Corona virus is back again

After several months of perceived calm, in late November increasing SARS-CoV-2 incidence rates in Europe and news about the new variant Omicron, B.1.1.529, classified by the WHO as of concern, shook markets again.

Not helping were also economic reports confirming inflation rates might not be as transitory as perceived in previous months, but rather here to stay – thus increasing the pressure on central banks to start the tapering process and rate increases earlier than expected.

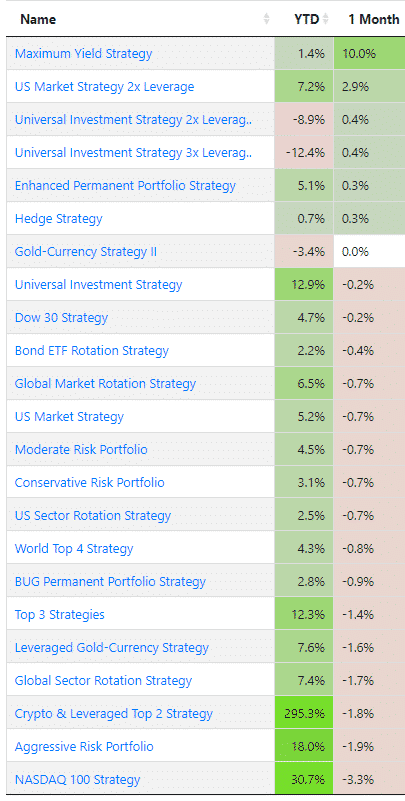

Markets closed November with the S&P500: -0.8%, Dow30: -3.5%, Nasdaq: +2% and Gold: -0.7%. Our strategies could not escape broad market results and closed mostly in red or marginally positive returns.

The only marked exception was our Maximum Yield Strategy, which did a mid-month switch into treasuries, thus escaping the ugly month end returns resulting from higher volatility, and closed with a +10% return in November.

Year end rally?

Looking at history, November and December regularly had strong returns. With the current uncertainties this could as well turn into a negative window dressing effort of institutional investors to clean up their portfolios for 2022.

Please join the forum and discuss the markets, our portfolios and LI strategies.

The Logical-Invest team.