We are navigating through an unknown economic environment. Central banks are experimenting with controlling inflation versus causing recessions. Economists are trying to compare todays macro trends to those of the late 60’s, early 70’s. Truth is they don’t know the outcome as today’s labor markets are very different from the past.

As the powers-to-be play out this experiment, the safety of our funds should be our priority. Be defensive. Have a plan.

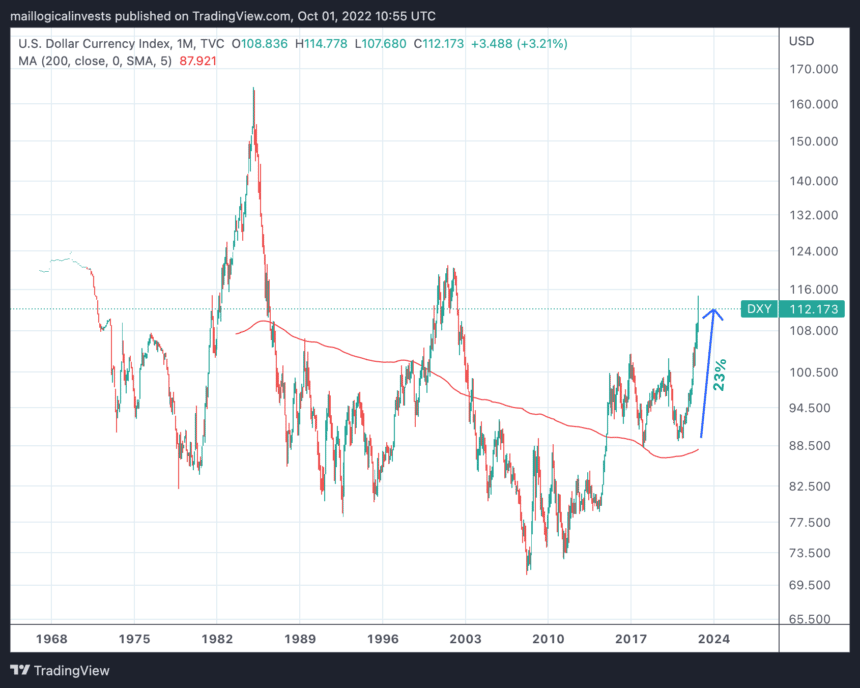

Dollar up everything else down

The USD index is up 17.6% year-to-date. That is quite a large change. It also part of the reason why gold and commodity prices are falling as they are priced in USD. The question becomes how high can the USD index go. If we were to enter a longer recession, this level could persist.

As you can see from the chart this only happened in the 1980’s.

When the USD rises substantially, equity/bond/gold correlations fail and all asset prices fall in tandem.

Treasuries

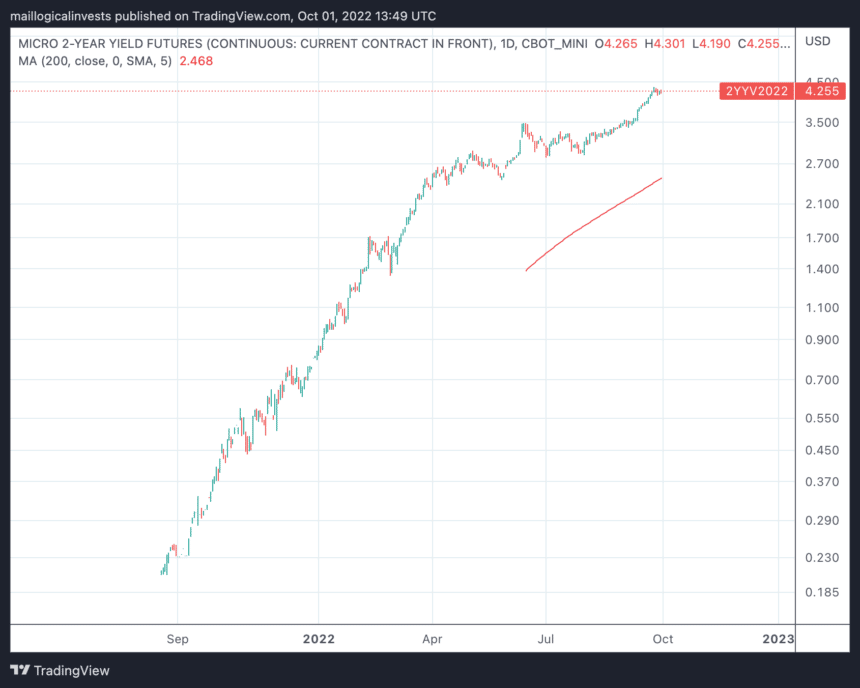

Just a few months ago, it was inconceivable to receive 4% interest, risk-free via a one or two-year Treasury. Below is a chart of the 2 year Treasury yield. At the beginning of the year it was at 0.8%. It is now at 4.2%, a 400% rise.

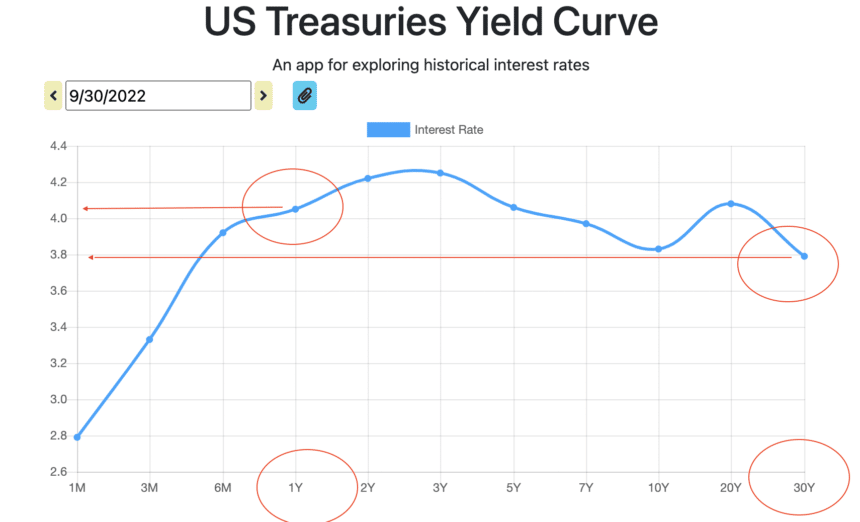

The long dated Treasuries has been slower to rise. The yield curve has once again inverted, with 1 and 2 year Treasuries yielding more than the 30 year one, currently at 3.8%.

The inversion, coupled with the current high yield for a short term paper, could signify further equity weakness as money can be parked for 1 year at a 4% interest.

The S&P500

The Fed’s last two bold hikes of 0.75% each shows that it has prioritized fighting inflation over crashing the market. And hence the SP500 lost 9% just this month and sits at -23% year to date. As we mentioned in the last newsletter, a recession is expected at leat in Europe as consumers and businesses face much higher energy costs. This may have been priced in to a certain degree in the equity prices but it could possibly get worse. This coupled with recent developments in Italy, Russia and Iran could cause further pain.

As we mentioned in the past, a possible scenario is that the Fed will overshoot both ways. It maybe overacting to inflation fears by raising rates aggressively. This could cause markets to fall and slow down inflation (given that the labor market does not follow the inflationary pressures). Once the Fed sees that it has slowed down inflation it may try to recover the markets by easing a bit and so on and so forth.

Performances

Let us know what you think in our forum.

The Logical-Invest team.