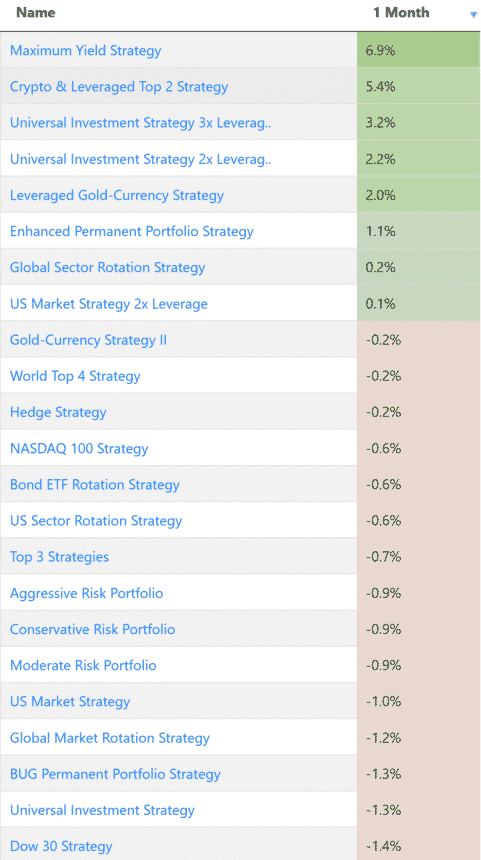

Strategy Performance – Protecting capital

All of our strategies protected capital, with positive gains or small losses (mostly less than -1%). The S&P fell -3% for the month. TLT was at down at -1.6%.

War in Europe

Just as we were hoping the COVID pandemic is finally past us and we can return to some degree of normalcy, war breaks out in Europe. Russia invades Ukraine and the world as we know it changes. These are unprecedented times for various reasons, including the re-militarisation of Germany, the use of of nuclear weapons as a threat and last but not least, the weaponization of money to an extent not seen before.

Weaponizing money

The chosen way for the West to fight this war is via sanctions. Although this has been done before it has never been used in such a scale and involving an economic force with Russia’s magnitude and influence. Let us not forget that Europe’s energy needs are dependant on Russian gas. The new experiment (because that is what this is) includes:

a. Banning Russian banks and entities from the SWIFT messaging system.

b. Freezing Russian central bank reserves held abroad so that Russia cannot use then to prop up the Ruble.

c. Create an international force to go after Russian oligarch assets as well as their golden visas, etc.

In normal times, war coupled with sanctions on Russia’s bank alone would cause the market to fall. In this type of market, where the Fed is king, bad news is good news. Meaning a possible destabilisation of the financial system will cause the Fed to think twice about tightening policy. Not raising rates as expected, is a plus for the markets, which explains why the S&P barely moved considering a new cold-war era has started.

