Outlook

July was a positive month for equities seeing gains in the SP 500 (+2.4% ) and the Nasdaq (+2.9%). On the contrary emerging market (EEM) were down by -6.4% which is an indication of investors worried about a resurgence of COVID-19 cases due to the new Delta variant.

For a second month, long term Treasury yields were down which means TLT rose by 3.7%. Gold was up +2.5%.

As volatility has returned to the markets we notice an advance of safe-heaven assets (Treasuries, gold) which has not been present in the past months, signalling caution. On top of that according to a recent article, only 30% of the S&P 500 constituents are trading above their 50-day moving average. This is a rare occurrence and could signal corrective or sideways action.

The new data on the new COVID Delta variant show that it is extremely contagious. This translates in much higher than anticipated levels of vaccination required to reach herd immunity. If they are not reached it may be possible that the virus becomes an ongoing problem that we have to learn to deal with.

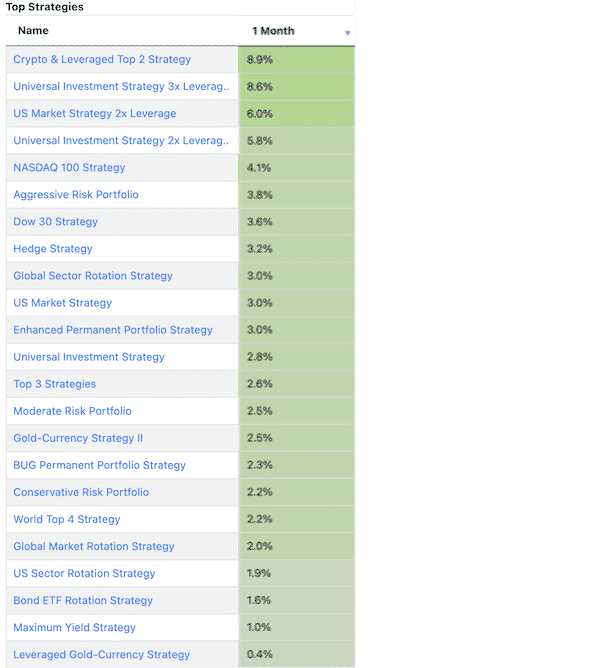

All strategies in the Green

All our strategies performed well for July with returns ranging from a modest +0.4% to a more aggressive +8.6% for our 3x UIS strategy and +8.9% for our new crypto strategy.

Tracking the new Crypto and Leveraged Strategy

After last month’s large correction in crypto assets, the strategy has recovered and is now is almost flat since inception. For July the strategy was invested in SPXL and TMF and had no exposure to crypto assets. This shows the flexibility of the strategy for investors that want to chase after aggressive growth not only in crypto but using traditional ETFs or a combination of the two.

As of this month the strategy re-enters a crypto allocation dipping it’s foot to new potential upside.

https://logical-invest.com/app/strategy/CLT2

Please join the forum and discuss the recent changes in the markets, our portfolios and LI strategies.

The Logical-Invest team.