Geopolitical risk raises gold

The unprecedented attack on Israel on October 7th and its subsequent response have heightened geopolitical tensions in the Middle East. This conflict is drawing in the U.S., as well as regional actors like Iran, Egypt and Turkey, raising the risk of a wider war that could destabilize the global economy.

In this context, gold has found its purpose as a safe-haven asset, rising 7.4% in October and threatening to breach the $2,000 price resistance for the fourth time since August 2020. It’s arguable whether surpassing this high mark could lead to a longer-term bull market for the yellow metal.

Strategies

While the SPY was down by -2.2%, some of our riskier strategies showed positive performance, starting with our Crypto & Leveraged Top 2 Strategy at +16.9%, followed by Universal Investment Strategy 3x Leveraged at +8.3%, and Maximum Yield Strategy at +7%.

The Crypto strategy benefited from a surge in Bitcoin’s price, fueled by expectations of an imminent approval for a spot Bitcoin ETF. The other strategies gained from their embedded hedge in gold. Notably, the UISx3 strategy maintained a leveraged 120% position in gold throughout October.

Longer term FED rates at 5%, ECB at 4%

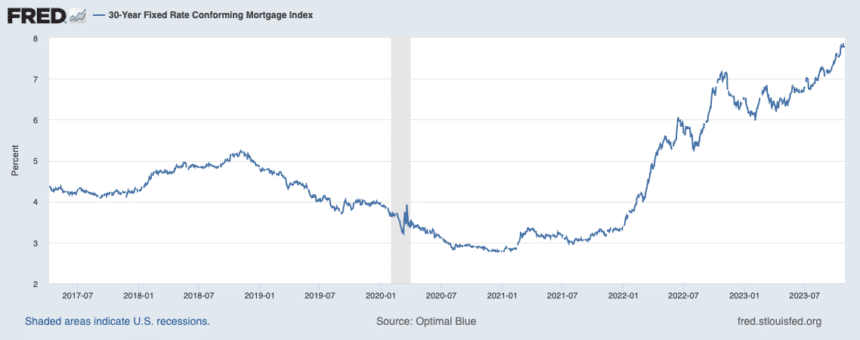

Long-term Treasuries continue to inch above the 5% mark, while the European Central Bank (ECB) has also attained a 4% rate. As indicated below, mortgage rates in the U.S. are on the rise, a trend that could further impact housing prices.

Seasonality

One should not overlook the “Santa Claus rally,” which historically suggests that the next two months are the most favorable for investing. While there have been exceptions, such as in 2008, it’s a factor worth considering, especially given the increasingly uncertain backdrop.

Conclusion

It’s prudent to keep a close eye on gold and to remain invested, in anticipation of a possible upside correction in the S&P 500.

Let us know what you think in our forum.

The Logical-Invest team.