We wish you a healthy, fulfilling new year near your family, friends and communities.

Strategy Performance

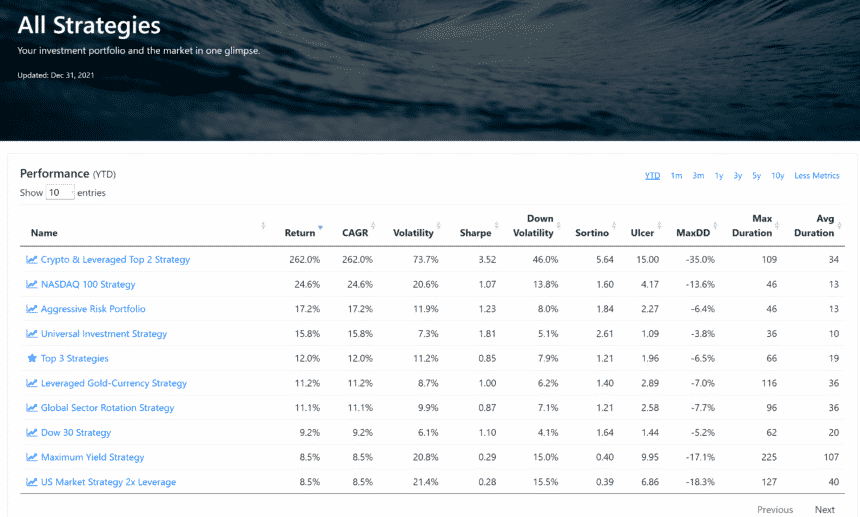

Most of our strategies were positive for 2021. Highlights were the Crypto & Leveraged strategy and the Nasdaq100. Most other strategies did well but unperformed the SP500 since they were partly allocated in safer assets, namely gold, Treasuries and TIPS.

The new Economic Regime: Rising rates

One thing has been clear this past year: The Fed and other central banks are finally “forced” to consider raising rates. The Fed has already set expectations for 3 interest rate hikes in 2022. The Bank of England raised it’s main rate from 0.1% to 0.25% on December 16.

“Forced” because politicians love to spend money and hate to tighten policy. They are usually forced into it by runaway inflation.

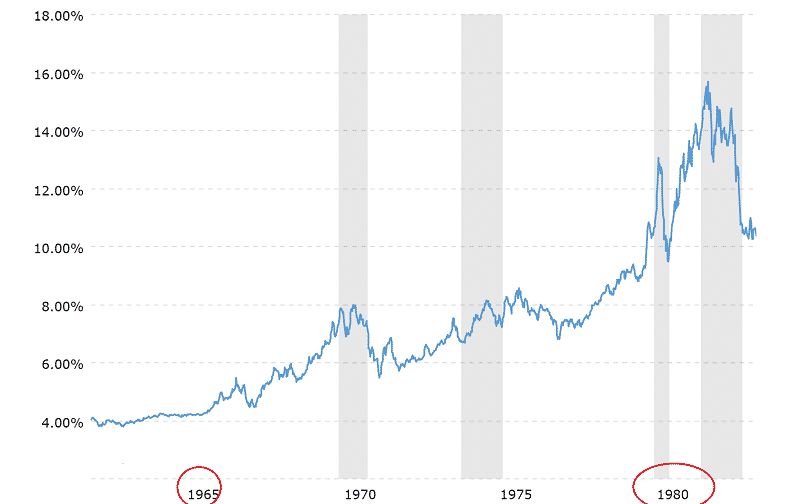

Looking back at history, the last time we had an upward trend in rates were from 1965 to 1981. Below is a chart of rates starting a steady trend up from around 4% in 1965, ending up above 14% on 1981.