Risks abound

Inflation

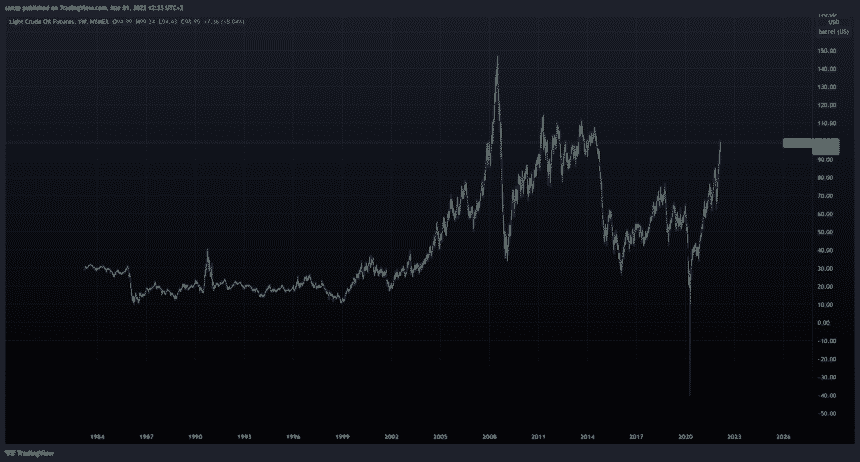

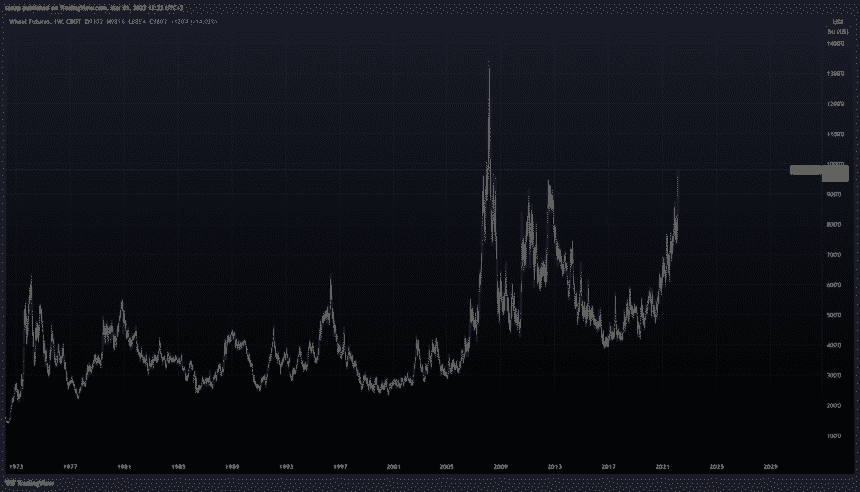

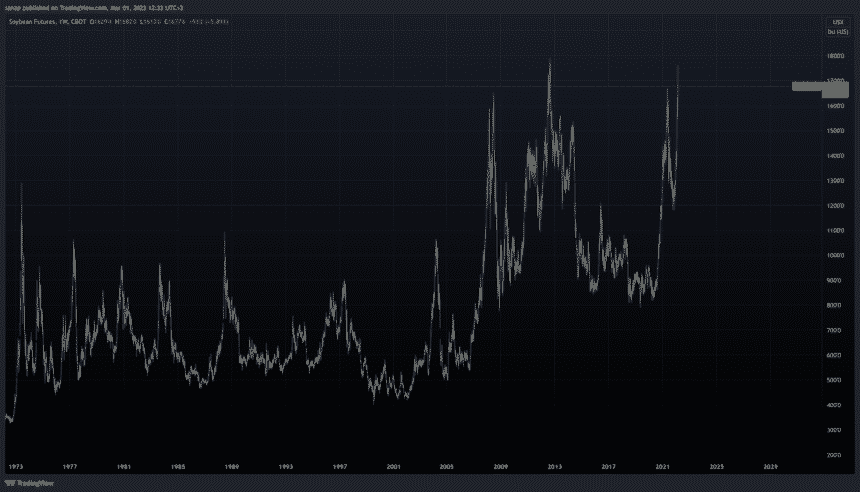

The first risk is already obvious: Rising inflation. We are already in an upward price trend in oil and gas as well as agricultural commodities. This will only get aggravated because of the war as both Russia and the Ukraine are exporters of oil, gas as well as critical food materials such as wheat.

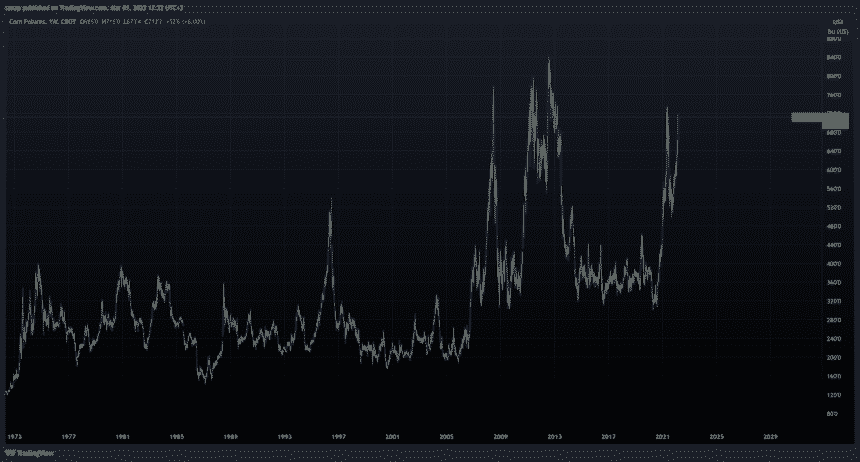

Below we can see that several basic materials are close to all time highs.

The last time that commodities peaked was towards the end of 2007, just before the 2008 crisis, causing political and economic instability and social unrest in both poor and developed nations (Wikipedia: 2008 world food price crisis).

