Fear of a coming recession?

And yet this is the perfect environment for a Logical Invest strategy.

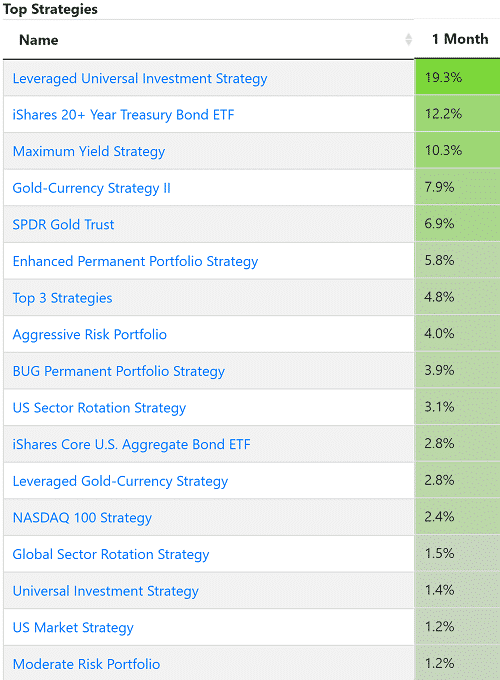

Our top performers for the month were the Leveraged Universal Investment Strategy (+19.9%) and the Maximum Yield strategy(+ 10.3%). Even our free Enhanced Permanent Portfolio returned 5% in August. Why? The answer is in the “safe-haven” assets: Bonds and Gold. Just this month, TLT is up by 11%, GLD by 8% while the SP500 lost -3%.

Our strategies use safe haven assets as hedges to dampen possible corrections. In difficult times they can increase allocation to these assets and not only dampen crashes but also increase long terms returns.

Inverted Curve = Recession?

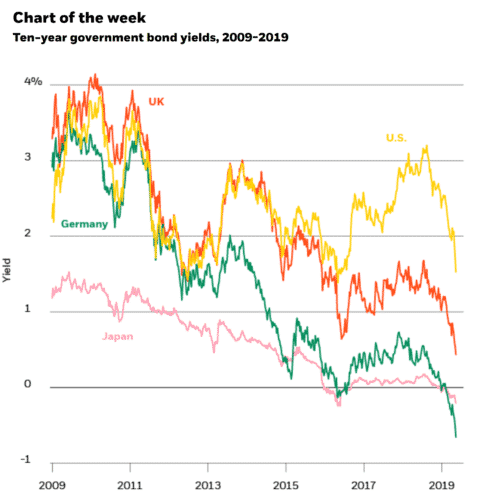

Looking at the financial media this past few weeks there is widespread talk of a coming recession due to the Treasury yield curve inversion. We have discussed this in the past (here and here) and there is evidence that an inverted curve may lead to a recession, although not immediately.

Maybe we should be asking a different question: Why would the FED cut rates after 10 years of not doing so? The SP500 is close to multi-year highs, the economy is doing well and unemployment has not been this low in decades lows? Cutting rates, we have been told, boosts the economy. It makes sense to do so during the 2008 massacre but does it makes sense now?

The answer may be that the Fed is forced into it in order to halt the rise of the U.S. dollar. Many foreign developed central banks keep rates close to or below zero. This creates a continuing flow of funds out of euros, Swiss francs, yen and other currencies looking for a 2% yield on the dollar. By cutting rates and allowing the possibility of further cuts, the Fed may be trying to line itself with the other central banks. An increasingly strong dollar can be harmful to the economy as it is a self-imposed tariff on U.S. goods and services abroad.

Another explanation is that the Fed is following rather than leading market forces. Continued demand for Treasuries pushes long yields down. This causes an inversion of the curve as the right side falls below the left. The Fed, to keep the curve from inverting cuts short rates; lowering the left side.

It will be interesting to see what will happen if the Fed keeps cutting rates and tries to weaken the dollar. This will have implications on many asset classes including equities, gold and other commodities.

Keep in mind that near-zero rates create a problem for pension funds that often assume a much higher market yield if they are to keep their promises. So if the chosen path is for long term low rates the question is how do you solve the pension problem?

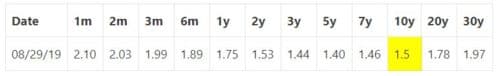

Here’s the updated inverted yield curve.

Receive our Enhanced Permanent Portfolio (+5.8%) allocations, every month right in your mailbox, for free. Just sign in, visit the EPP page and click “Customise as my portfolio”.

We look forward to a vivid discussion. Visit our site for daily updated dashboard.