The stick and the carrot

Fro the sake of argument, let us imagine that the FED is the parent and we, investors, we are the children. The parent gives us money and we spend it on toys, candy and what not. We get comfortable consuming as we assume the parent always provides,.

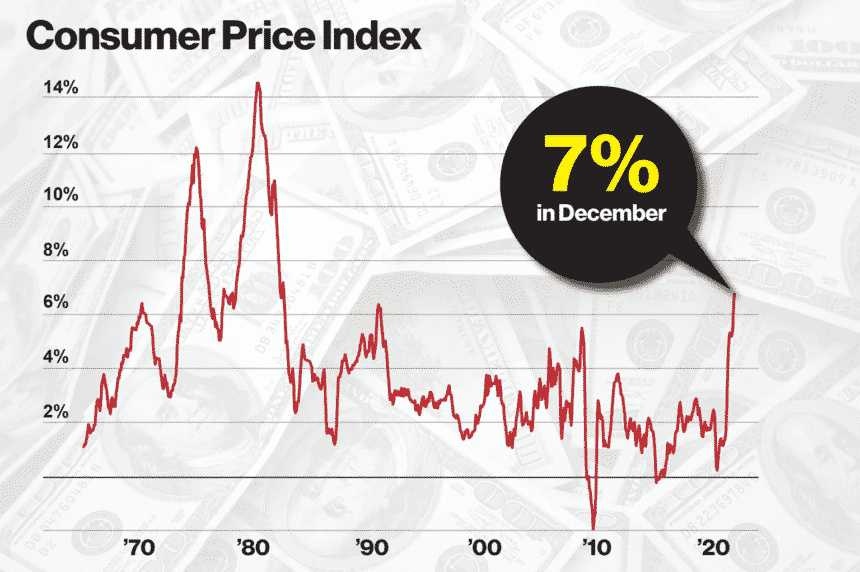

All is well. We keep buying and eventually force candy prices up.

The parent gets uncomfortable with the new prices and next time gives us less (i.e. tightens policy).

We are now forced to spend less and prices eventually stabilize. But we, the kids, are unhappy. We long for candy and not only can we not have it, we are doomed to live in fear and uncertainty.

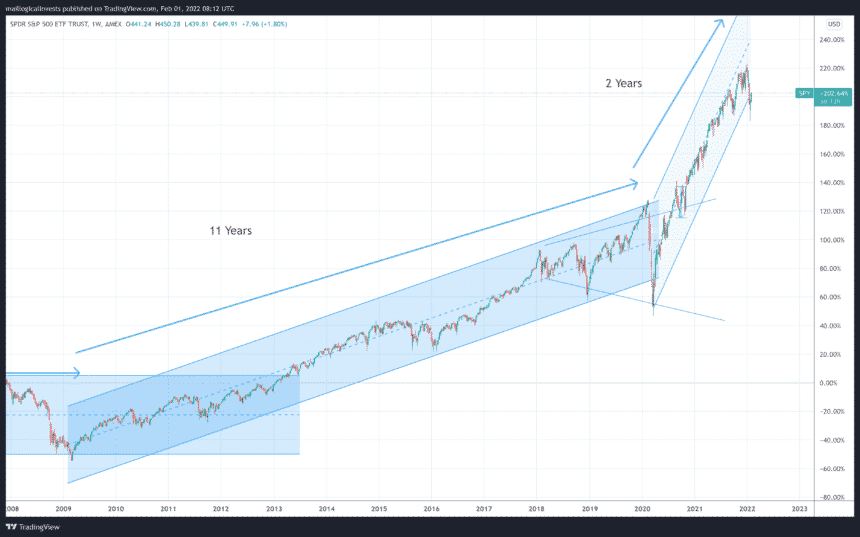

Too much unhappiness can cause trouble for the parent so she gives us a bit more. We are overjoyed and start spending again. Prices go back up. The parent once again pulls back on our allowance, prices go down and so on and so forth. If we can call this behavior, “the stick and the carrot” then we have been living mostly in the carrot.

This January was one of those “stick” months:

SPY -5.3% (max loss at -10%)

TLT -3.9%

GLD -1.7%

The stick and carrot portfolio – Diversify

The stick and carrot portfolio is none other than a generalised diversified portfolio. We cannot always win when the markets are against us but we can limit losses so as to be able to survive and ride the longer-term upside.

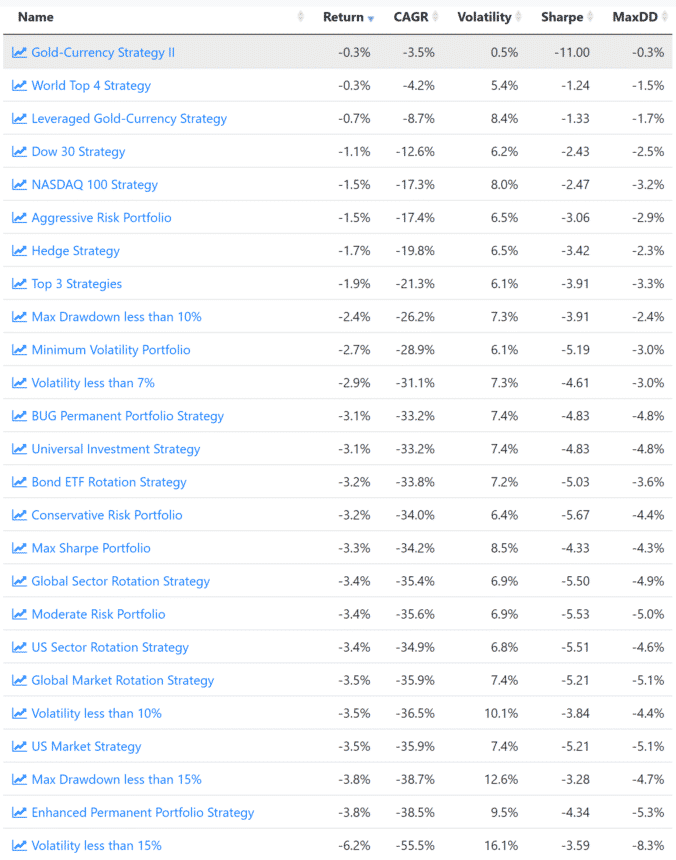

Most Logical Invest strategies provide diversification and limit losses during a 10% correction:

Strategy Performance

Cash is not always king

What about going to cash? It’s a solution but then the problem becomes when to re-enter the market? If you are somewhat experienced you must know that an investor runs two risks:

a. Never re-entering and losing on the long-term upside.

b. Re-entering after the correction has been ‘corrected’ (i.e. entering on a new high) just in time for a second correction. Yes, that’s always fun!…

Another argument against cash is inflation. Long-term, cash will bleed out purchasing power. Just look around at residential rental prices and supermarket receipts.

Food for thought. Let us know what you think in our forum.

The Logical-Invest team.