We updated our QuantTrader software to version 515S. Read about changes to our strategies. If you are using QuantTrader, this time you need to manually update it, please download from here.

Thank you FED

These first two months of 2019 are a prime example of how sensitive markets have become to interest rate policy.

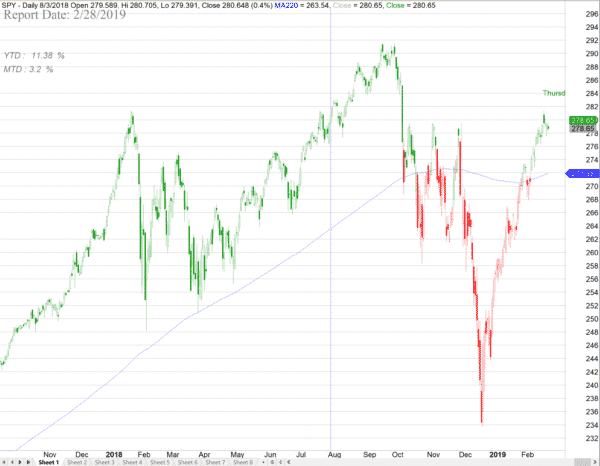

Following the December move in the S&P 500 which painted a negative year for US Equities, Chairman Jerome Powell signaled the Fed’s willingness to be patient, step back, and evaluate economic conditions, before thinking about any additional rate hikes.

With short-term rates essentially “on hold” and not expected to rise any time soon, risk-on behavior came back with a vengeance. Most assets rebounded, creating double digit returns in just these first 2 months. The S&P 500 is up 11% year-to-date, Emerging markets (EEM) 8% while High Yield Bonds have broken on to new highs adding 6.88%. ZIV, the inverse volatility ETF we use in our Maximum Yield Strategy returned an astounding 23% YTD.

The change in Fed policy diminishes the strong demand for the U.S. dollar we have seen throughout 2018. This was due to rising short-term rates which led foreign investors to buy risk-free U.S. debt (discussed here). Foreign risk assets as well as commodities may benefit from a stabilization in the U.S. dollar. This is already evident in some assets classes and countries: The United States Oil Fund ETF (USO), added 20% YTD, Canada did an exceptional 15%, while Russia a more modest 7.3%. Foreign government debt (PCY) was up 5.5% breaking into new multi-year highs.

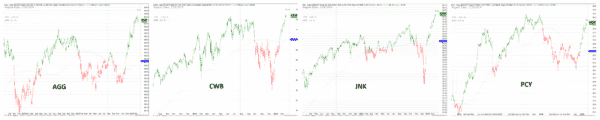

Another interesting trend to watch is the performance of bonds. They have been out of favor for sometime now but if you look at their charts you get a slightly different picture.

The SP500 ETF (SPY) has rebounded but not yet reached the previous top from September 2018.

Below are the charts for High Yield (JNK), Convertible (CWB), Aggregate U.S. Coprorate (AGG) and Foreign Sovereigns (PCY) bonds. Notice how most of them have almost reached or surpassed their historical highest points.

February was a another good month for our strategies, most of them returning profits. Check out our new ranking page were you can quickly compare backtested performances for most strategies and core portfolios:

https://logical-invest.com/app/rank

We wish you a happy new year and a prosperous 2019, and look forward to a vivid discussion.

Visit our site for daily updated dashboard.

The link to the ranking page returns an Internal Server Error. Please fix this and make it accessible directly from the app.