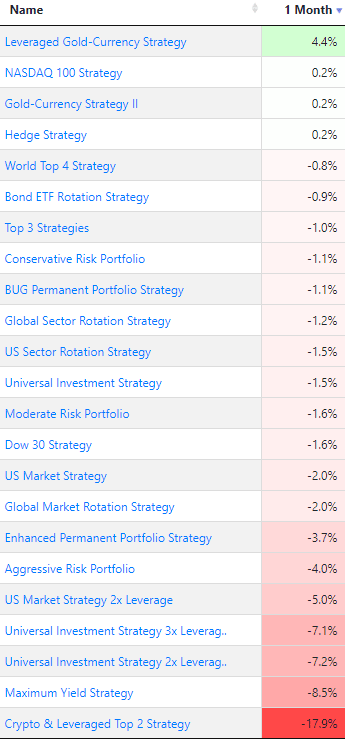

Performances

Let us know what you think in our forum.

The Logical-Invest team.