The S&P 500 moves higher

August was positive for the U.S. equity market (SPY +7%) and very negative for long term Treasuries (TLT -5%) as yields were hit by the FED’s decision to pursue a ‘flexible’ 2% inflation target. Gold remained flat (GLD -0.3%), just below it’s all time highs.

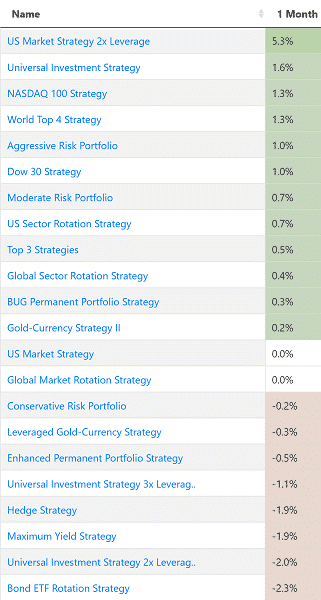

Our strategies were split around zero some posting moderate gains and some moderate losses.

The under performance of most strategies vs the SP500 is due to our hedge having some exposure to TLT and GSY (money market fund). This is an unavoidable side-effect of holding a hedged portfolio during extreme bullish moves.

Hedged strategies: Lower volatility can eventually outperform

Our philosophy at Logical Invest is to create diversified portfolios and to contain risk to acceptable levels.

When a portfolio losses 15% in a bear market it needs to rise by 17.6% to recoup.

When a portfolio looses 30%, it needs 43% to recoup.

When it loses 50%, it needs to go up by 100% just to break even.

This asymmetry has a profound effect in long term compound gains and is the reason why more conservative strategies can eventually outperform more aggressive strategies.

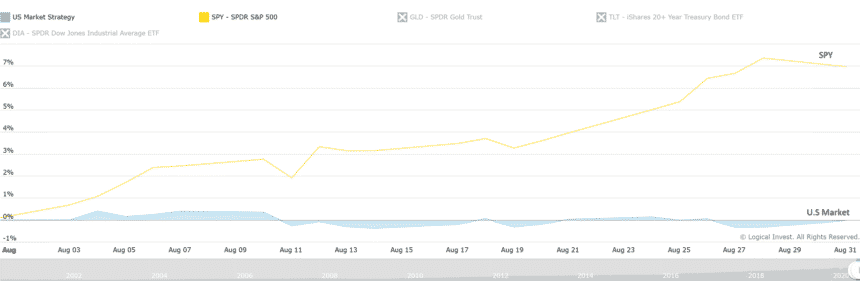

As a concrete example, let’s look at the SPY vs our U.S. Market strategy. As we mentioned the SP500 gained+7% this month. Since the U.S. Market strategy holds a hedge (either bonds or gold or both), it is bound to return less. For this particular month it was 0%.

Below is SPY (green line) vs the strategy (blue area) for August 2020.

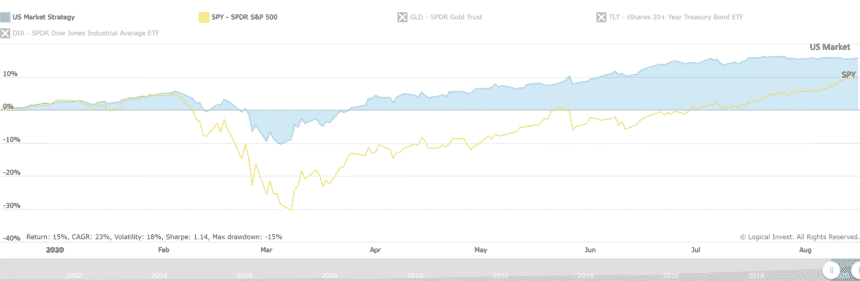

But if we go back and include the March market correction, we see a different picture. The following chart is year-to-date:

The U.S. Market strategy, although much less volatile ends up outperforming the SP500, mainly due to being less severly hit by the March crash. This has 2 advantages:

a. It is easier to stay in the market when you loose 15-20% than it is when you see your life savings down by 30+% and all the financial media (and possibly wife, kids and pets) screaming at you to get out!

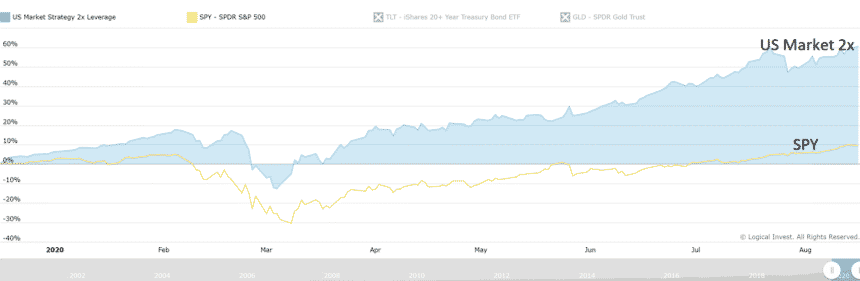

b. if you are a ‘pro’, you can leverage the strategy, target the SP500 volatility but get much higher returns for the same risk. The 2x Leveraged U.S. Market strategy (below) does that by using leveraged ETFs.

Although the above returns looks attractive, please note that our leveraged strategies should be used with care. They should only be used as a small part of a larger portfolio and with funds that you can afford to put at risk. You can find the U.S. Market strategy here.

Core Portfolio Update

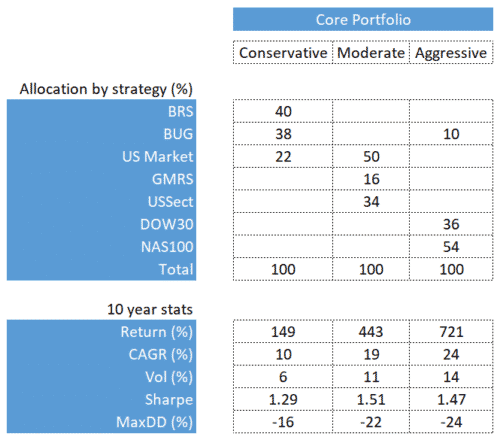

We received some negative feedback about the use of leveraged strategies in the Core Portfolios. We’ve therefore once again eliminated any leveraged strategy or ETF from these, and also skip single-stock strategies like DOW30 and NAS 100 from the Conservative and Moderate Core Portfolio. For performance purposes we maintain DOW30 and NAS 100 in the Aggressive Core Portfolio. See below the new composition and metrics:

Please recall that the default portfolios are thought as a starting point for building your own personalized portfolio. You can do so by clicking on the “pencil” icon on any portfolio detail view (example Aggressive Portfolio), or by using our Portfolio Builder or Portfolio Optimizer.

Please join the forum and discuss the recent changes in the markets, our portfolios and LI strategies.

The Logical-Invest team.

As requested by some subscribers, here a quick post & videos with three ways to return to the august versions, or even better:

Your own custom portfolio: https://logical-invest.com/creating-a-custom-portfolio/

The allocations of the previous portfolio versions at the strategy level:

Conservative:

BUG: 24

NAS100: 40

DOW30: 36

Moderate:

NAS100: 50

USMarket: 10

DOW30: 40

Aggressive:

NAS100: 55

UISx3: 15

DOW30: 30