Market surge in November

U.S. and foreign equity markets had an exceptional month due to major progress towards a coronavirus vaccine and expectations of easy monetary policy from central banks. The S&P 500 is up +10.9%, EFA (Developed countries) +14.3%, EEM +9.2% while hard hit economies like Italy and Spain are up +25% and 27% respectively.

Safe heavens under pressure

The surge in stocks has put competitive pressure on safe-haven assets such as bonds and gold. In bonds (TLT +1.7%) this pressure has been cushioned by expectations of continued central banks buying. Gold, on the other hand, had a substantial correction of -5.4%. Interestingly the dollar index, which is usually negatively correlated to gold, is also down -2.2%.

Strategies performance

Our equity based strategies performed well for the month while year-to-date strategy performances range from +58% to -6%. The SP500 has returned almost 14.5%.

Crypto markets: Is it 2017?

The one ‘safe-heaven’ asset, if we can call it such, that has benefited the most has been Bitcoin at +43% for the month.

For any (Enhanced or not) Permanent Portfolio buffs, back in January I posted an idea of a ‘Bitcoin Enhanced Permanent Portfolio”. Read the proposal on BPP here.

During the 2017 ‘bubble’ it almost touched the $20,000 mark. Since then it dropped to a low of $3,000 only to eventually return this month to its highest point.This momentum is driven by large publicly-traded companies (including MicrosStrategy and Square) allocating part of their treasury to Bitcoin. Moreover, Paypal announced it allows for purchase of Bitcoin and Ethereum to its vast retail customer base.

Above: Chart of BTC vs USD from 2017-present

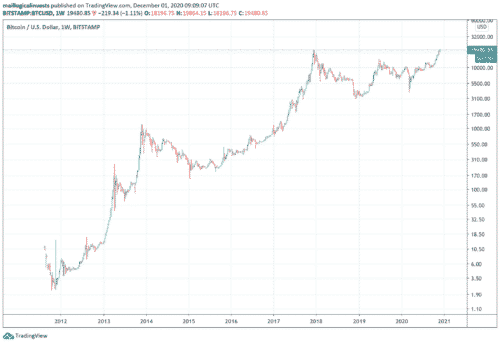

Below is the BTCUSD price from 2012 in logarithmic scale.

Ethereum-based decentralised finance (in short: DeFi) has taken off to create a nascent but growing financial system that mirrors and in some ways improves on the current one. This includes lending and borrowing protocols, decentralised derivatives such as futures and options as well as insurance products. On top of that there is ongoing experimentation of decentralised governance that may shape the future of corporate structure as well as zero-collateral ‘flash’ loans that allow penniless anonymous programmers to borrow millions and arbitrage away opportunities and inefficiencies previously only available to well-capitalised Hedge Funds. DeFi is currently the wild-west of finance where interest on capital can run above 100% APY but loss of principal is an expected and acceptable risk.

Please join the forum and discuss the recent changes in the markets, our portfolios and LI strategies.

The Logical-Invest team.