Contagion

The second risk is contagion, which strangely has not been discussed in the news. Anyone who remembers the European financial crisis that started with Greece, Spain, Italy and Portugal (the P.I.G.S as they were labelled), will tell you that the biggest threat to Europe was via E.U.’s (aka German-French) bank exposure to south European bonds and banks. Possible local defaults supposedly threatened the whole E.U. financial system via ‘contagion’.

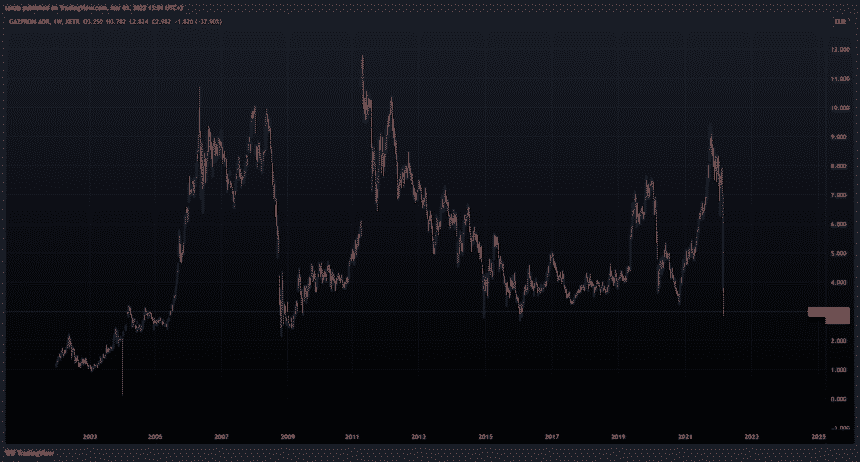

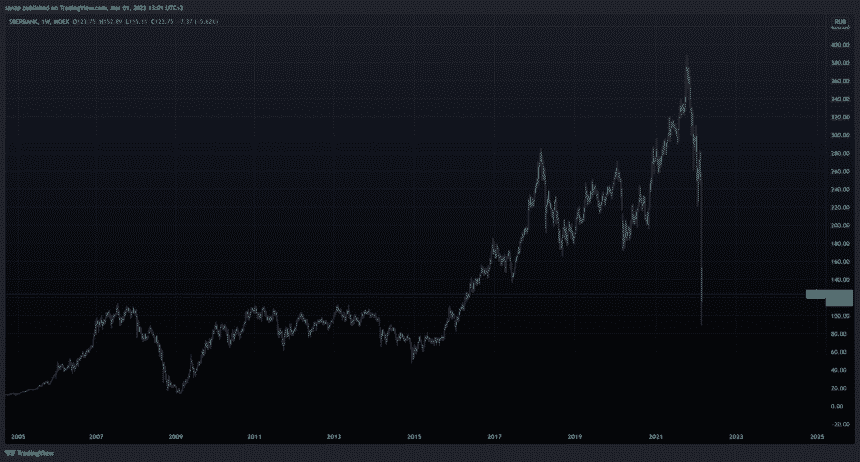

Presently, major Russian banks as well as major energy behemoths like Gazprom are affected but no one is talking about European (and U.S.) bank exposure to a vast array of products tied to various Russian companies.

Crypto

Bitcoin was designed for this type of environment, were a large entity (such as a government or the E.U.) turns around and confiscates your money. It also provides an outlet for ‘third-world’ county citizens to escape devaluation of currency (hyperinflation in Zimbabwe, Venezuela, sanctions in Turkey and now Russia). In theory, it is decentralized money that cannot be ‘stopped’ or controlled via SWIFT or other proprietary, centrally controlled mechanisms. So in theory it would be a good fit.

In practice, Bitcoin transactions as well as other blockchain transactions (Ethereum, etc) are easy to track for a sophisticated entity (a government agency) and provide less privacy that one would imagine. As it stands today, it would be very difficult to move large amounts of money via blockchain without getting noticed.

It will be interesting to see how Crypto reacts to this type of environment. Will it follow risk-on assets like the Nasdaq or safe heavens like gold? For now BTC has risen some +10% since the conflict started.

We wish for a quick resolution and our wishes go to the people suffering the consequences of war on all sides of the conflict.

Let us know what you think in our forum.

The Logical-Invest team.