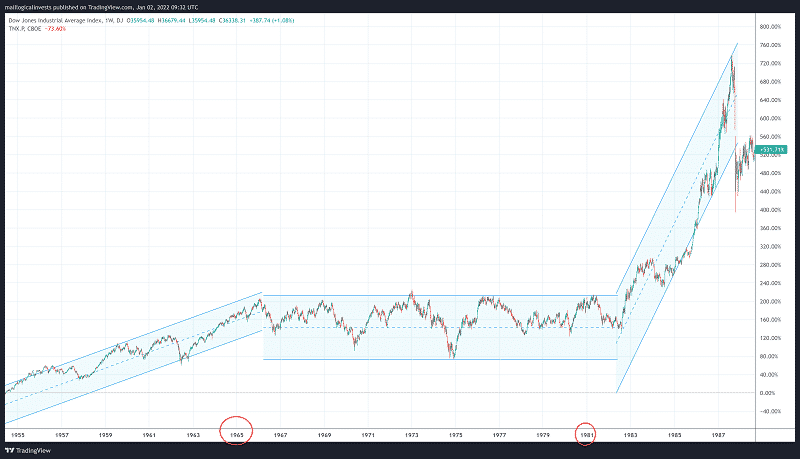

The Dow Jones Index was volatile and range-bound during this period.

This period has been well studied by economists (see a federal reserve essay) and has been labelled as “the greatest failure of American macroeconomic policy in the postwar period” (Siegel 1994). It is unlikely it will play out in the same pattern both because policy-makers have learned and adapted their tools and because circumstances are quite different. Nevertheless it may be helpful to visualise a possibility of more volatile market that doesn’t just go up.

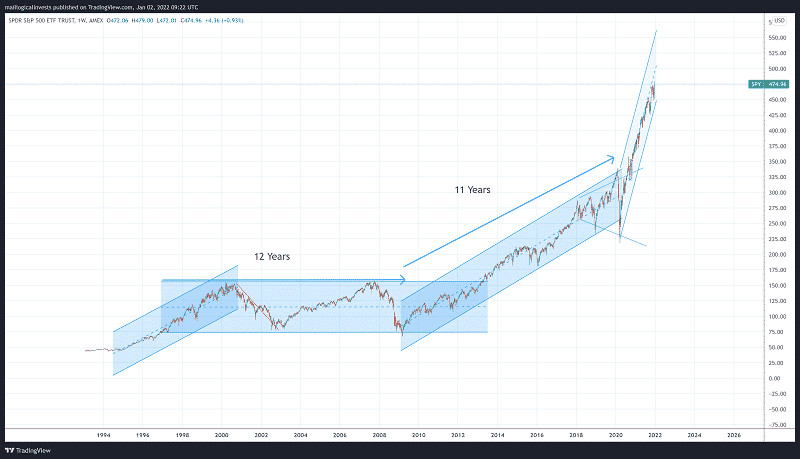

Another look at our current position in the SP500 shows the parabolic nature of the move since the pandemic started.

Boomers vs the new generation

These are some ideas and thoughts on changes that are bound to happen as we move forward towards a post-pandemic, interconnected and hopefully sustainable world. A new generation of young people need to take over and we need to keep track of the changes that are coming.

The idealists fighting for a sustainable future

“Why should I be studying for a future that soon will be no more, when no one is doing anything whatsoever to save that future? And what is the point of learning facts within the school system when the most important facts given by the finest science of that same school system clearly means nothing to our politicians and our society?”

Greta Thunberg – 31st October 2018

On that note, “Don’t Look Up” is this year’s all-star film about how leaders ignore to deal with an extinction-level event.

The pragmatists – boomers-vs-online-tribes

An interesting article of how social-engineered ‘new money’ (aka Crypto) and ‘Web3’ can create new structures and social groups that can challenge established institutions and governments.

https://wrongalot.substack.com/p/boomers-vs-online-tribes

Here are some highlights

The financial innovation we are building into the internet is transformative. We are unleashing a permissionless hyper-financialization to clash with permissioned over-financialization and government monopoly on money. This is the basis for a socioeconomic revolution….

Matti – https://wrongalot.substack.com/p/boomers-vs-online-tribes

…As these tribes discover themselves a new concept for digital self-determination emerges. How compatible is this with the current world order since we are founding sovereign digital societies?

It will be interesting to see once tribes take on the meatspace, its rivalry with governments becoming more apparent. Through Web 3 online tribes are likely to re-emerge from the digital and do things only governments (and Elon Musk) are supposed to do.

I expect that these movements will aspire to send rockets to Mars, fund nuclear fusion research, invest in biotech and do all what is deemed unthinkable or foolish by the boomers. But this will take time.

The era of organized online tribes is only in its infancy and building a robust tribe requires more than riding the price high.

Food for thought. Let us know what you think in our forum.

The Logical-Invest team.